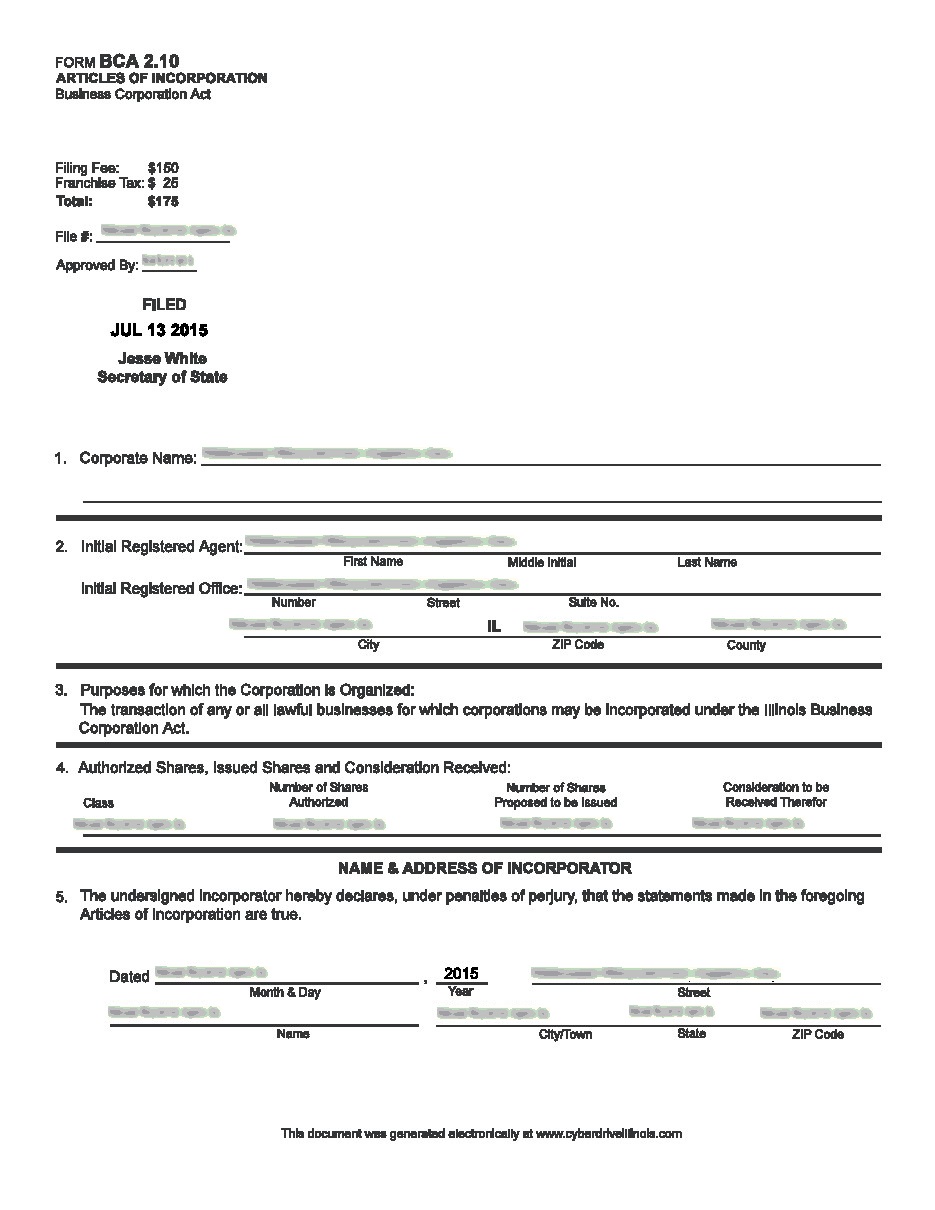

ILLINOIS CORPORATION total only $242

Including Illinois State Initial Filing fee $153 and $89 fee for checking name availability,preparing Illinois state-approved Articles of incorporation, filing Articles with state, sending Articles to you.

See what’s included

- $153 – Illinois State Initial Filing fee

- $89 – Checking name availability, preparing state-approved Articles of incorporation, filing Articles with state, sending Articles or Certificate of incorporation to you.

- Company Bylaws included.

- Ready to fill Stock Certificates included

- Meeting of Shareholders Minutes

- Meeting of Directors Minutes included

- Reminders about annual renewals through INCCONTACT

Once your company is set up, you will need:

- Tax ID (EIN) – free over the Internet or phone.

- Yearly Requirements and Fees for Illinois companies – Within 15 days after the Secretary of State mails your filed Articles of Incorporation, you must record it with the Office of the Recorder of Deeds of the County in which the registered office of your corporation is located. If recording cannot be accomplished within 15 days, record the Articles of Incorporation as soon as possible

- Company Minutes & Stock Certificates – are included in incorporation. You will have access to documents generated on your client account.

702-871-8678

702-871-8678