District of Columbia LLC and Corporation Registration and Formation

District of Columbia LLC and Corporation Registration and Formation

District of Columbia being the capital of the United States of America, presents just the right platform and avenues to small and mid-sized businesses, and even micro-businesses to grow, expand, and reach out to a global audience. A diversified economy with a gross state product of $141 billion in the 2nd quarter of 2018, it is considered to be the 6th largest metropolitan economy in the nation. You can form a District of Columbia business in any of the major Industries in DC include technology, retail, tourism (it is now the 2nd largest industry), Federal government, media & communications, and higher education among others. In fact, DC is home to a strong concentration of global institutions as well as local representation of major companies.

A vibrant and resilient economy driven by private sector expansion wherein private sector GDP in Q2-2016 was $83.4 billion!

You are probably wondering what the process for LLC formation or incorporation is. This is where we can be of help! We as one of the top District of Columbia registered agents can assist you with the successful registration of your business entity in the state.

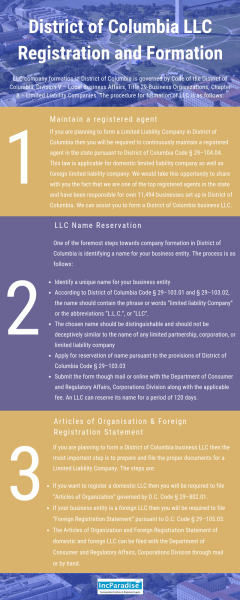

District of Columbia LLC Registration and Formation

LLC company formation in District of Columbia is governed by Code of the District of Columbia, Division V – Local Business Affairs, Title 29-Business Organizations, Chapter 8 – Limited Liability Companies. The procedure for formation of LLC is as follows:

Step#1: Maintain a registered agent

If you are planning to form a Limited Liability Company in District of Columbia then you will be required to continuously maintain a registered agent in the state pursuant to District of Columbia Code § 29–104.04. This law is applicable for domestic limited liability company as well as foreign limited liability company.

We would take this opportunity to share with you the fact that we are one of the top registered agents in the state and have been responsible for over 11,494 businesses set up in District of Columbia. We can assist you to form a District of Columbia business LLC.

Step#2: LLC Name Reservation

One of the foremost steps towards company formation in District of Columbia is identifying a name for your business entity. The process is as follows:

- Identify a unique name for your business entity

- According to District of Columbia Code § 29–103.01 and § 29–103.02, the name should contain the phrase or words “limited liability Company” or the abbreviations “L.L.C.”, or “LLC”.

- The chosen name should be distinguishable and should not be deceptively similar to the name of any limited partnership, corporation, or limited liability company

- Apply for reservation of name pursuant to the provisions of District of Columbia Code § 29–103.03

- Submit the form though mail or online with the Department of Consumer and Regulatory Affairs, Corporations Division along with the applicable fee. An LLC can reserve its name for a period of 120 days.

Step#3: Articles of Organization and Foreign Registration Statement

If you are planning to form a District of Columbia business LLC then the most important step is to prepare and file the proper documents for a Limited Liability Company. The steps are:

- If you want to register a domestic LLC then you will be required to file “Articles of Organization” governed by D.C. Code § 29–802.01.

- If your business entity is a foreign LLC then you will be required to file “Foreign Registration Statement” pursuant to D.C. Code § 29–105.03.

- The Articles of Organization and Foreign Registration Statement of domestic and foreign LLC can be filed with the Department of Consumer and Regulatory Affairs, Corporations Division through mail or by hand.

We can file the form on your behalf being your registered agent in the state and provide you with certified copies of the LLC registration.

In case, you have any questions regarding how to form a District of Columbia business, feel free to call us on 702-871-8678.

District of Columbia Corporation Registration and Formation

If you are planning to form a Corporation in District of Columbia then the procedure for registration and formation is as follows:

Step#1: Maintain a Registered Agent

If you are planning to form a business or professional corporation in District of Columbia then you will be required to continuously maintain a registered agent in the state pursuant to District of Columbia Code § 29–104.04. This law is applicable for domestic as well as foreign corporations.

We would take this opportunity to share with you the fact that we are one of the top registered agents in the state and have been responsible for over 11,494 businesses set up in District of Columbia. We can assist you to form a District of Columbia business as we are in compliance with all regulations in the State of District of Columbia.

Step#2: Corporate Name Reservation

In order to form a corporation in District of Columbia, one of the key steps is identifying a name for your business entity. The process is as follows:

- Identify a name for your business entity

- According to District of Columbia Code § 29–103.01 and § 29–103.02, a corporate name should contain the phrase or words “corporation”, “company”, “incorporated”, or the abbreviations “Corp.”, or “Inc.”

- The chosen name should be distinguishable and should not be deceptively similar to the name of any limited liability company, limited partnership, or any other corporation

- Apply for reservation of name pursuant to District of Columbia Code § 29–103.03.

- Submit the form though mail with the Department of Consumer and Regulatory Affairs, Corporations Division along with the applicable fee. A business corporation can reserve its name for a period of 120 days.

Step#3: Articles of Incorporation and Foreign Registration Statement

If you are planning to form a corporation in District of Columbia, then the most important step is to prepare and file the proper documents for a business corporation. The steps are:

- If you want to register a domestic corporation then you will be required to file “Articles of Incorporation” pursuant to D.C. Code § 29–302.02.

- If your business entity is a foreign corporation then you will be required to file an “Foreign Registration Statement” to transact business in the state pursuant to District of Columbia Code § 29-102.11.

- The application or documentation for registration of a corporation can be filed with the Department of Consumer and Regulatory Affairs, Corporations Division – through mail or by hand.

We can file the form on your behalf being your registered agent in the state and provide you with certified copies of the incorporation.

If you have any questions regarding District of Columbia incorporation or LLC formation, you can simply visit the District of Columbia Business formation page.

702-871-8678

702-871-8678