Incorporate in Delaware

Incorporate in Delaware

There has been an unprecedented rise off late, in the number of company incorporation in Delaware. If you are wondering why this is happening, then the answer is quite simple – Delaware provides the most favorable climate or environment for setting up your business. Whether it is privacy you seek or tax benefits, you will get it all in this state.

It is therefore no wonder that some of the biggest brands and also almost 65 percent Fortune 500 companies have headquarters in Delaware.

Why Choose Delaware for Incorporation?

The state of Delaware has flexible and established business laws that ensure that you are able to set up a company in Delaware with utmost ease and you can also reap higher business profits. In fact, the U.S. Chamber Institute for Legal Reform has mentioned that the state of Delaware has the best legal climate. So what are your advantages? Let’s take a quick look at them.

Different Corporations

Delaware laws on company incorporation allows you to set up three different types of corporations. These are general, closed and non-profit. Each type of corporation has its unique structure and thus will enable you exercise a variety of options.

Tax shelter

The state of Delaware provides the much needed tax shelter to corporations. If you are thinking of incorporating in Delaware then you will be happy to know that there are:

- No sales tax in Delaware

- No corporate tax on any investment income

- No corporate tax on interest

- No personal property tax

- No value-added taxes (VATs)

- No inheritance tax

- No stock transfer or capital shares tax

Corporate Privacy

As an owner of a corporation, you will enjoy maximum confidentiality as local Delaware laws disallow revealing personal information as well as information of Corporation owners.

Foreign Resident

Directors, managers, shareholders, members, and officers, of a corporation are not required to be residents of Delaware.

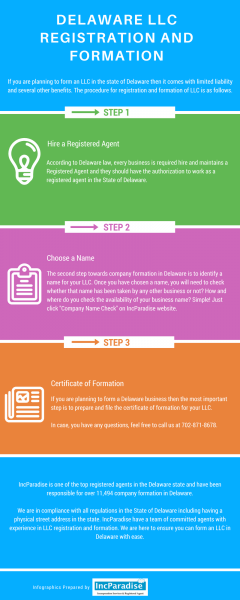

How do you incorporate in Delaware?

If you are planning to set up company in Delaware then you will be required to follow certain procedures that will aid in the formation of your LLC or incorporation. We at incparadise.net have specialists on our team who can guide you through setting up or forming an LLC, a Delaware C Corporation, and Delaware a S Corporation in the shortest possible period.

Here is a step by step procedure of how to incorporate in Delaware

Type of Business

You need to identify the type of business you want to start. You can choose from a benefit corporation to a general corporation, non-stock corporation, close corporation, LLC, limited partnership, or series LLC.

Business Name

The second step is to identify a name for your business along with the required suffix, which will indicate the type of business entity you have formed. If you opt for company incorporation in Delaware then some of the common suffixes include Corporation (or Corp.); Incorporated (or Inc.); Limited (or Ltd.); and Company (or Co.). If you opt for an LLC, the permitted suffix is LLC, Limited Liability Company, or L.L.C.

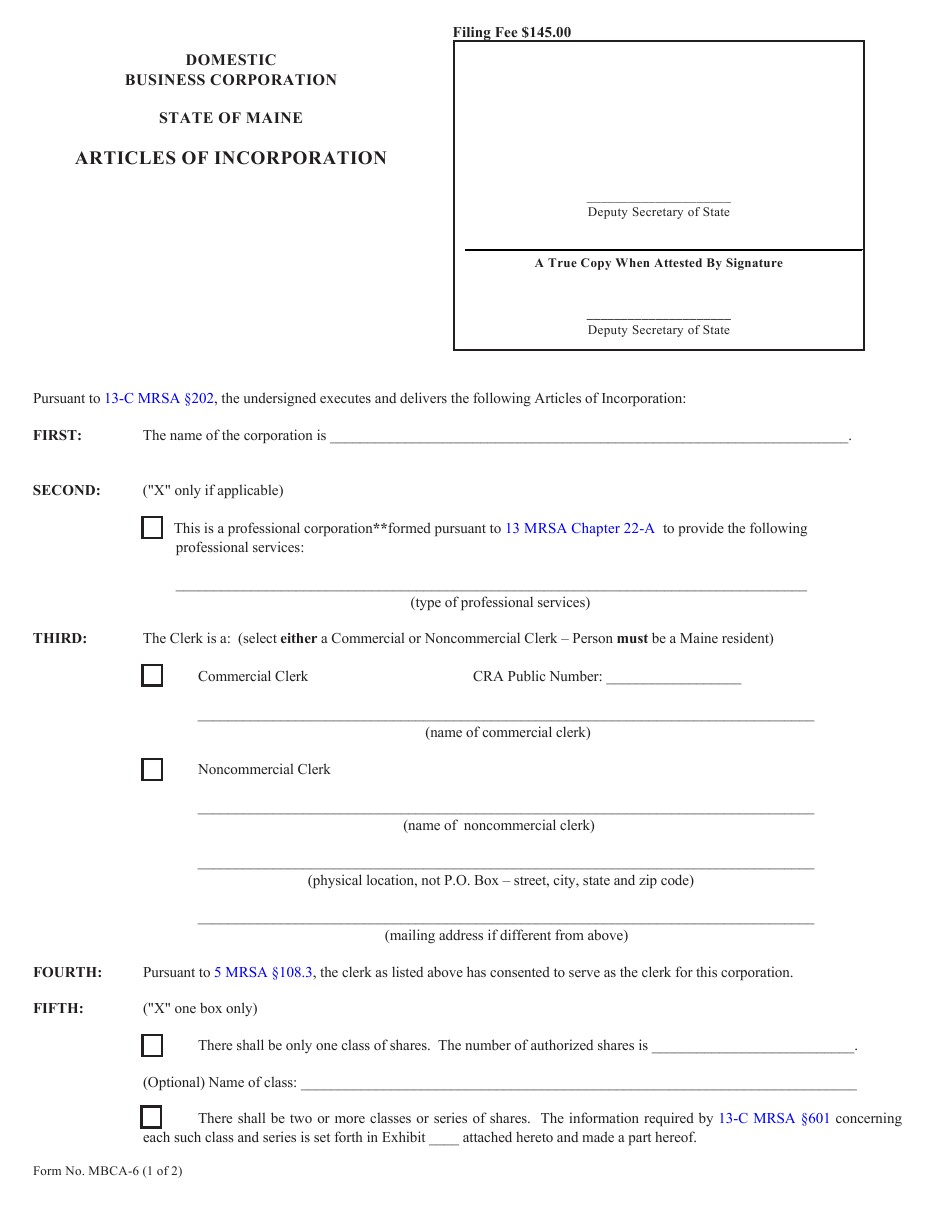

Certificate of incorporation

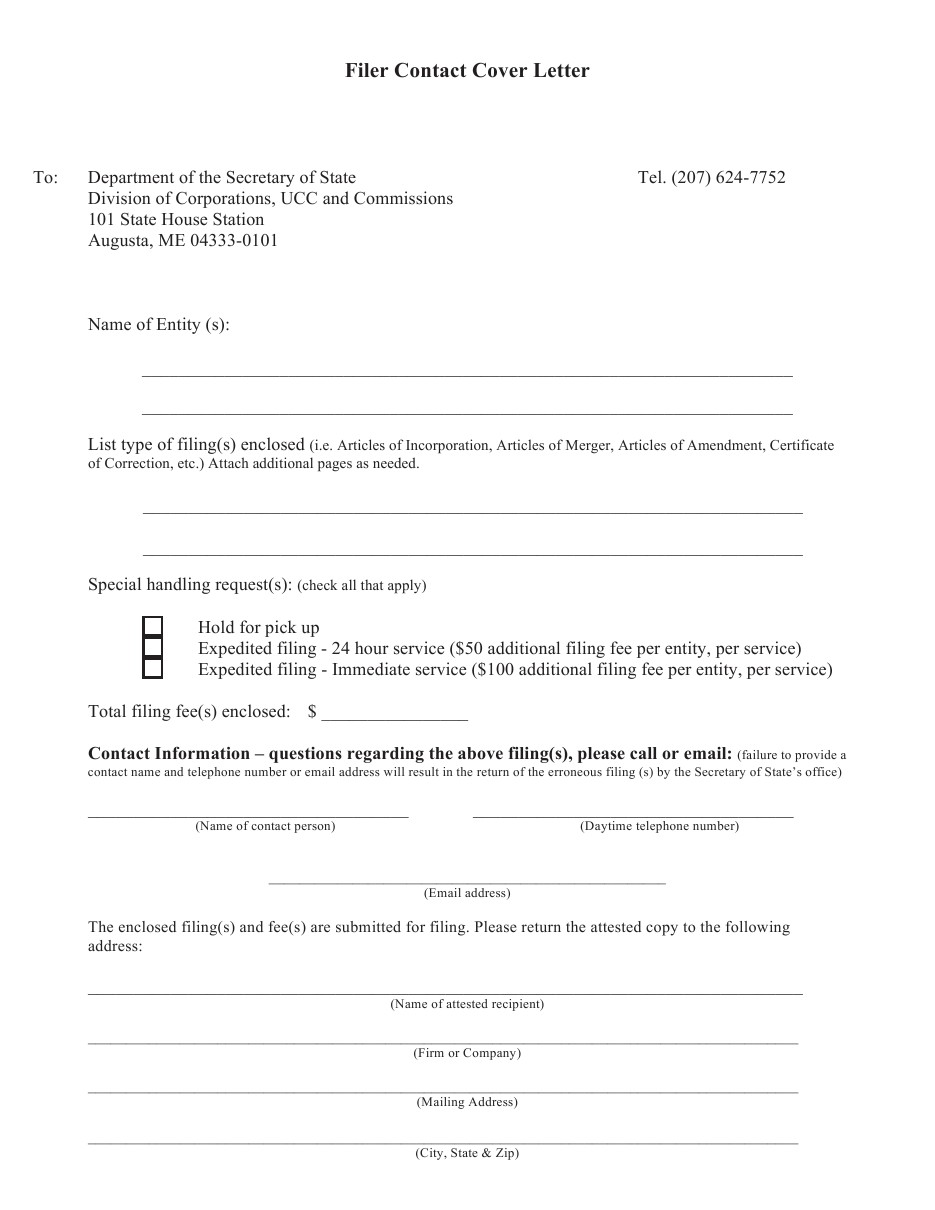

You will need to file certificate of incorporation, which we can always file on your behalf through the standard process or online or through expedited process.

Federal Tax ID

You will require a Federal Tax ID if you are planning to hire employees. It is also mandatory for opening a bank account in the name of the Delaware Corporation.

Receipt of Certificate

Once the company incorporation in Delaware process is complete, you will receive the “Delaware certificate of incorporation”.

Delaware Incorporation Agent

You will need a Delaware registered agent like incparadise.net to ensure your business meets all the necessary requirements. We can also receive any and all legal and business related paperwork on your behalf.

Costs and Fees associated with Delaware Incorporation

Is incorporating in Delaware expensive? This is question that most of our previous clients have asked and the answer is that “We ensure it is not burdensome to you!”

702-871-8678

702-871-8678