Incorporate in Rhode Island

Incorporate in Rhode Island

A report by Forbes ranks Rhode Island #43 in their list of “Best States for Business” and has a Gross State Product of $63 billion. Forbes ranks its economic climate at 36 and is ranked #32 in the 2016 Economic Index. The good news for those who want to set up companies in Rhode Island is that the state has made a few significant changes in the business tax law in order to improve its business and tax climate. One of the reasons for such a change is that the corporate income tax rate has decreased from 9% in 2014 to 7% in 2015. Apart from this, several business incentives have also been implemented to aid in the overall growth and support for small and medium enterprises.

Why Choose Rhode Island for Incorporation?

There was a time when manufacturing was one of the key economic drivers but today the economic health of Rhode Island is driven by multiple industries including manufacturing, financial services, fishing, hospitality, and agriculture. These are the industries who are mostly incorporating in Rhode Island. The annual growth rate have jumped from 0.2% in 2016 to 3.5% in 2017, the latter being faster than the overall growth rate of the nation at 3.4%.

Now let’s take a look at some of the salient benefits that are responsible for fuelling growth of small businesses in this state:

- Qualified Jobs Incentives Tax Credit: If you set up a company in Rhode Island and expand your workforce then you would be eligible to receive annual, redeemable tax credits for a period of 10 years as a part of the Qualified Jobs Incentive program. You can earn credits amounting to $7,500 per job per year. Download Application

- Industry Cluster Grants: Industry Cluster Grants is a program that encourages small and medium business entities to work together for the purpose of exchanging ideas, solving problems, and developing talent. The program makes available grants required for fund planning and organization of a cluster. As part of the program, “implementation grants” are also available for strengthening the cluster in specific areas like tech transfer, R&D, and workforce development. Implementation Grant Application Materials

How do you incorporate in Rhode Island?

What is the process through which you can set up company in Rhode Island? What type of documentation is required? Can the registration documents be filed online? If you are confronted with these questions then the following steps will help you in understanding how incorporation works in Rhode Island:

Type of Business

The first step towards incorporation in Rhode Island is choosing the type of business you want to form. You can choose to form an LLC or a Corporation. The type of business entity you want to form can be either domestic or foreign. The forms and fees will be different for each type of entity. Know more

Business Entity Name

The second most important step towards company incorporation in Rhode Island is registering your business entity name. There are 3 steps towards business name formation and they are:

- Naming Requirements: A corporation under 2005 Rhode Island Code – § 7-1.2-401 and an LLC under RI Gen L § 7-16-9 (2013) should contain words like “corporation”, “incorporated”, “limited liability company” or abbreviations like “corp.”, “inc.”, “ltd.”, “L.L.C.” or similar abbreviation.

- Business name search: You need to search for a business name that is not in use currently. You can conduct name search here.

- Name Reservation: Once you have identified business entity name, and if the name is available then you can reserve the name pursuant to 2005 Rhode Island Code – § 7-1.2-403 for business corporations and RI Gen L § 7-16-10 (2013) for LLC’s. You can reserve the name with the secretary of state for a non-renewable period of 120 days.

- A foreign business entity will have to register their business name pursuant to 2005 Rhode Island Code – § 7-1.2-404.

Choose a Registered Agent

Whether you form a corporation or an LLC business entity, in order to transact business in the state of Rhode Island, you will have to maintain a registered agent pursuant to RI Gen L § 7-16-11 (2013) for LLC and 2005 Rhode Island Code – § 7-1.2-501 for Business Corporations.

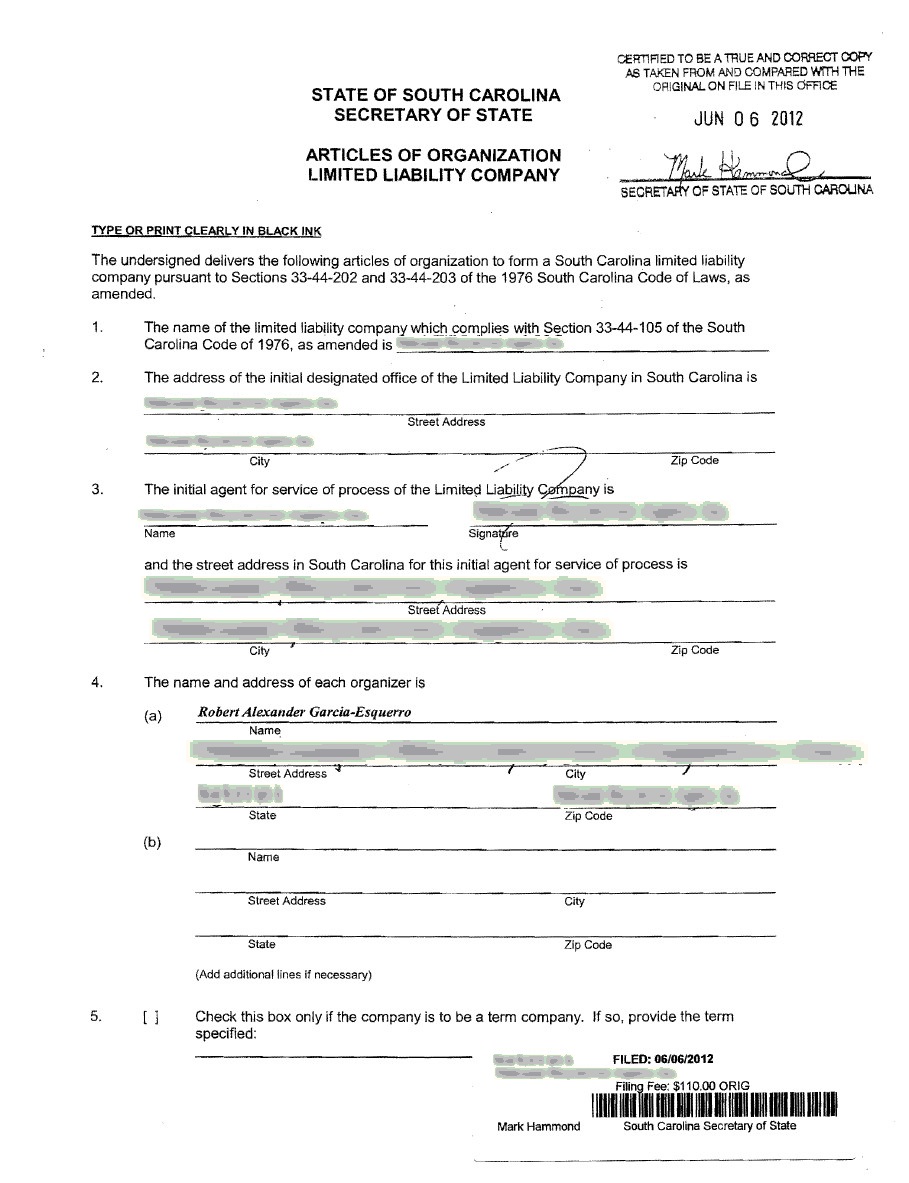

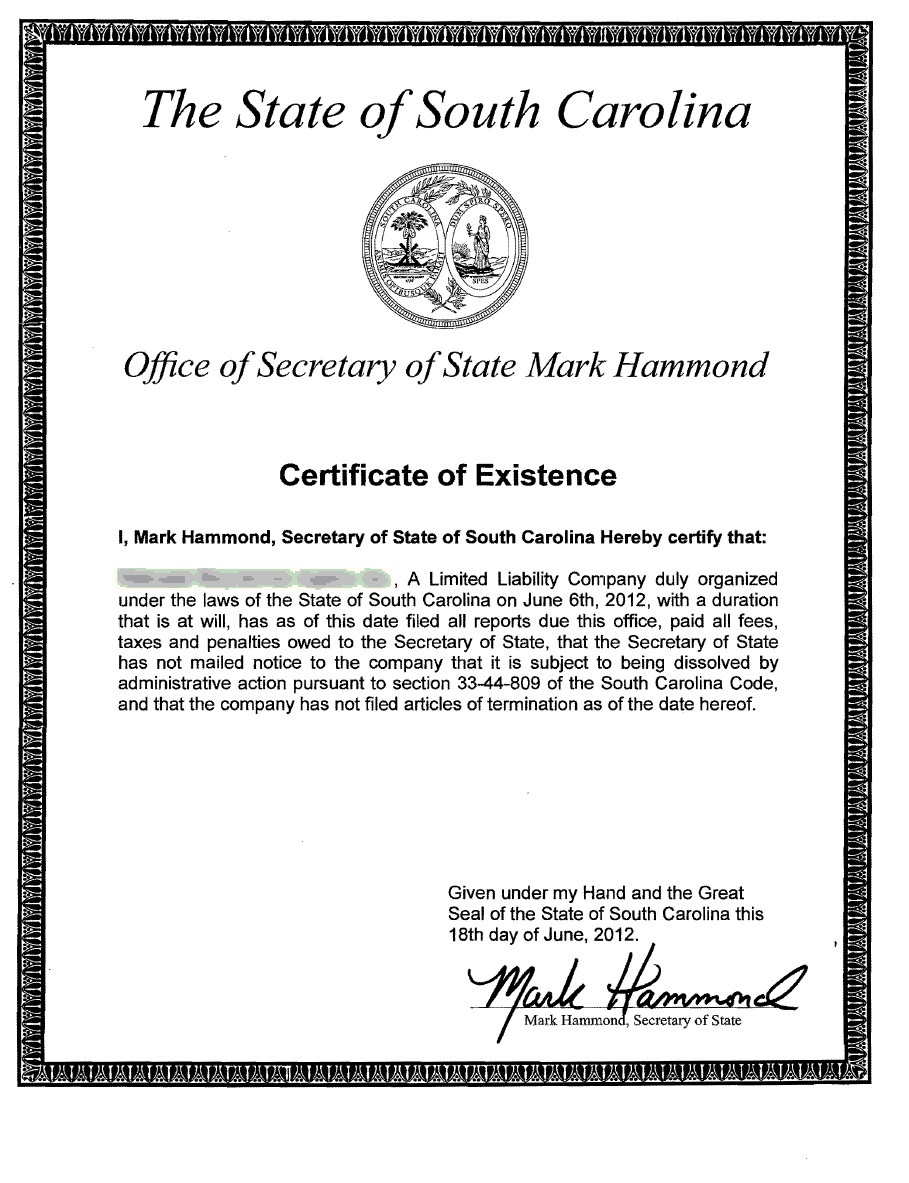

We are one of the respected registered agents in Rhode Island and will be responsible for initiating incorporation in Rhode Island through processing of your “Articles of Organization”, and “Articles of Incorporation” for domestic entities and “Application for Registration” and “Certificate of Authority” for foreign business entities.

Articles of Incorporation and Certificate of Authority

You will be required to file “Articles of Incorporation” pursuant to pursuant to RI Gen Laws § 7-1.2-202 (2005), if your business is a domestic corporation. You will have to file a “Certificate of Authority” pursuant to RI Gen Laws § 7-1.2-1405 (2005), if it is a foreign business entity. In order to streamline the process of incorporation in Rhode Island, we can file documents on your behalf through the online process or through an expedited process.

Date Stamped Copies

As a part of the process of company incorporation in Rhode Island, we will ensure, you receive date-stamped and filed copies that verifies that the state has filed as well as formed your corporation.

Costs and Fees associated with Rhode Island Incorporation

What would it cost to set up a company in Rhode Island? Check Fees here!

702-871-8678

702-871-8678