West Virginia Business License

West Virginia Business License

What do you require to establish your business in West Virginia? You need to register your business, business name, tax details etc., and you need to apply for a business license in West Virginia to make it operational in the state. However, it is important to know that you may require more than one license or permit or your business might not require a license at all.

Business licenses in the state can be broadly defined under 2 categories according to the state government:

- Regulatory licenses and permits

- Professional and occupational licenses and permits

Your business would fall under the “Regulatory licenses and permits” category if your business license is issued by different state agencies although the three most common types of regulatory licenses and permits fall under the following categories:

- Health and safety

- Environment

- Agriculture

A West Virginia company license in any of the above categories will be issued by the respective state agency like the Department of Agriculture (DOA), the Department of Health and Human Services (DHHS), or the Department of Environment Protection (DEP).

How do you apply for a license or permit? The only way you will be able to understand the process is through the “step-by-step” guide that we have created.

Step-by-Step Guide to West Virginia Business License Process

Step#1: The Industry or Business Type

How would you know what type of business or professional license is required to operate in West Virginia? The type of industry or the activities of a business entity helps in identifying the type of business license required. Different types of licenses and permits are issued by different state agencies or counties.

Let’s look at an example to understand this well.

General Construction or Contracting Business

- Licenses issued by: West Virginia Contractor Licensing Board

If your business activity is in construction including and it includes Remodeling & Repair then you will be required to apply for a business license for the same. Along with the license application, you will need to submit a “West Virginia Division of Labor Wage Bond Status Affidavit” - License Fee: $90

Information and Application

Food Service Establishment and Food Manufacturer

- Licenses issued by: West Virginia Department of Health and Human Resources, Public Health Sanitation Division

If you are planning to start a Food Service, Retail Food Establishment, or are planning to be a Food Manufacturer then you will need to apply for a business license in West Virginia. - Fee – Food Manufacturers: The license fee varies according to the “gross sales” of the manufacturing facility like the fee for a facility having gross sales of $0.00 to $7,499, will be $35. Similarly, a facility with gross sales of $1,000,000 to $4,999,999 will have a fee of $600. Download Application

- Fee – Food Service and Retail Food Establishments: The fee for a permit will be dependent on the type of service or establishment like Mobile Establishment, Restaurant, Retail Food Store, Retail Food Store Specialty Department, and Bar or Tavern among others. Download Application

Step#2: Licenses issued by City/County

If your business or industry type doesn’t fall under a state-wide license then you will have to check with the local city or county office. A West Virginia company license can also be issued by local counties or cities in which the business is located. Let’s look at an example to understand how this works.

Fayette County

You will need to obtain a permit from the Fayette County Health Department to operate a food establishment.

The Requirements are as follows:

- Submit a Plan Review Report (Form SF-35)

- Submit an Application for a West Virginia company license or permit to operate a Food Establishment (Form SF-05)

- Completed forms have to be submitted with the fee at least 30 days prior to your planned opening date for the Food Establishment

- The Fee for food establishment permits will vary according to the seating capacity and the number of retail food stores.

- You will have to contact Fayette County Health Department office to identify the fee amount.

Step#3: Issuance of a Business License

How is a business license in West Virginia issued? You have to identify the following to complete the process:

- The type of business or industry

- Do you need a license or a permit?

- Will it be issued by the state or the county?

Once you have identified the above, all you need to do is either download the application online or contact the concerned state department or city or clerk office.

It is important to note that a business license or permit will have to be renewed annually unless specific dates have been mentioned, to keep the business operational.

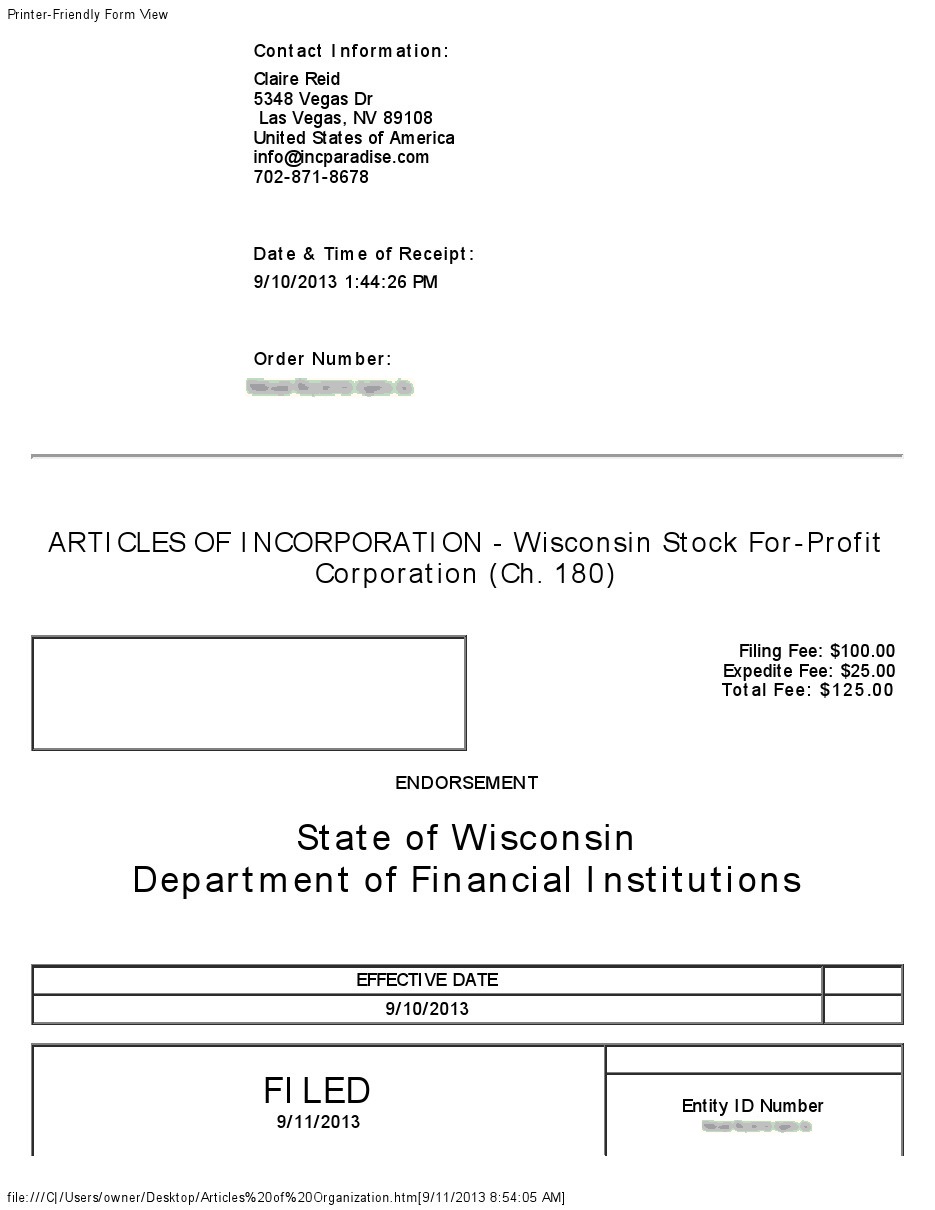

702-871-8678

702-871-8678