Georgia LLC and Corporation Registration and Formation

Georgia LLC and Corporation Registration and Formation

Why is Georgia considered to be a smart destination for small businesses? This is because the state of Georgia provides several small business incentives including tax relief to funds and loan guarantees. These incentives are some of the drivers that help to form a Georgia business with ease and flexibility. A report by the Kauffman Index of Entrepreneurial Activity has revealed that Georgia is ranked second in the nation when it comes to increase in entrepreneurial activity especially in the last decade.

We are one of the top Georgia registered agents and are familiar with all processes pertaining to the Georgia State and can provide information and assistance for a successful set up of your business!

Let’s take a look at how you can form a Georgia business LLC or Corporation.

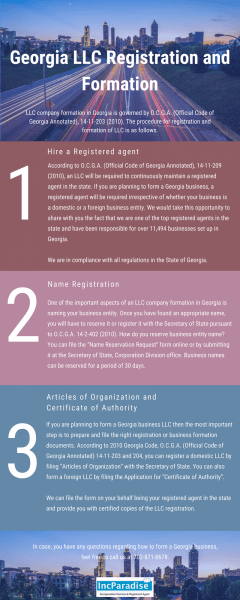

Georgia LLC Registration and Formation

LLC company formation in Georgia is governed by O.C.G.A. (Official Code of Georgia Annotated), 14-11-203 (2010). The procedure for registration and formation of LLC is as follows:

Step#1: Hire a registered agent

According to O.C.G.A. (Official Code of Georgia Annotated), 14-11-209 (2010), an LLC will be required to continuously maintain a registered agent in the state. If you are planning to form a Georgia business, a registered agent will be required irrespective of whether your business is a domestic or a foreign business entity. We would take this opportunity to share with you the fact that we are one of the top registered agents in the state and have been responsible for over 11,494 businesses set up in Georgia.

We are in compliance with all regulations in the State of Georgia.

Step#2: Name Registration

One of the important aspects of an LLC company formation in Georgia is naming your business entity. Once you have found an appropriate name, you will have to reserve it or register it with the Secretary of State pursuant to O.C.G.A. 14-2-402 (2010). How do you reserve business entity name? You can file the “Name Reservation Request” form online or by submitting it at the Secretary of State, Corporation Division office. Business names can be reserved for a period of 30 days.

Step#3: Articles of Organization and Certificate of Authority

If you are planning to form a Georgia business LLC then the most important step is to prepare and file the right registration or business formation documents. According to 2010 Georgia Code, O.C.G.A. (Official Code of Georgia Annotated) 14-11-203 and 204, you can register a domestic LLC by filing “Articles of Organization” with the Secretary of State. You can also form a foreign LLC by filing the Application for “Certificate of Authority”.

We can file the form on your behalf as your registered agent in the state and provide you with certified copies of the LLC registration.

In case, you have any questions regarding how to form a Georgia business, feel free to call us at 702-871-8678.

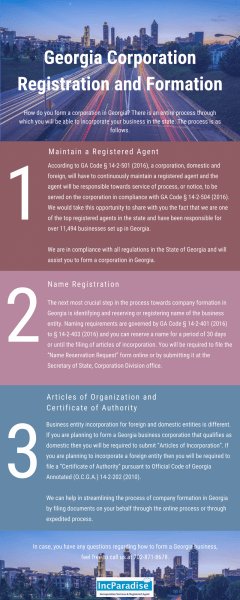

Georgia Corporation Registration and Formation

How do you form a corporation in Georgia? There is an entire process through which you will be able to incorporate your business in the state. The process is as follows::

Step#1: Maintain a Registered Agent

According to GA Code § 14-2-501 (2016), a corporation, whether domestic or foreign, will have to continuously maintain a registered agent and the agent will be responsible for service of process, or notice, to be served on the corporation in compliance with GA Code § 14-2-504 (2016). We would take this opportunity to share with you the fact that we are one of the top registered agents in the state and have been responsible for over 11,494 businesses set up in Georgia.

We are in compliance with all regulations in the State of Georgia and will assist you to form a corporation in Georgia.

Step#2: Name Registration

The next most crucial step in the process towards company formation in Georgia is identifying and reserving or registering the name of the business entity. Naming requirements are governed by GA Code § 14-2-401 (2016) to § 14-2-403 (2016) and you can reserve a name for a period of 30 days or until the filing of articles of incorporation. You will be required to file the “Name Reservation Request” form online or by submitting it at the Secretary of State, Corporation Division office.

Step#3: Articles of Incorporation and Certificate of Authority

Business entity incorporation for foreign and domestic entities is different. If you are planning to form a Georgia business corporation that qualifies as domestic then you will be required to submit “Articles of Incorporation”. If you are planning to incorporate a foreign entity then you will be required to file a “Certificate of Authority” pursuant to Official Code of Georgia Annotated (O.C.G.A.) 14-2-202 (2010).

We can help to streamline the process of company formation in Georgia by filing documents on your behalf through the online process or through an expedited process.

If you have any questions regarding Georgia Incorporation or LLC formation, you can simply visit the Georgia Business formation page.

702-871-8678

702-871-8678