Colorado LLC and Corporation Registration and Formation

What makes Colorado such an attractive destination to start small or medium sized business (SME’s)? There are many reasons why you should form a Colorado business and topmost among them is the fact that the state has an excellent business climate. Today, the state of Colorado has one of the most successful economies in the nation and is considered the 18th best state in terms of lower corporate tax. The state has a competitive tax system and is considered best suited to drive economic growth.

Let me take the opportunity to introduce startupr to you. We are one of the top Colorado registered agents and are familiar with all processes pertaining to the Colorado State and can provide information and assistance for a successful set up of your business!

Let’s take a look at how you can form a Colorado business LLC or Corporation.

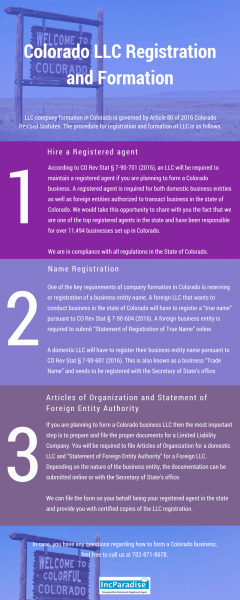

Colorado LLC Registration and Formation

LLC company formation in Colorado is governed by Article 80 of 2016 Colorado Revised Statutes. The procedure for registration and formation of LLC is as follows:

Step#1: Hire a registered agent

According to CO Rev Stat § 7-90-701 (2016), an LLC will be required to maintain a registered agent if you are planning to form a Colorado business. A registered agent is required for both domestic business entities as well as foreign entities authorized to transact business in the state of Colorado. We would take this opportunity to share with you the fact that we are one of the top registered agents in the state and have been responsible for over 11,494 businesses set up in Colorado.

We are in compliance with all regulations in the State of Colorado.

Step#2: Name Registration

One of the key requirements of company formation in Colorado is reserving or registration of a business entity name. A foreign LLC that wants to conduct business in the state of Colorado will have to register a “true name” pursuant to CO Rev Stat § 7-90-604 (2016). A foreign business entity is required to submit “Statement of Registration of True Name” online.

A domestic LLC will have to register their business entity name pursuant to CO Rev Stat § 7-90-601 (2016). This is also known as a business “Trade Name” and needs to be registered with the Secretary of State’s office.

Step#3: Articles of Organization and Statement of Foreign Entity Authority

If you are planning to form a Colorado business LLC then the most important step is to prepare and file the proper documents for a Limited Liability Company. You will be required to file Articles of Organization for a domestic LLC and “Statement of Foreign Entity Authority” for a Foreign LLC. Depending on the nature of the business entity, the documentation can be submitted online or with the Secretary of State’s office.

We can file the form on your behalf as your registered agent in the state and provide you with certified copies of the LLC registration.

In case, you have any questions regarding how to form a Colorado business, feel free to call us at 702-871-8678.

Colorado Corporation Registration and Formation

If you are planning to form a Corporation in Colorado then the procedure for registration and formation is as follows:

Step#1: Maintain a Registered Agent

According to CO Rev Stat § 7-90-701 (2016), you will be required to maintain a registered agent if you are planning to form a Colorado business. A registered agent is required for both domestic business entities as well as foreign corporations authorized to transact business in the state of Colorado. We would take this opportunity to share with you the fact that we are one of the top registered agents in the state and have been responsible for over 11,494 businesses set up in Colorado.

We are in compliance with all regulations in the State of Colorado.

Step#2: Name Registration

One of the key requirements of a company formation in Colorado is reserving or registration of a business entity name. A foreign business entity that wants to conduct business in the state of Colorado will have to register a “true name” pursuant to CO Rev Stat § 7-90-604 (2016). A foreign corporation is required to submit “Statement of Registration of True Name” online.

A domestic Corporation will have to register their business entity name pursuant to CO Rev Stat § 7-90-601 (2016). This is also known as a business “Trade Name” and needs to be registered with the Secretary of State’s office.

Step#3: Articles of Incorporation and Statement of Foreign Entity Authority

If you are planning to form a Corporation in Colorado then the type of registration form you will require is dependent on whether your business is based in Colorado or it is a foreign company. You will need to file Articles of Incorporation for a domestic Corporation and Statement of Foreign Entity Authority for a foreign business entity. Depending on the nature of the business entity, the documentation can be submitted online or with the Secretary of State’s office.

We can file the form on your behalf as your registered agent in the state and provide you with certified copies of the incorporation.

If you have any questions regarding Colorado incorporation or LLC formation, you can simply visit the Colorado Business formation page.

702-871-8678

702-871-8678