MOVING YOUR BUSINESS LLC OR CORPORATION TO TEXAS

Texas, home to 50 Fortune 500 companies, international corporations, and small businesses offers one of the best infrastructure and economic climate beneficial towards growth and expansion of all industries and businesses. There are several pro-business factors that not only safeguard business interests but also make moving LLC to Texas a good decision.

Introduction – Why Texas?

Thinking of moving Corporation to Texas? Why do businesses prefer to move to the Lone Star State? Texas is one of the few states that take pride on providing the perfect platform for small and medium sized enterprises (SME’s). This “right to work” state has witnessed a real GDP growth of 7.3 percent in 2018 as compared to -0.2 percent in 2016. Some of the industries that have made maximum contribution to the GDP include finance, insurance, real estate, rental, and leasing with $226.52 billion. Who wouldn’t want to be a part of such a thriving economy?

The business climate of Texas is further strengthened by the wide variety of business incentives and financial support offered by the state government and private organizations. Let’s take a look at the various benefits that 2.6 million small businesses are enjoying in the state:

- Pro-Business Tax Climate: Texas offers a highly competitive tax climate along with other incentives for the overall benefit of different types of businesses. At the end of the day, these tax benefits are targeted at boosting growth as well as the bottom line for those moving LLC to Texas. Some of the salient aspects of the tax benefits include:

- There are no corporate or personal income tax

- There are different types of sales tax exemption applicable for businesses especially on machinery and equipment

- If you are moving Corporation to Texas then you can enjoy franchise tax exemption if you are a seller, manufacturer, or installer of any type of solar energy devices.

- A business will be able to keep more profit made by the company due to low taxes.

- Businesses will be able to use lack of personal income taxes as an incentive for hiring purposes.

- The Texas Economic Development Act, Tax Code Chapter 313 encourages different types of businesses and projects including research and development, large-scale manufacturing, and a variety of investment projects

- State Incentive Programs: Whether you are moving LLC to Texas or a business corporation; the state offers a wide range of incentive and funding programs that small as well as medium sized businesses can leverage from. Some of the top programs include Texas Enterprise Fund (TEF), State Sales and Use Tax refunds, Texas Capital Fund Infrastructure Development and Real Estate Programs (INFRA/RE), Exempt-Facility Bonds, Tax-Exempt Industrial Revenue Bonds, Product Development and Small Business Incubator Fund, collectively (PDSBI), Freeport exemption, Goods-in-Transit Incentive, and Renewable Energy Incentives among others.

Steps to Move a Corporation to Texas

Are you thinking of moving Corporation to Texas? You are probably wondering what the process is for moving your business to this state. Let’s look at the registration options you have.

The Registration Options

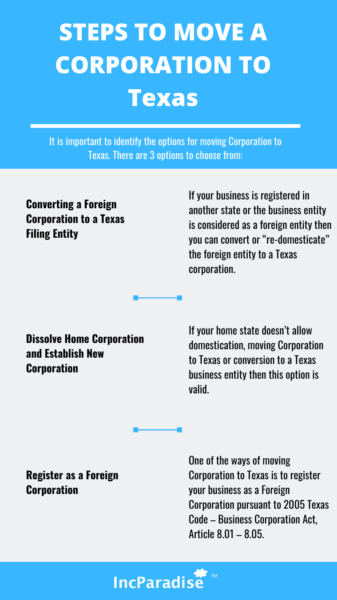

It is important to identify the options for moving Corporation to Texas. There are 3 options to choose from:

- Converting a Foreign Corporation to a Texas Filing Entity: If your business is registered in another state or the business entity is considered as a foreign entity then you can convert or “re-domesticate” the foreign entity to a Texas corporation. You will be required to adopt a “plan of conversion” complying with Texas Business Organizations Code BOC §10.103. In order to facilitate moving Corporation to Texas through this option will involve filing of the following documents with the Texas secretary of state:

- Certificate of Conversion pursuant to Texas Business Organizations Code-BOC § 10.154

- Certificate of formation for the converted Texas entity

- Certificate of account status from the Texas Comptroller of Public Accounts that indicates that the converting business entity is in good standing

- Dissolve home Corporation and Establish New Corporation: If your home state doesn’t allow domestication, moving Corporation to Texas or conversion to a Texas business entity then this option is valid. You will have to apply for a new Tax ID number in this state to transact. There are different types of documents that you will be required to file with the Texas Secretary of the state and they are:

- Depending on the type of Corporation like For-Profit Corporation or Professional Corporation, you will have to file a “Certificate of Formation” pursuant to Titles 1 and 2 of the Texas Business Organizations Code (BOC).

- Certificate of good standing from the existing state of the business entity

- Registration of Business Name

- State Business License Application

- Register as a Foreign Corporation: One of the ways of moving Corporation to Texas is to register your business as a Foreign Corporation pursuant to 2005 Texas Code – Business Corporation Act, Article 8.01 – 8.05. This option is aimed at helping you in continuing the business corporation in the current state of incorporation. It is important to note that you will be required to file annual report or Public Information Report in both Texas and your home state. If you are planning to register as a foreign Corporation then you will be required to file the following documents with the Secretary of State:

- Application for Registration of a Foreign For-Profit and Professional Corporation also known as the “certificate of authority”

- A declaration that the said corporation is in good standing

The documents pertaining to any of the above options can be mailed, faxed, or hand delivered to the office of the Secretary of State. Whatever option you choose, IncParadise can provide guidance and services for moving Corporation to Texas.

IncParadise can help move Your Corporation to Texas!

Steps to Move an LLC to Texas

If you plan moving LLC to Texas that has been formed in another state to Texas then there are several benefits that the LLC will enjoy. The LLC will be able to take advantage of the favourable business laws and tax structure of the state. Let’s take a look at the options you have.

The Registration Options

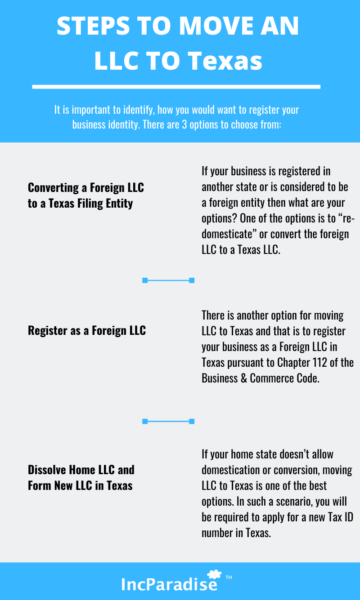

It is important to identify, how you would want to register your business identity. There are 3 options to choose from:

- Converting a Foreign LLC to a Texas Filing Entity: If your business is registered in another state or is considered to be a foreign entity then what are your options? One of the options is to “re-domesticate” or convert the foreign LLC to a Texas LLC. You can opt for this by adopting a “plan of conversion” that complies with Texas Business Organizations Code BOC §10.103. In order to facilitate moving LLC to Texas using this option, you will be required to file the following documents with the Texas secretary of state:

- Certificate of Conversion pursuant to Texas Business Organizations Code-BOC § 10.154

- Certificate of formation for the converted Texas entity pursuant to 2005 Texas Business Organizations Code, § 101.051

- Certificate of account status from the Texas Comptroller of Public Accounts that indicates that the converting business entity is in good standing

- Register as a Foreign LLC: There is another option for moving LLC to Texas and that is to register your business as a Foreign LLC in Texas pursuant to Chapter 112 of the Business & Commerce Code. This option will help you continue the LLC in the state it was originally registered as well as Texas. This also means that you will be required to file annual reports or public information reports in both Texas and your home state. If you are planning to register as a foreign LLC then you will be required to file the following documents with the Secretary of State:

- Application for Registration of a Foreign Limited Liability Company pursuant to 2005 Texas Business Organizations Code, § 101.462

- Notification Statement for “out of state” business entities pursuant to Chapter 112, Business & Commerce Code

- Dissolve home LLC and Form New LLC in Texas: If your home state doesn’t allow domestication or conversion, moving LLC to Texas is one of the best options. In such a scenario, you will be required to apply for a new Tax ID number in Texas. The formation of the new LLC will be governed by Title 3, chapter 101 of the Texas Business Organizations Code (BOC). There are different types of documents that you will be required to file with the Texas Secretary of the state to initiate new LLC formation and they are:

- You will have to file a “Certificate of Formation” pursuant to Titles 1 and 2 of the Texas Business Organizations Code (BOC).

- Registration of Business Name

- State Business License Application

The documents that are required to be submitted can be mailed, faxed, or hand delivered to the office of the Secretary of State. Depending on the option you choose, IncParadise can provide guidance and services for moving LLC to Texas.

We can help you to move Your LLC to Texas!

Move Your Business to Texas with IncParadise

If you have taken a decision related to moving LLC to Texas then it may be quite the hard work to ensure that you are filing all the right documents. If you are feeling overwhelmed then we are right here just for you! IncParadise will ensure that you are able to move your business to Texas with ease. We will guide you with our expertise, knowledge, and commitment so that your business can reach its intended potential in Texas.

Transferring your LLC or Corporation to Texas is hassle-free with us. With the help of our industry experts, you can be assured of a smooth and seamless transition process. Take advantage of our partner Eqvista’s quick and affordable valuation services to qualify for the process. Eqvista believes in delivering quality services and maintaining transparency throughout the process.

702-871-8678

702-871-8678