Incorporate in Colorado

Incorporate in Colorado

Is incorporation in Colorado the right business decision? Colorado is a state with a Gross State Product of $315 billion and is ranked 8th in the Forbes “Best States for Business” list. Forbes has also ranked the state at #3 when it comes to “Economic Climate”. If we talk about business tax climate, then the state ranks quite high on the “State Business Tax Climate Index,” thanks to the competitive tax system it has. Apart from this there are several benefits and state based tax incentives that aid in the future growth of businesses.

Why Choose Colorado for Incorporation?

There has been a rise in company incorporation in Colorado with small businesses setting up shop in the state. According to reports by U.S Small Business Administration (SBA), the number of small businesses has increased in industries including Accommodation and Food Services, Manufacturing, Mining, Quarrying, and Oil and Gas Extraction, Transportation and Warehousing, Information, Wholesale Trade, Retail Trade, and Educational Services among others. Here’s a Year over year (YOY) data for small businesses in Colorado:

- Year 2015 – Number of Small Businesses: 596,210 – Employment Created: 51,068 – Trade: 87.3%

- Year 2016 – Number of Small Businesses: 572,546 – Employment Created: 32,304 – Trade: 87.2%

- Year 2017 – Number of Small Businesses: 611,495 – Employment Created: 52,209 – Trade: 5,027

Now let’s take a look at some of the salient benefits that are responsible for fuelling growth of small businesses:

Colorado Opportunity Zones

If you set up a company in Colorado especially in the opportunity zones approved by the U.S. Treasury then you or your business entity will be eligible for investment by Opportunity Funds. The opportunity zones were created as a part of a 2017 tax reform package. You can check the opportunity zones map by clicking here.

Business Funding and Incentives

One of the advantages of an incorporation in Colorado is the availability of a variety of business funding and incentives, which will help your business to achieve the intended growth. Some of the popular programs include:

- Colorado Credit Reserve (CRR): This is a program jointly administered by the Colorado Housing and Finance Authority (CHFA) and OEDIT and it aids towards increasing the availability of credit to small businesses in the state.

- CDBG – Business Loan Funds: This is a program that involves 14 regions wherein businesses are provided funding in order to stimulate long-term economic development.

How do you incorporate in Colorado?

How do you set up a company in Colorado? What are the procedures? What forms and documentation are you required to submit and to whom? These are some of the common questions that you will be confronted with if you are new to the state. It is definitely not a difficult process but there are a few steps that need to be undertaken in order to conduct business in the state. The steps are:

Business Type

The first step towards incorporation in Colorado is choosing the type of business you want to form. Each type of corporation has its own advantages and disadvantages and the forms and fees are different. Business corporations can be classified under domestic and foreign corporations. You can also form Profit Corporation, Non-Profit Corporation, and Benefit Corporations. Know more

Business Entity Name

If you are planning to set up a company in Colorado then the next step is to start by identifying, searching, reserving, and then registering the business entity name. There are 3 steps towards business name formation and they are:

- Naming Requirements: You need to use terms and abbreviations in an entity name like “Corporation”, “Corp”, and “Inc”. The names should be distinguishable like” EFG Inc is not the same as EFG Inc but EFG Inc is the same as efg inc.

- Business name search: You need to search for a business name that is not in use currently. You can conduct name search here.

- Name Reservation: Once you have identified business entity name, it is advisable to reserve the name with the Secretary of State pursuant to §7-90-602 and part 3 of Article 90 of Title 7 of the Colorado Revised Statutes (C.R.S.). Name reservations are valid for 120 days and can be renewed through filing of Statement of Renewal of Reservation of Name.

Choose a Registered Agent

A domestic business entity as well as foreign entity authorized to transact business in the state of Colorado will have to maintain a registered agent pursuant to CO Rev Stat § 7-90-701 (2016). We are one of the respected registered agents in Colorado and will be responsible for initiating an incorporation in Colorado through processing of your “Articles of Incorporation” for domestic corporations and “Statement of Foreign Entity Authority” for foreign corporations.

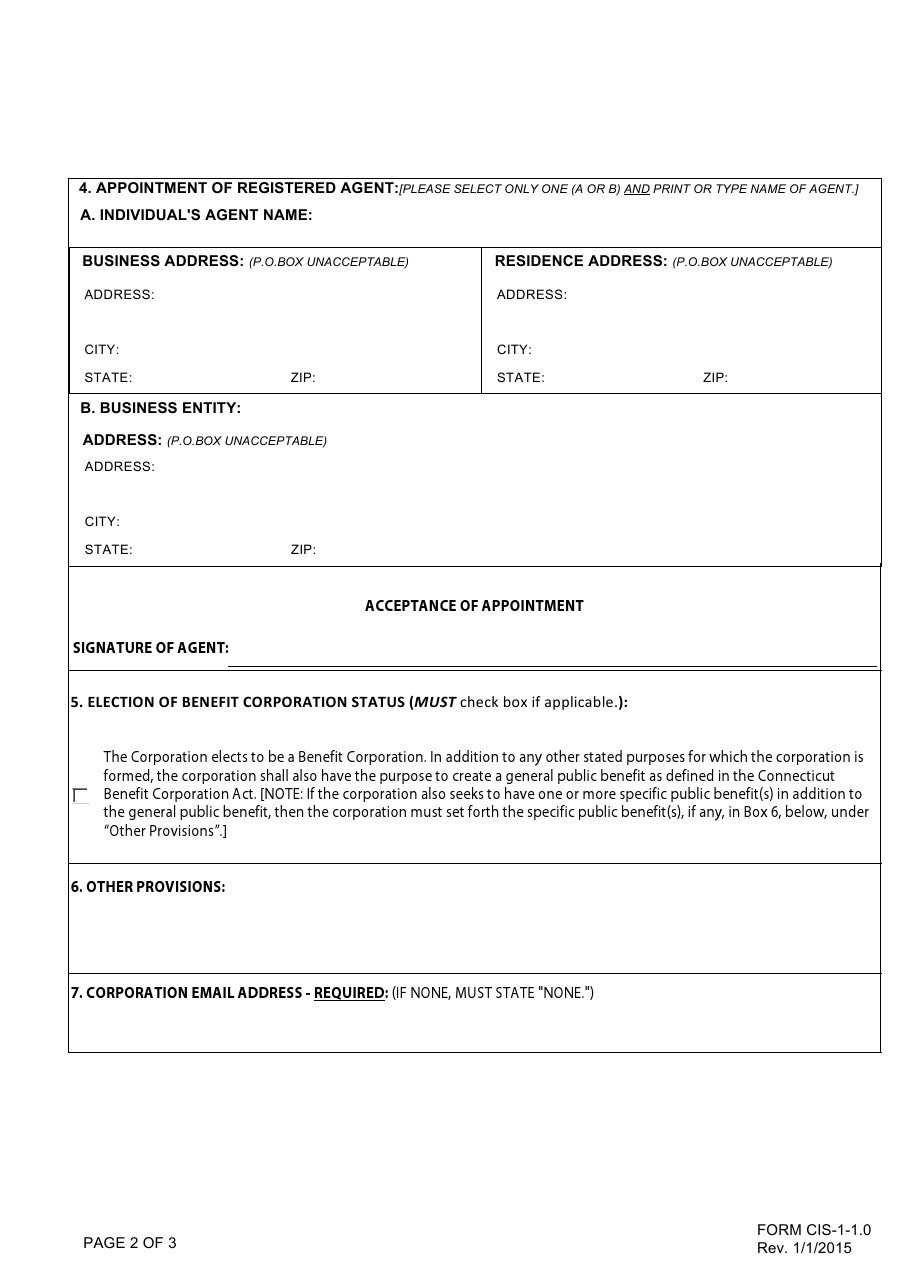

Articles of Incorporation and Statement of Foreign Entity Authority

You will be required to submit “Articles of Incorporation” if your business is a domestic corporation and a “Statement of Foreign Entity Authority” if it is a foreign business entity. In order to streamline the process of incorporating in Colorado, we can file documents on your behalf through the online process or through an expedited process.

Date Stamped Copies

As a part of the process of a company incorporation in Colorado, we will ensure, you receive date-stamped and filed copies that verifies the state has filed as well as formed your corporation.

Costs and Fees associated with Colorado Incorporation

What would it cost to set up company in Colorado?

Check Fees here!

702-871-8678

702-871-8678