A global city with a highly educated workforce, District of Columbia provides businesses with just the platform they require. Incorporation in District of Columbia means you will have access to global influencers and policymakers. There are a variety of DC industries that your business can be a part of like the hospitality industry, which is one of the strongest sectors. Data Science & Analytics, Retail, and Security Technology are also some of the top industries. One of the salient aspects of DC is the “smart city” initiative wherein it is ranked 6th smartest city in the World according to IESE Cities in Motion Index 2017. Economically, it is on the rise with the real gross domestic product (GDP) of the District of Columbia in 2017 crossing the $110 billion mark.

Home to Lockheed Martin, Freddie Mac, Fannie Mae, and 18 other Fortune 500’s!

Why Choose District of Columbia for Incorporation?

If you are planning to set up company in District of Columbia then the good news is that it is the perfect platform for small businesses. In fact, the small business scene in D.C. area has everything right from sewing studio’s to fish-and-chips shop, prohibition-inspired gin distillery, and pie shop with music rehearsal studio, and many other innovative businesses.

Now let’s take a look at some of the salient benefits that are responsible for fuelling growth of small businesses:

Supermarket Tax Incentives

As a part of the Supermarket Tax Exemption Act of 2000, DC will waive fees and tax to retail and grocery stores located in specific neighborhoods. This is an incentive directed at encouraging investment and development in areas that lack access to fresh food and groceries. You can avail of the incentive post company incorporation in District of Columbia. A supermarket or retail store can receive the following benefits for a period of 10 years post renovation or development:

- Exemption in business license fee

- Exemption in real property tax

- Sales and use tax exemption especially on building materials used for construction

- Exemption in personal property tax

Eligible Areas | More Information

How do you incorporate in District of Columbia?

What is the process of incorporation in District of Columbia? What type of documentation is required? These are some of the common questions that you will be confronted with if you planning to start a new business in the state. The following steps will enable understanding of the entire process:

Business Type

The first step towards company incorporation in District of Columbia is choosing the type of business you want to form. You can choose to form an LLC or a Corporation. The type of business entity you want to form can be domestic or foreign entity. The forms and fee will be different for each type of entity.

Business Entity Name

One of the most important steps towards incorporation in District of Columbia is naming your business entity. You have to start by identifying, searching, reserving, or registering the business entity name. There are 3 steps towards business name formation and they are:

- Naming Requirements: According to District of Columbia Code § 29–103.01 and § 29–103.02, the name of a business entity should contain words like “corporation”, “incorporated”, “limited liability company” or abbreviations like “corp.”, “inc.”, “ltd.”, “L.L.C.”, ”Ltd., ” or similar abbreviation.

- Business name search: You need to search for a business name that is not in use currently. You can conduct name availability search here.

- Name Reservation: Once you have identified business entity name, you will have to reserve the name pursuant to District of Columbia Code § 29–103.03 as a part of company incorporation in District of Columbia process. You can reserve the name for a period of 120 days with the Department of Consumer and Regulatory Affairs, Corporations Division.

- Name Registration: According to District of Columbia Code § 29–103.04, a foreign business entity that is not registered to do business in the District under subchapter VI of this chapter will be required to register its name, or an alternate trade name as required by § 29-105.06. A foreign business entity will be required to submit the name registration application with the Mayor’s office.

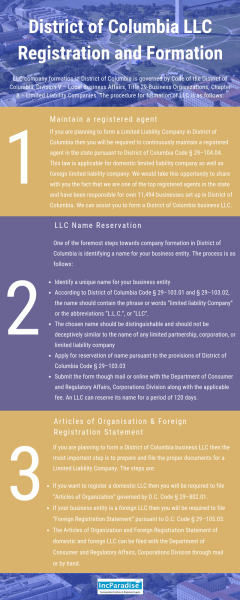

Choose a Registered Agent

Whether you form a corporation or an LLC business entity, in order to transact business in the state of District of Columbia, you will have to maintain a registered agent pursuant to District of Columbia Code § 29–104.04 (July 2, 2011, D.C. Law 18-378, § 2, 58 DCR 1720; Mar. 5, 2013, D.C. Law 19-210, § 2(a)(18), 59 DCR 13171).

We are one of the respected registered agents in Washington DC and will be responsible towards initiating incorporation in District of Columbia through processing of your Certificate of Formation and Application for Registration for LLC and Articles of Incorporation and Certificate of Authority for business corporations.

Articles of Incorporation and Foreign Registration Statement

You will be required to file “Articles of Incorporation” pursuant to D.C. Code § 29–302.02, if your business is a domestic corporation. You will have to file a “Foreign Registration Statement” pursuant to District of Columbia Code § 29-102.11, if it is a foreign business entity. In order to streamline the process of company incorporation in District of Columbia, we can file documents on your behalf through the online process or through expedited process.

Date Stamped Copies

As a part of the process of company incorporation in District of Columbia, we will ensure, you receive date-stamped and filed copies that verifies the state has filed as well as formed your corporation.

Costs and Fees associated with District of Columbia Incorporation

What would it cost to set up company in District of Columbia? Check Fees here!

Order LLC now Order INC now

702-871-8678

702-871-8678