Date: 07/06/2015 |

Category: |

Author: Jakub Vele

Why incorporate in Colorado?

Business Information & Rankings

- Colorado ranked 2nd on the State Science & Technology Index. (Milken Institute, 2004)

- Colorado ranked 8th on the State Business Tax Climate Index. (Tax Foundation, 2004)

- Colorado ranked 4th on the Most Preferred State to Live In. (Harris Poll, 2004)

- Government Technology magazine ranked six Colorado cities in the top 10 among Digital Cities.

Cost of Living Index

| For Denver, CO (2005): | Index Score |

| Composite: | 103.0 |

| Housing: | 105.2 |

| Utilities: | 96.9 |

| Misc. Goods & Services: | 100.8 |

Crime Rate

Colorado is ranked 30th in crime. (FBI, 2004)

Fees & Taxes

Business Inventory Tax

Colorado does not tax business inventory.

Corporate Income Tax

Rate: 4.63%.

Qualified taxpayers may pay an alternative tax of 0.5% of gross receipts from sales in or into Colorado.

Personal Income Tax

A flat rate of 4.63% of federally adjusted taxable income is levied.

Personal Property Tax

Industrial and commercial property is assessed for property tax purposes at 29% of market value.

State Sales and Use Tax

Base Rate: 2.9 %

Machinery Rate: None

Exemptions provided for purchases of machinery or machine tools in excess of $500 to be used directly in manufacturing tangible personal property.

Unemployment Insurance

Colorado charges new employers 3.12% for 2 years.

Date: 06/22/2015 |

Category: |

Author: Jakub Vele

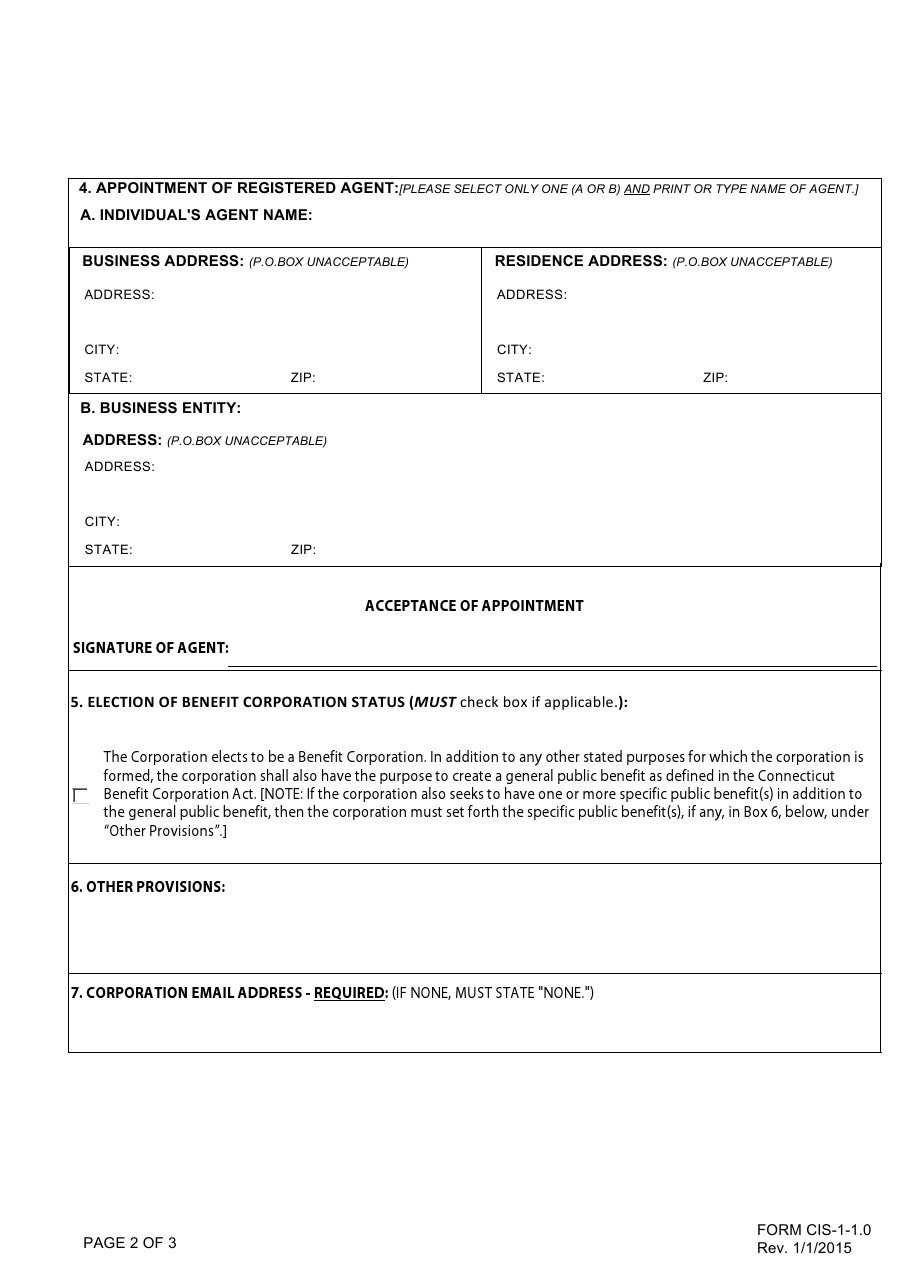

CONNECTICUT CORPORATION total only $359.00

Including Connecticut State Initial Filing fee $250.00, $20 a file stamped copy of the Articles of Incorporation and $89.00 fee for checking name availability,preparing Connecticut state-approved Articles of incorporation, filing Articles with state, sending Articles to you.

See what’s included

Once your company is set up, you will need:

- Tax ID (EIN) – free over the Internet or phone.

- $75.00 to file the Organization and First Report. The Organization and First Report must be filed within 30 days of the date on which the corporation holds its organization meeting.

- Company Minutes & Stock Certificates – are included in incorporation. You will have access to documents generated on your client account.

Connecticut additional services

Date: 07/06/2015 |

Category: |

Author: Jakub Vele

ORDER ONLINE: Use this online order form and pay by credit card.

Date: |

Category: |

Author: Jakub Vele

Connecticut LLC (Limited Liability Company)

ORDER ONLINE: Use this online order form and pay by credit card.

Date: |

Category: |

Author: Jakub Vele

Connecticut Registered Agent / Resident Agent

Pricing $89.00 per year, special for pre-pay $40 per year

Don’t get fooled by companies claiming the lowest price and increasing it later. Our pricing is very simple. We charge $89 per year. We also have few specials. Whenever you decide to pre-pay additional years you get them for $40/year.

New Company

starting business

(new corporation, LLC, etc.)

Order now

Change of Agent

changing existing

agent to us

Order now

Renewals

existing clients

for CT resident agent

Order now

Why you need a Registered Agent?

Connecticut State laws require business entities to maintain a Resident Agent in the state that you form your business. The agent’s name and office address are included in the Articles of Incorporation or Articles of Organization to give public notice of where to send important documents to your business entity.

If you need Registered agent in other State than Connecticut click here.

We offer Registered Agent service in all 50 States.

State Fee for changing Connecticut Registered Agent

Change of Registered Agent: $25.00 (stock Corp.) or $10.00 (non stock)

Change of Registered Agent Address: $25.00 (stock) or $10.00 (non stock)

Registered Agent Requirements

Any individual at least 18 years of age with a physical address in Colorado may act as a registered agent. Also, any business entity registered with the Colorado Secretary of State may act as agent. As of July 1, 2004, an entity can serve as its own agent. You may NOT appoint the Secretary of State as a registered agent for service of process. You may appoint only one individual or business entity as agent.

Date: |

Category: |

Author: Jakub Vele

Annual Reports for Connecticut Corporations & LLCs

For corporations there is an initial report due within 30 days after incorporation. The cost is $150. For LLCs the cost is $80.

There is an annual report due each year in the anniversary month of the incorporation filing date. The cost for the annual report for corporations is $150 annually. The annual filing fee for LLCs is $80.

If you need help, we can file the annual report for you. Our fee is $45.

To order our service, click on the following links:

702-871-8678

702-871-8678