Incorporate in Arizona

Incorporate in Arizona

Why is Arizona an attractive place for setting up new businesses? We are talking of a state whose current-dollar GDP was $305.8 in 2016 indicating a growth of 2.6 percent. The largest industries in Arizona instrumental in driving Arizona GDP include insurance, finance, rental, real estate, and leasing. Businesses like Avnet Inc., set up a company in Arizona and has recorded $26.2 billion revenue and is currently ranked 108 on the Fortune 500 list. Some of the other Arizona businesses featuring the Fortune 500 list include Freeport-McMoRan Inc., Insight Enterprises, and Republic Services of Phoenix.

Why Choose Arizona for Incorporation?

Is company incorporation in Arizona a beneficial decision? Definitely! Arizona has seen a rise in the numbers of small and medium sized businesses being formed in the state. There are approximately 519,504 small businesses in the state and they account of 97% of Arizona Businesses. This increase in business formations in the state can be attributed to a variety of benefits and advantages. Let’s look at some of them.

Tax Climate

In 2017, in a move to support incorporation in Arizona by larger number of businesses, the corporate income tax rate was reduced from 5.5 to 4.9 percent.

Tax Relief

There is a variety of tax relief programs offered to businesses in Arizona. Some of the most popular programs include:

- Quality jobs tax credit: The primary goal is to encourage incorporation in Arizona, business investments as well as creation of employment opportunities in the state. Businesses can get tax credits of up to $9,000 spread over a 3-year period for each new quality job.

- Foreign trade zone: If you set up a company in Arizona and if it is situated in a zone or a sub-zone under a FTZ (foreign trade zone) then the business will be eligible for a maximum of 72.9 percent reduction in their personal and real property taxes. The FTZ zones or sub-zones are situated in Phoenix, Tucson, San Luis, Naco, and Nogales.

- Sales tax exemptions: The state of Arizona offers new businesses, and sales tax exemptions on any equipment or machinery used directly in their manufacturing processes, research and development process, smelting operations, and production and transmission of electrical power.

How do you incorporate in Arizona?

Planning to set up a company in Arizona? The first thing that you need to know is how to incorporate your business. There are several processes involved in the registration of your business in the state. We at incparadise.net have a team of specialists who can guide you through setting up an Arizona C Corporation, S Corporation, and LLC in the shortest possible period.

Let’s take a quick look at how to incorporate in Arizona

- Type of Business: You can form different types of business entities under domestic or foreign entities and this includes Limited Liability Companies (LLC), Business Trusts, Limited Partnerships (LP), General Partnerships, (GP), C and S Corporations, Closed Corporation, Professional Corporation, and Sole Proprietorship. It is important that you identify the type of business you want to set up in the state.

- Business Entity Name: The next most important step is to “name” your business. The “Statutory Name Requirements” will be different for different business entities and needs to be considered in order to proceed towards incorporation in Arizona. Whether you are forming a Corporation or a Limited Liability Company (LLC), it is important to ensure that the names contain specific words like “LLC”, Limited Liability Company”, “inc.”, “corp.” etc. You need to also ensure the name is distinguishable from other entity names that are currently on file with the Arizona Secretary of State and the Arizona Corporation Commission.

- Registered Agent: According to A.R.S. §§ 10-501 (for-profits), 10-3501 (nonprofits), 10-1507 (foreign corps), 29-604 (LLCs), 29-806 (foreign LLCs), if you are planning to set up a company in Arizona, you are required to appoint a statutory agent in the state. The primary duty of a registered agent is to fulfill the purpose of accepting service of process (legal documents or lawsuit papers) on behalf of the business entity. As one of the top registered agents in Arizona, incparadise.net, will provide everything that under “service of process” in the state for you.

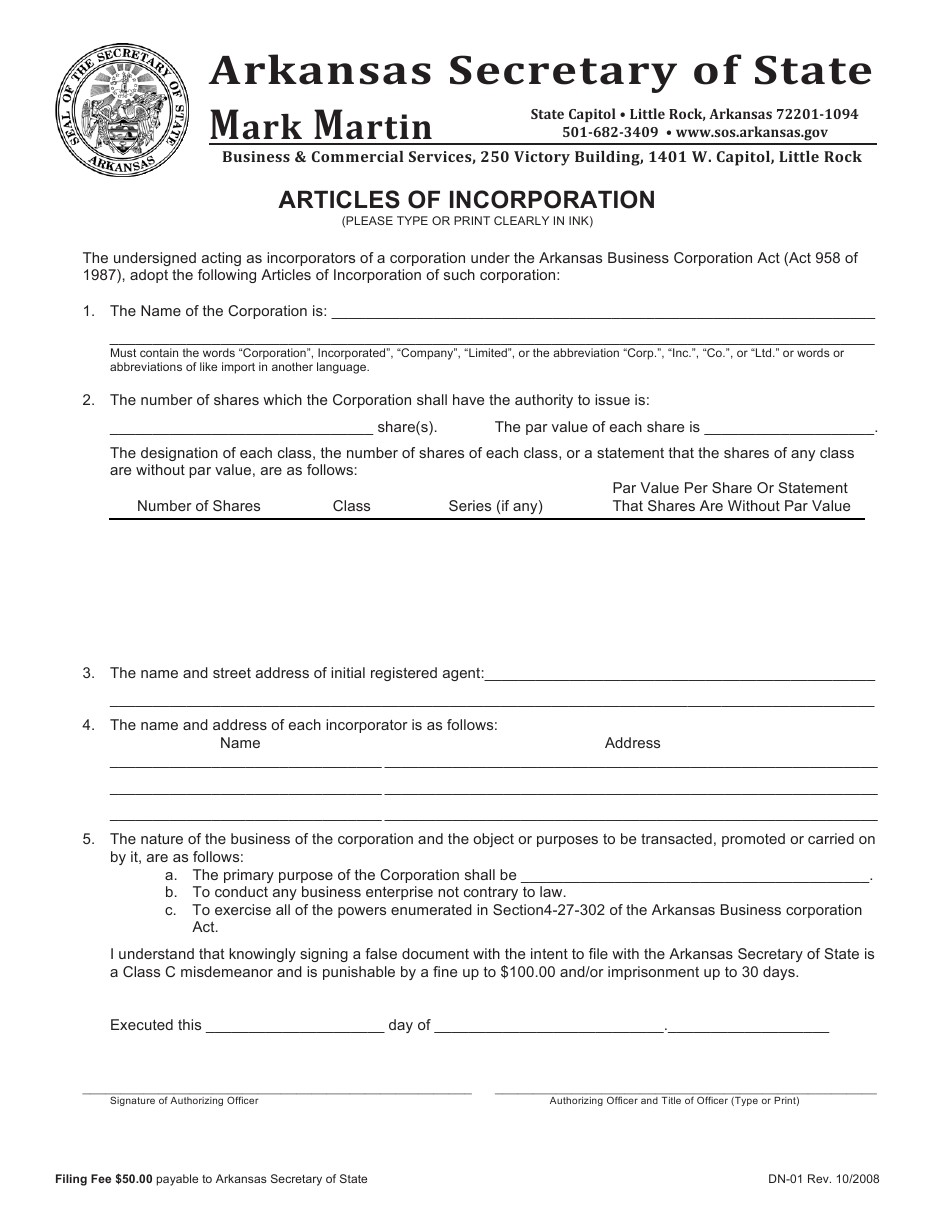

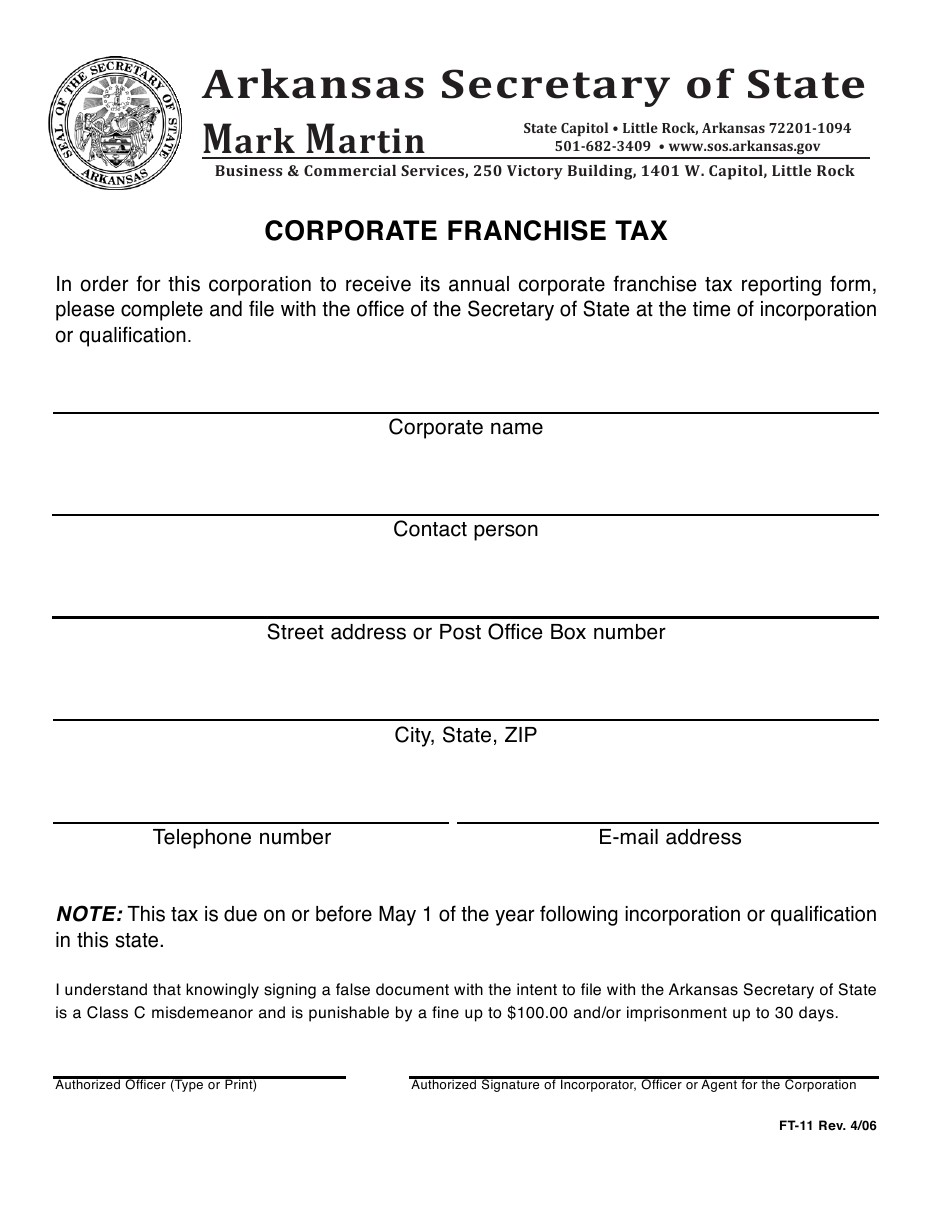

- Certificate of Incorporation: Incorporation in Arizona involves the filing of “Articles of Incorporation” for a Professional Corporation or For-Profit Corporation. The articles need to be submitted to the Arizona Corporation Commission and should include documents like Cover Sheet, Director Attachment (if applicable), Incorporator Attachment (if applicable), Statutory Agent Acceptance, and Certificate of Disclosure with any applicable attachments. You can submit it through mail, deliver it in person, or submit online. We can always file on your behalf through the standard process online or through expedited process.

- Date Stamped Copies: As a part of the process of company incorporation in Arizona, we will ensure, you receive a Certified Copy of your documents and a Certificate of Status confirming the state of Arizona has filed as well as formed your corporation.

Costs and Fees associated with Arizona Incorporation

What would it cost to set up a company in Arizona? Check Fees here!

702-871-8678

702-871-8678