Incorporate in North Dakota

Incorporate in North Dakota

The economy is one of the primary reasons for increase in incorporation in North Dakota but some of the other factors include the variety of industries that businesses can grow in and expand. One of the largest industries is the agricultural industry and it plays a key role in the economy as well. Manufacturing is another industry that is ranked among the best in the nation and generates revenue in food processing, construction machinery, farm machinery, aircraft and motor vehicle parts among others. The new entrant in the list of top industries is the travel industry and is considered the third biggest in the state thanks to a revenue generation of $4.6 billion in 2010

Why Choose North Dakota for Incorporation?

What makes incorporation in North Dakota a good business decision? A report by WalletHub has ranked North Dakota #1 best state to start a business using a variety of key indicators like overall business costs. The “Flickertail State” is ranked #11 in Business Costs by Forbes and is ranked #4 in terms of Labor Supply. The business climate along with a stable economy and variety of tax incentives provides small businesses with the opportunity to grow and expand.

Now let’s take a look at some of the salient benefits that are responsible for fuelling growth of small businesses:

- North Dakota Opportunity Zones: The ND Opportunity Zones is a program aimed at especially those that have set up companies in North Dakota or any new business. This is a community development program that was established by Congress in the Tax Cut and Jobs Act of 2017. The objective of the program is to encourage long-term investments in low-income tracts as well as urban communities in the state. North Dakota has 25 opportunity zones and forming your business in this zone will open doors for a variety of tax incentives. List of Tracts

- North Dakota Tax Incentives: There are several tax incentives including exemptions and tax credits that you can benefit from post company incorporation in North Dakota. These tax incentives are being made available by the North Dakota Department of Commerce and the most popular incentives include:

– Corporate Income Tax Exemption

– Sales & Use Tax Exemption

– Property Tax Exemption

– Renaissance Zones Tax Incentives

– Research Expense Credit

How do you incorporate in North Dakota?

What is the process of incorporation in North Dakota? What type of documentation is required? These are some of the common questions that you will be confronted with if you are planning to start a new business in the state. The following steps will enable understanding of the entire process:

Business Type

The first step towards incorporation in North Dakota is choosing the type of business you want to form. The different types of business structures that you can form in the Flickertail State include Sole Proprietorship, General Partnership (GP), Limited Partnership (LP), Limited Liability Partnership (LLP), Limited Liability Limited Partnership (LLLP), Professional Limited Liability Partnership (PLLP), Limited Liability Company (LLC), Farm Limited Liability Company, General Business Corporation, and Farm Corporation among others.

The type of business entity you want to form can be domestic or foreign entity. The forms and fee will be different for each type of entity.

Business Entity Name

One of the most important steps towards incorporation in North Dakota is naming your business entity. You have to start by identifying, searching, reserving, or registering the business entity name. There are 3 steps towards business name formation and they are:

- Naming Requirements: A corporate name governed by ND CENT CODE § 10-19.1-13 and an LLC name under North Dakota Century Code, Chapter 10-32.1-11 should contain words like “corporation”, “incorporated”, “limited liability company” or abbreviations like “corp.”, “inc.”, “ltd.”, “L.L.C.” or similar abbreviation.

- Business name search: You need to search for a business name that is not currently in use. You can conduct name search here.

- Name Reservation: Once you have identified a business entity name, you can reserve a corporate name pursuant to ND CENT CODE § 10-19.1-14 and an LLC name pursuant to North Dakota Century Code, Chapter 10-32.1-12. The form for reservation of name has to be submitted with the Office of the Secretary of State and it will be effective for a period of 12 months.

Choose a Registered Agent

Whether you form a corporation or an LLC business entity, in order to transact business in the state of North Dakota, you will have to maintain a registered agent pursuant to North Dakota Century Code, Chapter 10-32.1-16 for LLC and ND CENT CODE § 10-19.1-15 for Business Corporations.

We are one of the respected registered agents in North Dakota and will be responsible for initiating incorporation in North Dakota through processing of your “Articles of Organization”, and “Articles of Incorporation” for domestic entities and “Certificate of Authority” for foreign business entities. Know more.

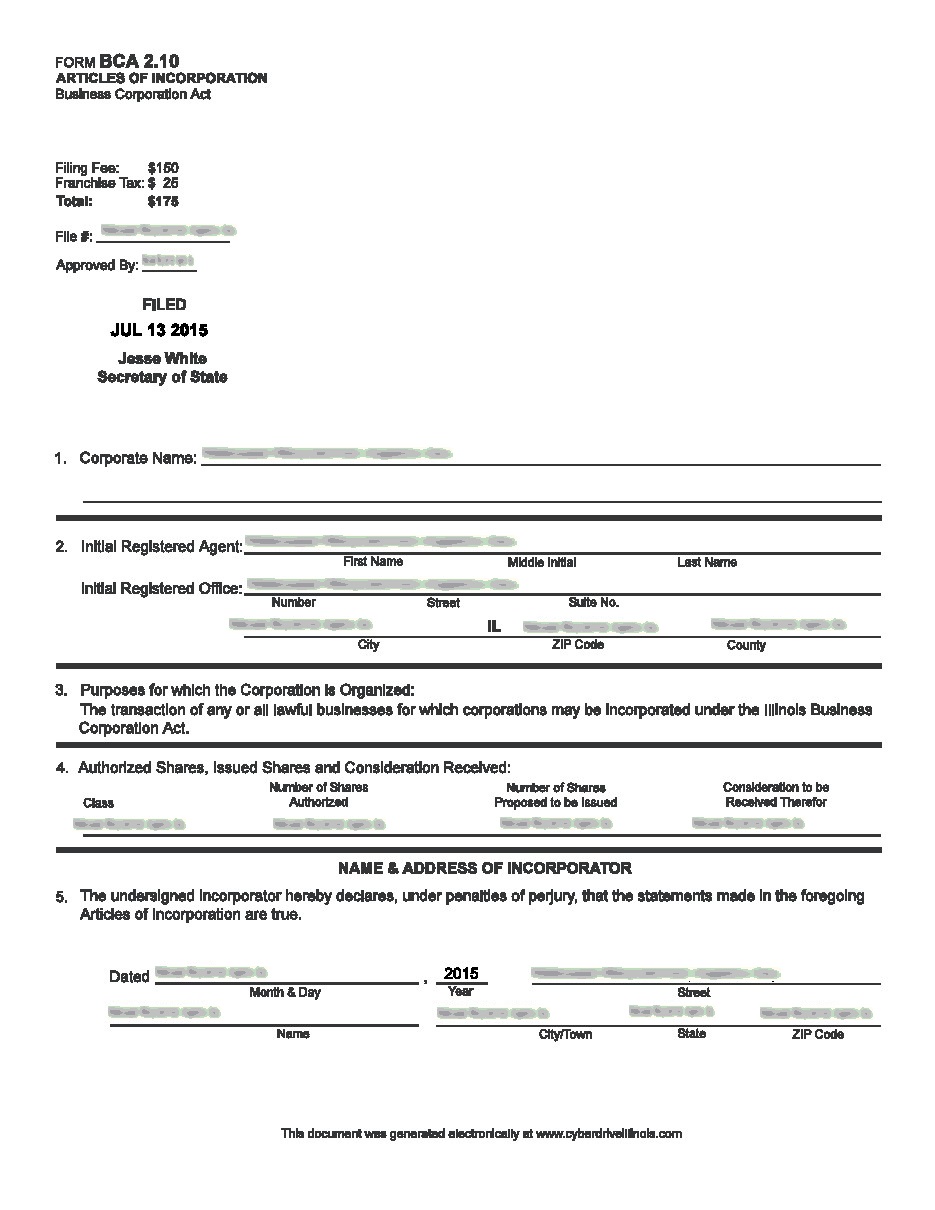

Articles of Incorporation and Certificate of Authority

You will be required to submit “Articles of Incorporation” pursuant to ND CENT CODE § 10-19.1-11, if your business is a domestic corporation. If your business entity is a foreign corporation then you will have to submit a “Certificate of Authority” pursuant to ND CENT CODE § 10-19.1-134 through 136. In order to streamline the process of incorporation in North Dakota, we can file documents on your behalf.

Date Stamped Copies

As a part of the process of company incorporation in North Dakota, we will ensure, you receive date-stamped and filed copies that verifies the state has filed as well as formed your corporation.

Costs and Fees associated with North Dakota Incorporation

What would it cost to set up company in North Dakota? Check Fees here!

702-871-8678

702-871-8678