ARIZONA CORPORATION total only $184.00

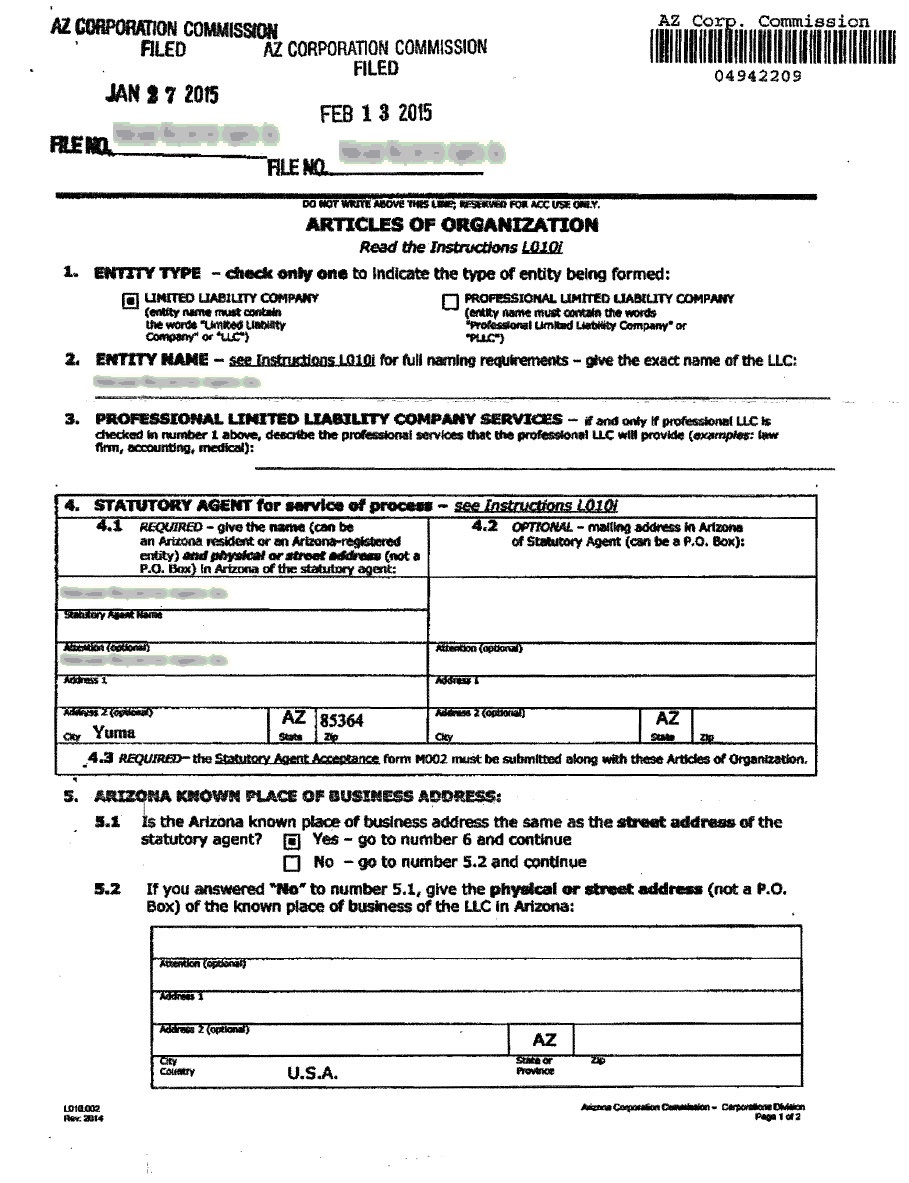

Including Arizona State Initial Filing fee $60.00, processing fee $35 and $89.00 fee for checking name availability,preparing Arizona state-approved Articles of incorporation, filing Articles with state, sending Articles to you.

See what’s included

- $60.00 – Arizona State Filing fee

- $35.00 – Arizona processing fee

- $89.00 – Checking name availability, preparing state-approved Articles of Incorporation, filing Articles with state, mailing them to you.

- Company Bylaws included.

- Ready to fill Stock Certificates included

- Meeting of Shareholders Minutes

- Meeting of Directors Minutes included

- Reminders about annual renewals through INCCONTACT

Once your company is set up, you will need:

- Tax ID (EIN) – free over the Internet or phone.

- Publishing requirements in Arizona – You must publish your filed Articles of Incorporation in a newspaper in general circulation where the principal business office is located. Proof (File Affidavit of Publication) of publication must be submitted to the state. This affidavit needs to be notarized and sent to the Arizona Corporations Commission.

- Yearly Requirements and Fees for Arizona companies – Each year in the corporation’s anniversary month, the annual report is due. The state fee is $45. We charge $15 if you use our service for filing the Annual Report. LLCs do not have annual filing requirements

- Company Minutes & Stock Certificates are included in incorporation. You will have access to documents generated on your client account.

702-871-8678

702-871-8678