News

FAQ

Delaware Incorporation Frequently Asked Questions

Do I need to reserve a corporate name?

No, but it is recommended to reserve a name prior to filing to ensure that it remains available during the incorporation process.

How do I reserve a corporate name?

The reservation of your corporate name will be handled by IncParadise and is included in the price of our service.

Do I have to renew my name registration?

No.

How do I incorporate in Delaware?

When using our service, IncParadise will file, on your behalf, the required administrative forms and articles of incorporation with the appropriate Delaware agency.

Is a registered agent required?

Yes. The registered agent must either be (1) an individual resident of Delaware or (2) a corporation, limited partnership, limited liability company or domestic statutory trust with authority to transact business in Delaware, whose business office is the same as the registered office. As part of our ongoing service, IncParadise does provide a registered agent service option that you can select during the online registration process.

How many Incorporators are required to form a corporation in Delaware?

One or more are required.

How many Directors are required to start a corporation in Delaware?

One or more as defined in the entity’s bylaws.

Are corporations in Delaware required to file an Annual Report?

Yes. All Delaware domestic corporations are required to file an Annual Report and pay any taxes and fees due on or before March 1st.

Didn’t find answer to your question? Email as at [email protected]

Why Delaware?

Why incorporate in Delaware?

Almost 500 companies get incorporated in Delaware every single day, and two-thirds of Fortune 500 companies are incorporated in this small state as well. If you are thinking about incorporating, you should consider Delaware as the top choice. Here is the summary of reasons, why this East Coast state attracted so many business in the last 50 years.

Flexible Corporate Law for Delaware corporations

Delaware is known for keeping its corporate law up to date and very business friendly. One third of state income comes from incorporation fees and revenues, and local lawmakers want to make sure it will continue to be the same way in the future. That’s why companies can be sure that if they incorporate in Delaware, they don’t have to be afraid of unpleasant surprises coming in the near future. Among others, these are the most important law advantages of incorporating in Delaware

- Flexibility in the corporation’s structure and allocation of rights among its shareholders.

- Asset protection – companies can include provision in the corporate charter that eliminates personal liability of directors and shareholders

- Privacy protection – company is not required to list director’s or officer’s names in the formation document.

Quality of Delaware courts and judges, Delaware Court of Chancery

The Delaware court of Chancery is known for focusing only on business law and handling only business cases. You can be sure, that your case will be handled properly according to the latest laws and business practices. And corporations prefer this Delaware court for one more reason – it uses only judges, no juries. Judges who have excellent knowledge of local business law and plenty of experience handling business cases.

Another legal reason why corporations are choosing Delaware is that most corporate lawyers in USA have studied Delaware corporate law in the school. Almost all legal textbooks rely on Delaware case law and most lawyers are familiar with the business practices in this state.

Venture capitalists & angel investors prefer to invest to companies incorporated in Delaware

Thanks to all the reasons listed above, you have better chance of getting funding from investors if you are incorporated in Delaware. Venture capitalist and angel investors are aware of all the advantages of having a company formed in this state, their lawyers are very familiar with Delaware business laws, and pretty much all of them have experience dealing with Delaware companies and corporations.

No state corporate income tax

If your company does not operate in Delaware, there is no income tax charged to your corporation.

No personal income tax for non-residents

You are not resident of Delaware but you want to incorporate in this state? No problem, and as an advantage, you don’t have to pay any personal income tax.

Thanks to all these advantages, Delaware is the most popular state for incorporating your business. Join hundreds of thousands of companies and incorporate in Delaware today.

_______________________________________________

Business Information & Rankings

- Delaware ranks 1st on the Work Environment Index. (2005)

- Delaware ranks 1st on the “Decent Work in America” study (UMass Amherst’s Political Economy Research Institute, 2005)

- Delaware ranked 18th for Friendly Business Tax Climate (The Tax Foundation, 2005)

- Delaware’s State/Local Tax Burden in 3rd lowest in the U.S. (The Tax Foundation).

Cost of Living Index

| For Wilmington, DE (2005): | Index Score |

|---|---|

| Composite: | 105.0 |

| Housing: | 102.4 |

| Utilities: | 106.0 |

| Misc. Goods & Services: | 101.3 |

Crime Rate

Delaware is ranked 24th on the State Crime Index. (FBI, 2004)

Fees & Taxes

Business Inventory Tax

Delaware does not tax business inventory.

Corporate Franchise Tax

All corporations incorporated in the State of Delaware are required to file an Annual Franchise Tax report and to pay a franchise tax. The minimum tax is $35.00 with a maximum tax of $165,000.00.

Corporate Income Tax

The general corporation rate is 8.7%.

Gross Receipt Tax

Delaware assesses a gross receipts tax on the seller of goods (tangible or otherwise) or provider of services. Business and occupational gross receipts tax rates range from 0.096% to 1.92%, depending on the business activity.

Personal Income Tax

Variable. The income tax rate starts at 2.2% for income starting at $2,000 and going up to $5,000. Income over $60,000 is assessed at 5.95%.

Personal Property Tax

Delaware does not assess a state-level tax on real or personal property. Real estate is subject to county property taxes, school district property taxes, vocational school district taxes, and if located within an incorporated area, municipal property taxes.

State Sales and Use Tax

Delaware does not levy a general sale or use tax.

Unemployment Insurance

Delaware’s new employers pay 2.5% for 2 years.

Incorporate in Delaware

Incorporate in Delaware

There has been an unprecedented rise off late, in the number of company incorporation in Delaware. If you are wondering why this is happening, then the answer is quite simple – Delaware provides the most favorable climate or environment for setting up your business. Whether it is privacy you seek or tax benefits, you will get it all in this state.

It is therefore no wonder that some of the biggest brands and also almost 65 percent Fortune 500 companies have headquarters in Delaware.

Why Choose Delaware for Incorporation?

The state of Delaware has flexible and established business laws that ensure that you are able to set up a company in Delaware with utmost ease and you can also reap higher business profits. In fact, the U.S. Chamber Institute for Legal Reform has mentioned that the state of Delaware has the best legal climate. So what are your advantages? Let’s take a quick look at them.

Different Corporations

Delaware laws on company incorporation allows you to set up three different types of corporations. These are general, closed and non-profit. Each type of corporation has its unique structure and thus will enable you exercise a variety of options.

Tax shelter

The state of Delaware provides the much needed tax shelter to corporations. If you are thinking of incorporating in Delaware then you will be happy to know that there are:

- No sales tax in Delaware

- No corporate tax on any investment income

- No corporate tax on interest

- No personal property tax

- No value-added taxes (VATs)

- No inheritance tax

- No stock transfer or capital shares tax

Corporate Privacy

As an owner of a corporation, you will enjoy maximum confidentiality as local Delaware laws disallow revealing personal information as well as information of Corporation owners.

Foreign Resident

Directors, managers, shareholders, members, and officers, of a corporation are not required to be residents of Delaware.

How do you incorporate in Delaware?

If you are planning to set up company in Delaware then you will be required to follow certain procedures that will aid in the formation of your LLC or incorporation. We at incparadise.net have specialists on our team who can guide you through setting up or forming an LLC, a Delaware C Corporation, and Delaware a S Corporation in the shortest possible period.

Here is a step by step procedure of how to incorporate in Delaware

Type of Business

You need to identify the type of business you want to start. You can choose from a benefit corporation to a general corporation, non-stock corporation, close corporation, LLC, limited partnership, or series LLC.

Business Name

The second step is to identify a name for your business along with the required suffix, which will indicate the type of business entity you have formed. If you opt for company incorporation in Delaware then some of the common suffixes include Corporation (or Corp.); Incorporated (or Inc.); Limited (or Ltd.); and Company (or Co.). If you opt for an LLC, the permitted suffix is LLC, Limited Liability Company, or L.L.C.

Certificate of incorporation

You will need to file certificate of incorporation, which we can always file on your behalf through the standard process or online or through expedited process.

Federal Tax ID

You will require a Federal Tax ID if you are planning to hire employees. It is also mandatory for opening a bank account in the name of the Delaware Corporation.

Receipt of Certificate

Once the company incorporation in Delaware process is complete, you will receive the “Delaware certificate of incorporation”.

Delaware Incorporation Agent

You will need a Delaware registered agent like incparadise.net to ensure your business meets all the necessary requirements. We can also receive any and all legal and business related paperwork on your behalf.

Costs and Fees associated with Delaware Incorporation

Is incorporating in Delaware expensive? This is question that most of our previous clients have asked and the answer is that “We ensure it is not burdensome to you!”

Advantages of Incorporating a Business in Delaware

Advantages of Incorporating a Business in Delaware

A small article by Business News Daily refers to Delaware as the “State of Small Business” and this is because the state offers optimum business environment. Currently, there are approximately 75,000 small businesses in Delaware and there is a consistent rise in the number of startup companies in Delaware each year.

The question is, what makes Delaware one of the first choices for incorporating a business or forming an LLC? To start with, there are several advantages that play a key role in driving successful outcomes for businesses. Let’s take a quick look at some of the advantages you may be able to enjoy when you register a new company in Delaware.

Advantages that drive New Business Formation

There are several advantages that you can enjoy when we help you register a new business in Delaware. Some of them include:

Advantage #1: Multiple Tax Benefits

Kiplinger’s Personal Finance Magazine has named Delaware as the “Most Tax-Friendly State” and this is because of the following:

- No tax on fixed-income investments owned by corporations

- No local or state sales tax

- No personal property tax

- No inheritance tax

- No value-added taxes (VATs)

- No inventory or unitary tax

Advantage #2: The Court System

The state of Delaware has a completely separate court system from others, which is known as the Court of Chancery. It is a court that allows the state of Delaware to adjudicate corporate litigation. The corporate laws of the court have the ability to influence Supreme Court decisions as well. Apart from this, the State Bar Association in Delaware reviews the corporate laws of the state on a regular basis. So, if you incorporate in Delaware, you will be able to leverage the advantages of such a favorable system of reviewing various legal matters.

Advantage #3: Multiple Benefits

When you register a new company in Delaware, you can benefit from the following advantages:

- Incorporation costs are low and the process of filing is quite easy and relatively quick

- The annual franchise tax in the state of Delaware is quite low

- Delaware offers greater privacy protection, which translates into a high level of anonymity and privacy for LLCs and corporations.

- Corporations can hold bonds, stocks, or even securities of other corporations, within or outside Delaware without any limitation to the amount.

- Delaware law provides provisions for close corporation

- You can keep your corporate records and books in Delaware or anywhere outside the state

There are several other advantages that vary according to the type of startup company in Delaware you want to establish like partnership firms, corporations, LLC etc.

Are there any Disadvantages of Incorporating in Delaware?

If you want to register a new business in Delaware, it is one of the best decisions you can take. There are several advantages and a handful of disadvantages. One of the disadvantages is the filing fees. The filing fee in the state is expensive as compared to some of the other states. Similarly, the annual franchise tax filing fee in Delaware is quite high for large businesses that possess several shares.

At the end of the day, there is only one thing that matters, which is whether the advantages outweigh the disadvantages. You will be happy to know that the advantages of incorporating a startup company in Delaware is far higher than the disadvantages.

Order LLC now Order INC now

Delaware LLC and Corporation Registration and Formation

Delaware LLC and Corporation Registration and Formation

Delaware is ranked among the top states under the business-climate tax index and provides just the right innovative as well as entrepreneurial environment. Isn’t this reason enough to form a Corporation in Delaware?

One of the best decisions you can take today is to start a new business in Delaware. Wondering how? We are going to walk you through the entire process right from providing relevant information regarding forming a new business to the actual registration of the company. Whether you are thinking of forming an LLC or incorporating in Delaware, here’s some information that will definitely guide you through the process.

The first step in company formation in Delaware is to identify the type of business entity. Some of the business entity types that you can choose from include Corporations, Limited Liability Companies (LLC), General Partnerships (GP), Public Benefit Corporations which started on August 1, 2013, Statutory Trusts, and Limited Partnerships (LP) among others.

If you choose to form a Delaware business from the above then you will be required to file formation or incorporation documents with the Delaware Division of Corporations. If you are planning to form sole proprietorship firms then you will not be required to file with the Delaware Division of Corporations.

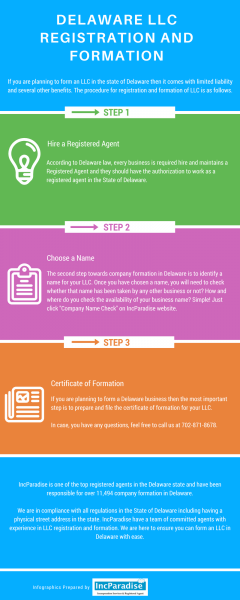

Delaware LLC Registration and Formation

If you are planning to form an LLC in the state of Delaware then it comes with limited liability and several other benefits. The procedure for registration and formation of LLC is as follows:

Hire a registered agent

According to Delaware law, every business is required to hire and maintain a Registered Agent and they should have the authorization to work as a registered agent in the State of Delaware. We would take this opportunity to share with you the fact that we are one of the top registered agents in the state and have been responsible for over 11,494 companies formed in Delaware.

We are in compliance with all regulations in the State of Delaware including having a physical street address in the state.

Choose a Name

The second step towards company formation in Delaware is to identify a name for your LLC. Once you have chosen a name, you will need to check whether that name has been taken by any other business or not? How and where do you check the availability of your business name?

You can check availability right here!

Certificate of Formation

If you are planning to form a Delaware business then the most important step is to prepare and file the certificate of formation for your LLC.

In case, you have any questions, feel free to call us at 702-871-8678.

Order LLC now

Delaware Corporation Registration and Formation

If you are planning to form a Corporation in Delaware then the procedure for registration and formation is as follows:

Hire a registered agent

According to Delaware law, every business is required to hire and maintain a Registered Agent and they should have the authorization to work as a registered agent in the State of Delaware. We would take this opportunity to share with you the fact that we are one of the top registered agents in the state and have been responsible for over 11,494 companies formed in Delaware.

We are in compliance with all regulations in the State of Delaware including having a physical street address in the state.

Choose a Name

In order to form a Corporation in Delaware you will have to identify a name for your business entity. Once you have chosen a name, you will need to check whether that name has been taken by any other business or not? How and where do you check the availability of your business name?

You can check availability right here!

Certificate of Formation

If you are planning to form a corporation in Delaware then the most important step is to prepare and file the Certificate of Incorporation for your business entity.

In case, you have any questions, feel free to call us at 702-871-8678.

We have a team of committed agents with experience in Corporation registration and formation. We are here to ensure you can form a Corporation in Delaware with ease.

We take pride in our work and have successfully filed over 62,846 annual lists since 2002.

If you have any questions regarding Delaware incorporation or LLC formation, you can simply visit the Delaware Business formation page.

702-871-8678

702-871-8678