Texas LLC and Corporation Registration and Formation

The second largest economy in the US, the gross state product of Texas in 2016 was 1.616 trillion. It is also home to 6 of the top 50 Fortune 500 companies. This is one amongst many reasons why company formation in Texas is always considered as the most favorable or beneficial.

The state and local tax burdens in this state is among the lowest and is ranked 8th when it comes to providing a good business tax climate. The growing and stable economy, strong infrastructure, good labor laws, and long-term business growth perspective provides the foundation required to form a Corporation in Texas.

How do you form a Texas LLC or Corporation? Where do you start? The process for registration and formation may seem like an exhaustive one but once you have hired a top Texas registered agent like us, we will ensure, the entire process is simple and quick for you.

Let’s take a look at how to form a Texas business corporation or LLC.

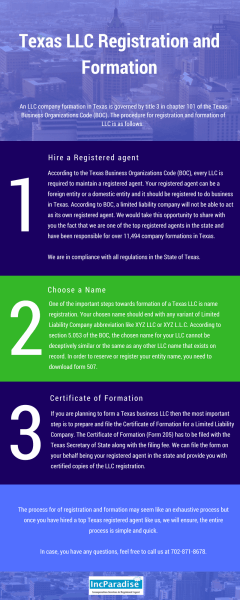

Texas LLC Registration and Formation

An LLC company formation in Texas is governed by title 3 in chapter 101 of the Texas Business Organizations Code (BOC). The procedure for registration and formation of LLC is as follows:

Hire a registered agent

According to the Texas Business Organizations Code (BOC), every LLC is required to maintain a registered agent. Your registered agent can be a foreign entity or a domestic entity and they should be registered to do business in Texas. According to BOC, a limited liability company will not be able to act as its own registered agent. We would take this opportunity to share with you the fact that we are one of the top registered agents in the state and have been responsible for over 11,494 company formations in Texas.

We are in compliance with all regulations in the State of Texas.

Choose a Name

One of the important steps towards formation of a Texas LLC is name registration. Your chosen name should end with any variant of Limited Liability Company abbreviation like XYZ LLC or XYZ L.L.C. According to section 5.053 of the BOC, the chosen name for your LLC cannot be deceptively similar or the same as any other LLC name that exists on record. In order to reserve or register your entity name, you need to download the form 507.

Certificate of Formation

If you are planning to form a Texas business LLC then the most important step is to prepare and file the Certificate of Formation for a Limited Liability Company. The Certificate of Formation (Form 205) has to be filed with the Texas Secretary of State along with the filing fee. We can file the form on your behalf as your registered agent in the state and provide you with certified copies of the LLC registration.

In case, you have any questions, feel free to call us at 702-871-8678.

Order LLC now

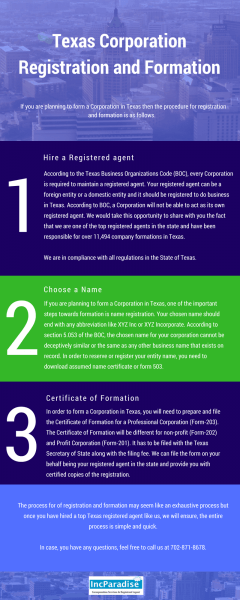

Texas Corporation Registration and Formation

If you are planning to form a Corporation in Texas then the procedure for registration and formation is as follows:

Hire a registered agent

According to the Texas Business Organizations Code (BOC), every Corporation is required to maintain a registered agent. Your registered agent can be a foreign entity or a domestic entity and they should be registered to do business in Texas. According to BOC, a Corporation will not be able to act as its own registered agent. We would take this opportunity to share with you the fact that we are one of the top registered agents in the state and have been responsible for over 11,494 company formations in Texas.

We are in compliance with all regulations in the State of Texas.

Choose a Name

If you are planning to form a Corporation in Texas, one of the important steps towards formation is name registration. Your chosen name should end with any abbreviation like XYZ Inc or XYZ Incorporate. According to section 5.053 of the BOC, the chosen name for your corporation cannot be deceptively similar or the same as any other business name that exists on record. In order to reserve or register your entity name, you need to download an assumed name certificate or form 503.

Certificate of Formation

In order to form a Corporation in Texas, you will need to prepare and file the Certificate of Formation for a Professional Corporation (Form-203). The Certificate of Formation will be different for both non-profit (Form-202) and Profit Corporation (Form-201). It has to be filed with the Texas Secretary of State along with the filing fee. We can file the form on your behalf as your registered agent in the state and provide you with certified copies of the registration.

If you have any questions regarding Texas incorporation or LLC formation, you can simply visit the Texas Business formation page.

702-871-8678

702-871-8678