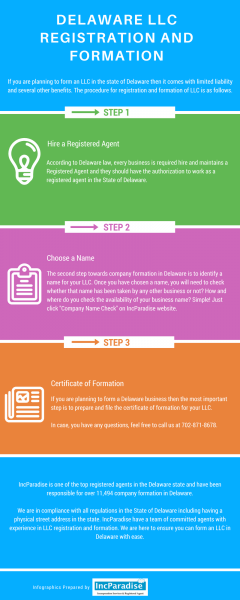

Advantages of Incorporating a Business in Delaware

Advantages of Incorporating a Business in Delaware

A small article by Business News Daily refers to Delaware as the “State of Small Business” and this is because the state offers optimum business environment. Currently, there are approximately 75,000 small businesses in Delaware and there is a consistent rise in the number of startup companies in Delaware each year.

The question is, what makes Delaware one of the first choices for incorporating a business or forming an LLC? To start with, there are several advantages that play a key role in driving successful outcomes for businesses. Let’s take a quick look at some of the advantages you may be able to enjoy when you register a new company in Delaware.

Advantages that drive New Business Formation

There are several advantages that you can enjoy when we help you register a new business in Delaware. Some of them include:

Advantage #1: Multiple Tax Benefits

Kiplinger’s Personal Finance Magazine has named Delaware as the “Most Tax-Friendly State” and this is because of the following:

- No tax on fixed-income investments owned by corporations

- No local or state sales tax

- No personal property tax

- No inheritance tax

- No value-added taxes (VATs)

- No inventory or unitary tax

Advantage #2: The Court System

The state of Delaware has a completely separate court system from others, which is known as the Court of Chancery. It is a court that allows the state of Delaware to adjudicate corporate litigation. The corporate laws of the court have the ability to influence Supreme Court decisions as well. Apart from this, the State Bar Association in Delaware reviews the corporate laws of the state on a regular basis. So, if you incorporate in Delaware, you will be able to leverage the advantages of such a favorable system of reviewing various legal matters.

Advantage #3: Multiple Benefits

When you register a new company in Delaware, you can benefit from the following advantages:

- Incorporation costs are low and the process of filing is quite easy and relatively quick

- The annual franchise tax in the state of Delaware is quite low

- Delaware offers greater privacy protection, which translates into a high level of anonymity and privacy for LLCs and corporations.

- Corporations can hold bonds, stocks, or even securities of other corporations, within or outside Delaware without any limitation to the amount.

- Delaware law provides provisions for close corporation

- You can keep your corporate records and books in Delaware or anywhere outside the state

There are several other advantages that vary according to the type of startup company in Delaware you want to establish like partnership firms, corporations, LLC etc.

Are there any Disadvantages of Incorporating in Delaware?

If you want to register a new business in Delaware, it is one of the best decisions you can take. There are several advantages and a handful of disadvantages. One of the disadvantages is the filing fees. The filing fee in the state is expensive as compared to some of the other states. Similarly, the annual franchise tax filing fee in Delaware is quite high for large businesses that possess several shares.

At the end of the day, there is only one thing that matters, which is whether the advantages outweigh the disadvantages. You will be happy to know that the advantages of incorporating a startup company in Delaware is far higher than the disadvantages.

Order LLC now Order INC now

702-871-8678

702-871-8678