MOVING YOUR BUSINESS LLC OR CORPORATION TO DELAWARE

Does it make good business sense in moving LLC to Delaware or moving any other type of business? According to an analysis by the New Jersey Business and Industry Association, Delaware is currently ranked #1 for best business climate in the 7 state regions from Massachusetts to Maryland.

Introduction – Why Delaware?

What makes this state a popular destination for registration of start-ups and for moving Corporation to Delaware? Today, 67.2 percent of Fortune 500 companies are based out of Delaware and almost 1.4 million legal entities were incorporated in 2018. The number of LLC’s formed in 2018 was 157,142 as compared to 128,852 in 2016 and 44,669 corporation in 2018 as compared to 40,253 in 2016. This is not all, Forbes ranks Delaware #5 when it comes to business costs and the economic growth was at an annual rate of 5.7 percent in 2017, which is faster than the growth rate of the nation at 3.4%.

There are several industries that are contributing towards the $63.86 billion Real Gross Domestic Product (GDP) and every business incorporated in the state, planning to incorporate, or moving LLC to Delaware can benefit from this growing economy. The question is – what benefits or advantages are there for your business? Some of the benefits or advantages that businesses can leverage from:

- Favourable Tax Shelter: Moving Corporation to Delaware or an LLC comes with several benefits as this state is considered to be one of the most favourable tax shelters in the nation. An analysis by New Jersey Business and Industry Association revealed that the state of Delaware had the lowest sales tax rate (zero) in May 2018. Some of the benefits include:

- There is no sales tax in the state of Delaware

- The state does not levy corporate tax on any interest

- A holding corporation in the state that has equity investments or fixed-income investments, will not be taxed on the gains on a state level

- The state doesn’t have any personal property tax

- Real estate property tax is applicable on the county level but it is very low as compared to other states

- The state doesn’t have any value-added taxes (VATs)

- Delaware doesn’t have any inheritance tax or stock transfer taxes

- The Judicial System: One of the greatest benefits of moving Corporation to Delaware is the judicial system. It is different from any other judicial system in the country and is referred to as the Delaware “Court of Chancery”. This court of equity allows the state of Delaware to adjudicate any corporate litigation. The court can provide guidance and help with litigation for businesses incorporated in Delaware.

- State Incentive Programs: Whether you are moving LLC to Delaware or a business corporation; the state offers a wide range of tax and other incentive programs that businesses can leverage from. Some of the top programs include New Business Facility Tax Credit, New Economy Jobs Tax Credit, Research and Development Tax Credit, Green Industries/Brownfield Tax Credit, Delaware Capital Access Program, State Small Business Credit Initiative Participation Loan, EDGE Grants, Delaware Manufacturing Extension Partnership, and New Business Facility Corporate Income Tax Credit among others.

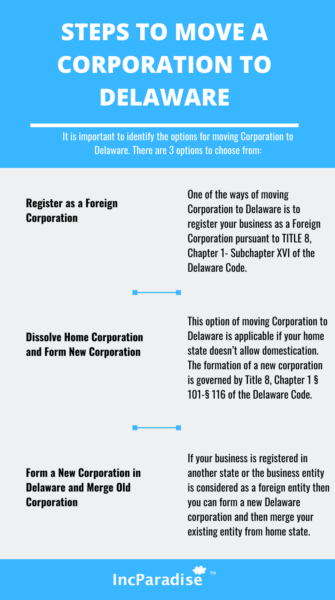

Steps to Move a Corporation to Delaware

If you are thinking of moving Corporation to Delaware, what are the possible options for moving your business to this state?

The Registration Options

It is important to identify the options for moving Corporation to Delaware. There are 3 options to choose from:

- Register as a Foreign Corporation: One of the ways of moving Corporation to Delaware is to register your business as a Foreign Corporation pursuant to TITLE 8, Chapter 1- Subchapter XVI of the Delaware Code. This option will help you to continue your corporation as it is in your state of incorporation as well as register as a foreign corporation in Delaware. It is important to note that you will be required to file annual report in your home state and “Annual Franchise Tax Report” in Delaware. If you are planning to register as a foreign Corporation then you will be required to file the following documents with the Delaware Division of Corporations:

- Qualification Certificate of a foreign corporation pursuant to Delaware Code § 371

- A Certificate of Existence that is dated within six months prior to filing of the Foreign Qualification Certificate

- Dissolve home Corporation and Form New Corporation: This option of moving Corporation to Delaware is applicable if your home state doesn’t allow domestication. The formation of a new corporation is governed by Title 8, Chapter 1 § 101-§ 116 of the Delaware Code. If you dissolve your corporation in the home state then you will be required to apply for a new Tax ID number in Delaware. The documents required to process the incorporation with the Delaware Division of Corporations are:

- Depending on the type of Corporation like Stock Corporation or Non-Stock Corporation, you will have to file a “Certificate of Incorporation” pursuant to 8 Del. C. 1953, § 102.

- Certificate of good standing from the existing state of the business entity

- Registration of Business Name

- State Business License Application

- Form a New Corporation in Delaware and Merge Old Corporation: If your business is registered in another state or the business entity is considered as a foreign entity then you can form a new Delaware corporation and then merge your existing entity from home state. The requirements for a new corporation in Delaware will be through filing a Certificate of Incorporation. In order to facilitate moving Corporation to Delaware through this option will involve filing merger documents with the Delaware Division of Corporations like:

- Certificate of Merger of Foreign Corporation into DE Corporation pursuant to 8 Del. C. 1953, § 252

- Filing Cover Memo

The documents pertaining to any of the above options can be mailed using regular or express mail, faxed, or hand delivered to the office of the Delaware Division of Corporations. Whatever option you choose, IncParadise can provide guidance and services for moving Corporation to Delaware.

Let the Top Incorporation Company in Delaware Help with Moving your Business!

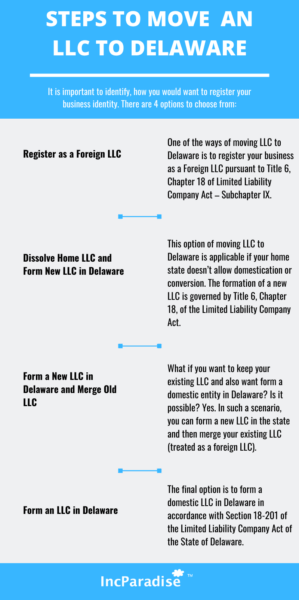

Steps to Move an LLC to Delaware

Moving LLC to Delaware to benefit from the various tax incentives and other business incentive programs is a good decision but how do you move your LLC? Do you need to form a new LLC or can it continue as the existing entity? Let’s take a look at the options offered by the state of Delaware.

The Registration Options

It is important to identify, how you would want to register your business identity. There are 4 options to choose from:

- Register as a Foreign LLC: One of the ways of moving LLC to Delaware is to register your business as a Foreign LLC pursuant to Title 6, Chapter 18 of Limited Liability Company Act – Subchapter IX. Through this option, you will be able to continue your LLC as it is in your home state and also operate as a foreign LLC in Delaware. The good news is that a foreign LLC is not required to file any annual report although you will be required to pay an annual tax. If you are planning to register as a foreign LLC then you will be required to file the following documents with the Delaware Division of Corporations:

- Certificate of Registration of Foreign Limited Liability Company pursuant to 68 Del. Laws, § 18-902

- Certificate of Existence that should be dated within six months prior to the filing date of the Certificate of Registration

- Filing Cover Memo

- Dissolve home LLC and Form New LLC in Delaware: This option of moving LLC to Delaware is applicable if your home state doesn’t allow domestication or conversion. The formation of a new LLC is governed by Title 6, Chapter 18, of the Limited Liability Company Act. One of the benefits of this option is that dissolving your LLC in home state will not entail any federal tax consequences. The documents required to process the formation with the Delaware Division of Corporations are:

- You will have to file Certificate of Formation of a Limited Liability Company pursuant to 68 Del. Laws, § 18-201

- Filing Cover Memo

- Registration of Business Name

- Form a New LLC in Delaware and Merge Old LLC: What if you want to keep your existing LLC and also want form a domestic entity in Delaware? Is it possible? Yes. In such a scenario, you can form a new LLC in the state and then merge your existing LLC (treated as a foreign LLC). In order to facilitate moving LLC to Delaware through this option will involve filing merger documents with the Delaware Division of Corporations like:

- Certificate of Merger or Consolidation of Foreign Limited Liability Company into Delaware Limited Liability Company pursuant to Title 6, Section 18-209 of the Delaware Limited Liability Company Act

- Filing Cover Memo

- Form a New LLC in Delaware and Merge Old LLC: Form an LLC in Delaware: The final option is to form a domestic LLC in Delaware in accordance with Section 18-201 of the Limited Liability Company Act of the State of Delaware. In order to enable moving LLC to Delaware the existing or the original LLC members or owners can contribute membership interests to the new LLC

The documents pertaining to any of the above options can be mailed using regular or express mail, faxed, or hand delivered to the office of the Delaware Division of Corporations. Depending on the option you choose, IncParadise can provide guidance and services for moving LLC to Delaware.

Choose Delaware Experts to help move your LLC!

Move Your Business to Delaware with IncParadise

The state of Delaware offers several advantages and benefits to LLC’s, Corporations, and other forms of businesses. If you plan on moving LLC to Delaware or your corporation then the processing related to the moving, conversion, or formation of the business entity can be quite complicated and cause inconvenience. This is where you need experts to ensure the entire process is organized and smooth.

IncParadise one of the top registered agents in Delaware will guide you through the entire process with our knowledge, experience, and commitment so that your business can achieve its short-term and long-term goals.

Looking to move your LLC or Corporation to Delaware? Allow us to take care of the conversion process for you. The valuation of your business is an integral part of the conversion. Get in touch with Eqvista to avail the best service in business valuation. With Eqvista, you can be assured of timely and accurate valuation of your business.

702-871-8678

702-871-8678