News

FAQ

Colorado Incorporation Frequently Asked Questions

Do I need to reserve a corporate name?

No, but it is recommended to reserve a name prior to filing to ensure that it remains available during the incorporation process.

How do I reserve a corporate name?

The reservation of your corporate name will be handled by IncParadise and is included in the price of our service.

Do I have to renew my name registration?

No.

How do I incorporate in Colorado?

When using our service, IncParadise will file, on your behalf, the required administrative forms and articles of incorporation with the appropriate Colorado agency.

Is a registered agent required?

Yes. The registered agent must either be (1) a natural person at least eighteen years old whose primary residence or usual place of business is in Colorado or (2) an entity whose usual place of business is in this state. As part of our ongoing service, IncParadise does provide a registered agent service option that you can select during the online registration process.

How many Incorporators are required to form a corporation in Colorado?

One or more are required.

How many Directors are required to start a corporation in Colorado?

One or more as defined in the entity’s bylaws.

Are corporations in Colorado required to file an Annual Report?

Yes. A report must be filed by the end of the second calendar month following delivery of the corporation’s original articles, and every year thereafter in the applicable filing period.

How long does it take to process an application?

Applications filed online are processed immediately. Expedite service is not available for documents that are filed online.

Do I receive any paper work back after filing online?

You may obtain a copy of anything filed with the SOS via the website. Colorado does not send back confirmation copies of filings. Copies are available for free online after the document is processed and put on record.

Who has to file an annual report?

All entities, with the exception of limited partnerships, are required to file an annual report with the Secretary of State. An annual report can be filed online starting at the beginning of the second month prior to the month of organization of the entity.

What are EMail notifications?

The Secretary of State offers two forms of email notification. You may sign up for either one or both forms of notification. One receivea general news which includes updates to documents available for online filing, changes to forms or filing procedures, as well as technology updates. The other is to receive updates for specific business entities of record. You will receive notification whenever a document is filed affecting the business(es) for which you have signed up. This will allow you to track any changes being made to an entity. Also, you will receive email notification when the annual report is due.

Who can be a registered agent?

Any individual at least 18 years of age with a physical address in Colorado may act as a registered agent.

Didn’t find answer to your question? Email as at [email protected]

Colorado Business License

Colorado Business License

Now that you have already thought of forming an LLC or incorporating a business in the state of Colorado, it is important to ask: does your establishment require a business license? The state does not have a general business license but some of the cities and counties may require businesses to procure a local general business license in order to conduct business in that region.

It is important to note that a business license in Colorado pertaining to a specific industry is issued or regulated by agencies related to that industry, for example restaurant businesses require “Retail/Food Licenses”, which are regulated by the Department of Public Health & Environment while licenses for gas stations are regulated by the Department of Labor and Employment, Division of Oil and Public Safety.

Types of Business License in Colorado

Where and how do you apply for a business license in Colorado? In order to understand how to apply for a license or permit, you need to understand the types of licenses that are regulated or issued in the state.

License for Regulated Industries

The Department of Regulatory Agencies (DORA) is responsible for regulating various industries, professions and businesses that require licenses or permits. The licenses or permits are issued and renewed by DORA’s Divisions with assistance from various Boards and Commissions. Let’s look at an example to understand this well:

If you are setting up “Wholesale Drug Outlets” in the state then you will require a Colorado company license to conduct business. The issuance authority for the license is DORA Division and State Board of Pharmacy. Your firm or drug store will have to meet statutory requirements for licensure.

The type of pharmacy license you will apply for is dependent on the type of entity. For example “Hospital Satellite Pharmacy (HSP)” License Application will be different from “In-State Manufacturer of Prescription Drugs”.

It is important to note that a pharmacy business license will expire on October 31 of even-numbered years.

Sales and Use Tax License

This is another type of Colorado company license that a business entity based in the state will require.

In the state of Colorado, there are different types of sales tax license and businesses will have to apply for the type of business license that is most applicable to them. In other states, this type of license is also known as a vendor’s license, reseller’s license, or even a resale certificate. This type of license is issued by the Colorado Department of Revenue and is valid for a two-year period. You have to renew this license at the end of each odd-numbered year. Here is a list of some of the most common licenses:

- Standard Retail License: This type of business license is also known as “Sales Tax License”. This license is issued to those businesses that have a retail sales counter or store and it is in a permanent location. Some business entities may be involved in both retail and wholesale sales. In such a scenario, you can use the standard retail license for both instead of applying for separate wholesale licenses.

- Wholesale License: This is a business license in Colorado that is meant for those business entities that are involved in selling to other licensed vendors.

- Special Event License: There are two types of special event license: single and multiple. The single license comes with 2 year validity and is meant for businesses conducting a single event from a temporary location. The multiple licenses are for one or more events and have 2-year validity as well.

Some of the other business license in Colorado that fall under this category includes Exempt Certificate for Non-profit, Charitable, School, Religious or Government Organizations, Exempt License for Contractors, and license for Small Home Businesses.

The fee for the above license vary according to the type of license and according to the location i.e., different for businesses inside Colorado and those outside.

Additional Permits or Licenses

Apart from the above mentioned license types, the state of Colorado also requires businesses to acquire permits or licenses relevant to the nature of specific services. The license fee and conditions related to the issuance of such Colorado company license will vary. This is just like the license fee for Manufacturer/Distributor in the gaming industry which is $3,700 while the license fee for Original Auto Dealer is $ 519. Specific services or businesses that require additional permits and licenses include:

- Beer and Wine Licenses

- Bingo and Raffle Licenses.

- Plumbing Permits

- Gaming

- Auto Industry

Advantages of Incorporating a Business in Colorado

Advantages of Incorporating a Business in Colorado

One of the key drivers of startup companies in Colorado is the numerous business incentives being offered apart from the salient advantages. Once you have formed a Colorado business, you or your business entity will be able to benefit from these incentives and advantages. The Department of Revenue of Colorado administers most of the tax incentives including exemptions as well as tax credits, while OEDIT (Office of Economic Development and International Trade) along with other state agencies administer non-tax programs and other credit programs.

Business Growth Incentive for New Businesses

As one of the top registered agents in the state, we can help you to register a new business in Colorado as this will ensure you are able to leverage all types of business gains and state provided incentives and grants. Let’s take a quick look at why Colorado is considered one of the best places for establishing a business:

Advantage#1: Salient benefits of Corporation or LLC formation

Corporation

- Limited Liability: The shareholders in of a Colorado C Corporation will enjoy limited liability where the corporation’s debts are concerned.

- Easy Conversion to S Corporation: If you register a new company in Colorado as a C Corporation, you can always convert with ease to an S Corporation and enjoy the benefits of flow through taxation.

- Long life: When you register a new business in Colorado as a Corporation, you will be able to raise additional funds by selling stock.

- Colorado public benefit corporation: You can also establish your business entity as a Colorado public benefit corporation, which will enable long-term value creation. Such a corporation will also be able to benefit from several incentives laid out by the state.

LLC

- Flexible Profit Distribution: A startup company in Colorado registered as an LLC has the benefit of being able to select different ways of distribution of profits

- Limited Liability: As an owner of a Colorado LLC, you will be able to enjoy limited liability protection quite similar to what a corporation enjoys.

- Flow through Taxation: When you register a new company in Colorado, an LLC can benefit from the process of flow through taxation that will ensure there are no double taxations.

- No Minutes of meetings: Unlike a corporation, an LLC startup company in Colorado will not be required to maintain any minutes of its meetings or resolutions.

Advantage#2: Beneficial Programs

Several beneficial programs have been introduced in the state of Colorado to enhance the growth of small and medium sized businesses. Once you register a new business in Colorado, you will be able to benefit from the programs especially those that are either focused on a business specific industry, type of business, or location of business. Some of the top programs include:

- Colorado Credit Reserve (CRR): This is a program wherein a startup company in Colorado can avail credit options. This program is being administered by the Colorado Housing and Finance Authority (CHFA) and Colorado Office of Economic Development and International Trade (OEDIT).

- Work Opportunity Tax Credit (WOTC): This is a type of federal tax credit wherein employers are encouraged to hire a targeted group of job seekers. If you register a new company in Colorado, you can get federal tax credit between $2,400 and $9, 600 for each new hire.

- Colorado Microloans: This is a Microloan Program and its aim is to provide small loans to startup companies in Colorado as well as entrepreneurial small businesses. The program has been created by the Colorado Economic Development Commission (EDC) and is being administered by the Colorado Office of Economic Development and International Trade (OEDIT). The loan amount through this program can vary from $5,000 to $50,000.

Are there any Disadvantages of Incorporating in Colorado?

The state of Colorado provides a long list of benefits and advantages to businesses but are there any disadvantages if you register a new business in Colorado? The disadvantages are very few and almost inconsequential like, the fact that you have to pay a higher fee and the time taken to process incorporation is also longer as compared to other forms of organization. The fact is that these are small disadvantages compared to the several benefits that can steer ahead your business towards substantial growth.

Apart from the above mentioned programs, there are several other programs that businesses can benefit from including the Transferable Tax Credit program, Strategic Fund Incentive, State Trade Expansion Program, Regional Tourism Act, Job Growth Incentive Tax Credit, and Enterprise Zone Tax Credits among others.

Colorado LLC and Corporation Registration and Formation

Colorado LLC and Corporation Registration and Formation

What makes Colorado such an attractive destination to start small or medium sized business (SME’s)? There are many reasons why you should form a Colorado business and topmost among them is the fact that the state has an excellent business climate. Today, the state of Colorado has one of the most successful economies in the nation and is considered the 18th best state in terms of lower corporate tax. The state has a competitive tax system and is considered best suited to drive economic growth.

Let me take the opportunity to introduce startupr to you. We are one of the top Colorado registered agents and are familiar with all processes pertaining to the Colorado State and can provide information and assistance for a successful set up of your business!

Let’s take a look at how you can form a Colorado business LLC or Corporation.

Colorado LLC Registration and Formation

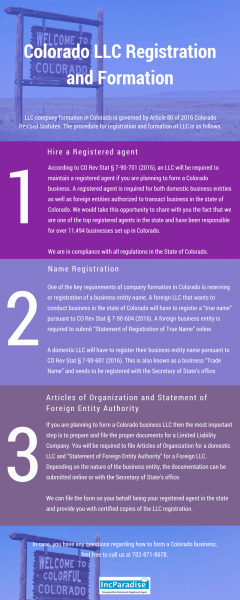

LLC company formation in Colorado is governed by Article 80 of 2016 Colorado Revised Statutes. The procedure for registration and formation of LLC is as follows:

Step#1: Hire a registered agent

According to CO Rev Stat § 7-90-701 (2016), an LLC will be required to maintain a registered agent if you are planning to form a Colorado business. A registered agent is required for both domestic business entities as well as foreign entities authorized to transact business in the state of Colorado. We would take this opportunity to share with you the fact that we are one of the top registered agents in the state and have been responsible for over 11,494 businesses set up in Colorado.

We are in compliance with all regulations in the State of Colorado.

Step#2: Name Registration

One of the key requirements of company formation in Colorado is reserving or registration of a business entity name. A foreign LLC that wants to conduct business in the state of Colorado will have to register a “true name” pursuant to CO Rev Stat § 7-90-604 (2016). A foreign business entity is required to submit “Statement of Registration of True Name” online.

A domestic LLC will have to register their business entity name pursuant to CO Rev Stat § 7-90-601 (2016). This is also known as a business “Trade Name” and needs to be registered with the Secretary of State’s office.

Step#3: Articles of Organization and Statement of Foreign Entity Authority

If you are planning to form a Colorado business LLC then the most important step is to prepare and file the proper documents for a Limited Liability Company. You will be required to file Articles of Organization for a domestic LLC and “Statement of Foreign Entity Authority” for a Foreign LLC. Depending on the nature of the business entity, the documentation can be submitted online or with the Secretary of State’s office.

We can file the form on your behalf as your registered agent in the state and provide you with certified copies of the LLC registration.

In case, you have any questions regarding how to form a Colorado business, feel free to call us at 702-871-8678.

Colorado Corporation Registration and Formation

If you are planning to form a Corporation in Colorado then the procedure for registration and formation is as follows:

Step#1: Maintain a Registered Agent

According to CO Rev Stat § 7-90-701 (2016), you will be required to maintain a registered agent if you are planning to form a Colorado business. A registered agent is required for both domestic business entities as well as foreign corporations authorized to transact business in the state of Colorado. We would take this opportunity to share with you the fact that we are one of the top registered agents in the state and have been responsible for over 11,494 businesses set up in Colorado.

We are in compliance with all regulations in the State of Colorado.

Step#2: Name Registration

One of the key requirements of a company formation in Colorado is reserving or registration of a business entity name. A foreign business entity that wants to conduct business in the state of Colorado will have to register a “true name” pursuant to CO Rev Stat § 7-90-604 (2016). A foreign corporation is required to submit “Statement of Registration of True Name” online.

A domestic Corporation will have to register their business entity name pursuant to CO Rev Stat § 7-90-601 (2016). This is also known as a business “Trade Name” and needs to be registered with the Secretary of State’s office.

Step#3: Articles of Incorporation and Statement of Foreign Entity Authority

If you are planning to form a Corporation in Colorado then the type of registration form you will require is dependent on whether your business is based in Colorado or it is a foreign company. You will need to file Articles of Incorporation for a domestic Corporation and Statement of Foreign Entity Authority for a foreign business entity. Depending on the nature of the business entity, the documentation can be submitted online or with the Secretary of State’s office.

We can file the form on your behalf as your registered agent in the state and provide you with certified copies of the incorporation.

If you have any questions regarding Colorado incorporation or LLC formation, you can simply visit the Colorado Business formation page.

Incorporate in Colorado

Incorporate in Colorado

Is incorporation in Colorado the right business decision? Colorado is a state with a Gross State Product of $315 billion and is ranked 8th in the Forbes “Best States for Business” list. Forbes has also ranked the state at #3 when it comes to “Economic Climate”. If we talk about business tax climate, then the state ranks quite high on the “State Business Tax Climate Index,” thanks to the competitive tax system it has. Apart from this there are several benefits and state based tax incentives that aid in the future growth of businesses.

Why Choose Colorado for Incorporation?

There has been a rise in company incorporation in Colorado with small businesses setting up shop in the state. According to reports by U.S Small Business Administration (SBA), the number of small businesses has increased in industries including Accommodation and Food Services, Manufacturing, Mining, Quarrying, and Oil and Gas Extraction, Transportation and Warehousing, Information, Wholesale Trade, Retail Trade, and Educational Services among others. Here’s a Year over year (YOY) data for small businesses in Colorado:

- Year 2015 – Number of Small Businesses: 596,210 – Employment Created: 51,068 – Trade: 87.3%

- Year 2016 – Number of Small Businesses: 572,546 – Employment Created: 32,304 – Trade: 87.2%

- Year 2017 – Number of Small Businesses: 611,495 – Employment Created: 52,209 – Trade: 5,027

Now let’s take a look at some of the salient benefits that are responsible for fuelling growth of small businesses:

Colorado Opportunity Zones

If you set up a company in Colorado especially in the opportunity zones approved by the U.S. Treasury then you or your business entity will be eligible for investment by Opportunity Funds. The opportunity zones were created as a part of a 2017 tax reform package. You can check the opportunity zones map by clicking here.

Business Funding and Incentives

One of the advantages of an incorporation in Colorado is the availability of a variety of business funding and incentives, which will help your business to achieve the intended growth. Some of the popular programs include:

- Colorado Credit Reserve (CRR): This is a program jointly administered by the Colorado Housing and Finance Authority (CHFA) and OEDIT and it aids towards increasing the availability of credit to small businesses in the state.

- CDBG – Business Loan Funds: This is a program that involves 14 regions wherein businesses are provided funding in order to stimulate long-term economic development.

How do you incorporate in Colorado?

How do you set up a company in Colorado? What are the procedures? What forms and documentation are you required to submit and to whom? These are some of the common questions that you will be confronted with if you are new to the state. It is definitely not a difficult process but there are a few steps that need to be undertaken in order to conduct business in the state. The steps are:

Business Type

The first step towards incorporation in Colorado is choosing the type of business you want to form. Each type of corporation has its own advantages and disadvantages and the forms and fees are different. Business corporations can be classified under domestic and foreign corporations. You can also form Profit Corporation, Non-Profit Corporation, and Benefit Corporations. Know more

Business Entity Name

If you are planning to set up a company in Colorado then the next step is to start by identifying, searching, reserving, and then registering the business entity name. There are 3 steps towards business name formation and they are:

- Naming Requirements: You need to use terms and abbreviations in an entity name like “Corporation”, “Corp”, and “Inc”. The names should be distinguishable like” EFG Inc is not the same as EFG Inc but EFG Inc is the same as efg inc.

- Business name search: You need to search for a business name that is not in use currently. You can conduct name search here.

- Name Reservation: Once you have identified business entity name, it is advisable to reserve the name with the Secretary of State pursuant to §7-90-602 and part 3 of Article 90 of Title 7 of the Colorado Revised Statutes (C.R.S.). Name reservations are valid for 120 days and can be renewed through filing of Statement of Renewal of Reservation of Name.

Choose a Registered Agent

A domestic business entity as well as foreign entity authorized to transact business in the state of Colorado will have to maintain a registered agent pursuant to CO Rev Stat § 7-90-701 (2016). We are one of the respected registered agents in Colorado and will be responsible for initiating an incorporation in Colorado through processing of your “Articles of Incorporation” for domestic corporations and “Statement of Foreign Entity Authority” for foreign corporations.

Articles of Incorporation and Statement of Foreign Entity Authority

You will be required to submit “Articles of Incorporation” if your business is a domestic corporation and a “Statement of Foreign Entity Authority” if it is a foreign business entity. In order to streamline the process of incorporating in Colorado, we can file documents on your behalf through the online process or through an expedited process.

Date Stamped Copies

As a part of the process of a company incorporation in Colorado, we will ensure, you receive date-stamped and filed copies that verifies the state has filed as well as formed your corporation.

Costs and Fees associated with Colorado Incorporation

What would it cost to set up company in Colorado?

Check Fees here!

702-871-8678

702-871-8678