Incorporate in Virginia

Incorporate in Virginia

What makes incorporation in Virginia, a good business decision? Forbes has ranked the “Old Dominion” #4 in their list of “Best States for Business” and #1 in “Regulatory Environment” and these rankings go on to prove just one thing – it has one of the best business climates! The Gross State Product of Virginia as of November 2018 was $538 billion and businesses that are located in this state can enjoy a range of benefits right from low operating costs to a business-friendly tax structure. It is a “right-to-work” state and the manufacturing industry has one of the lowest average workers’ compensation costs in the country.

Why Choose Virginia for Incorporation?

The economy of Virginia is quite diverse and is driven by key industries including Corporate Services, Food & Beverage Processing, Information Technology, Life Sciences, Manufacturing, Supply Chain Management, and Unmanned Systems. Quite often than not, it is considered as “America’s Corporate Hometown” and provides businesses with access to world-class talent. The state’s overall infrastructure has promoted company incorporation in Virginia and today it is home to a large number of small businesses.

One of the catalysts driving the economy of the state and creating a good climate for businesses is “Strong Infrastructure.” If you set up a company in Virginia then you can benefit from several aspects of the state’s strong infrastructure. Here are some interesting facts:

- According to a study by Cyberstates 2018, Virginia is home to the 3rd-highest concentration of tech workers in the country

- 37 Virginia companies are in the Fortune 1000 list

- The Greater Richmond region, which is Virginia, is considered to be the most suitable for corporate headquarters

- Hampton Roads boasts of 2,600 miles of shoreline and is home to diverse real estate, world-class port facility, and major military commands

- The Roanoke region is one of the best destinations for setting up tourism business thanks to 22 miles of urban greenway, 600 miles of trails, 300,000 acres of national forest, and 24 rivers and creeks.

- It boasts of being the 4th-highest number of “Active Duty Members” in the country that is responsible for providing the state with a robust pool of skilled and dedicated workers

- 88.7% of the Virginia population have access to broadband with speed of 100mbps or faster and hence is a leader in digital and physical connectivity

- Fairfax County is considered to be the East Coast center of technology innovation due to its proximity to the nation’s capital – Washington D.C

How do you incorporate in Virginia?

What is the process through which you can set up company in Virginia? What type of documentation is required? Can the registration documents be filed online? If you are confronted with these questions then the following steps will help you to understand how incorporation works in Virginia:

Type of Business

The first step towards incorporation in Virginia is choosing the type of business you want to form. You can choose to form an LLC or a Corporation. The type of business entity you want to form can be either a domestic or a foreign entity. The forms and fee will be different for each type of entity.

Business Entity Name

The second most important step towards company incorporation in Virginia is registering your business entity name. There are 3 steps towards business name formation and they are:

- Naming Requirements: A corporation under VA Code § 13.1-630 (2016) and an LLC under VA Code § 13.1-1012 (2016) should contain words like “corporation”, “incorporated”, “limited liability company” or abbreviations like “corp.”, “inc.”, “ltd.”, “L.L.C.” or similar abbreviation.

- Business name search: You need to search for a business name that is not in use currently. You can conduct a name search here.

- Name Reservation: Once you have identified business entity name, and if the name is available then you can reserve the name pursuant to VA Code § 13.1-631 (2016) for business corporations and VA Code § 13.1-1013 (2016) for LLC’s. You can reserve the name with the secretary of state for a non-renewable period of 120 days.

- A foreign business entity will have to register their business name pursuant to VA Code § 13.1-632 (2016).

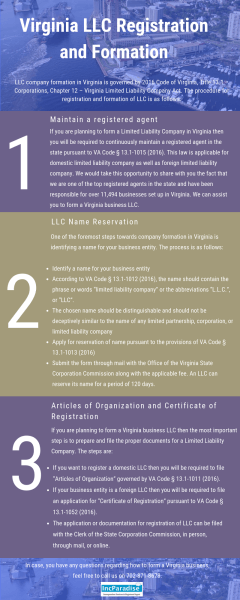

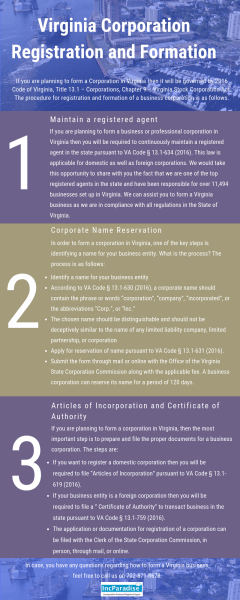

Choose a Registered Agent

Whether you form a corporation or an LLC business entity, in order to transact business in the state of Virginia, you will have to maintain a registered agent pursuant to VA Code § 13.1-1015 (2016) for LLC and VA Code § 13.1-634 (2016) for Business Corporations.

We are one of the respected registered agents in Virginia and will be responsible towards initiating incorporation in Virginia through processing of your “Articles of Organization”, and “Articles of Incorporation” for domestic entities and “Certificate of Registration” and “Certificate of Authority” for foreign business entities.

Articles of Incorporation and Certificate of Authority

You will be required to file “Articles of Incorporation” pursuant to VA Code § 13.1-619 (2016), if your business is a domestic corporation or a “Certificate of Authority” pursuant to VA Code § 13.1-759 (2016), if it is a foreign business entity. In order to streamline the process of incorporation in Virginia, we can file documents on your behalf through the online process or through an expedited process.

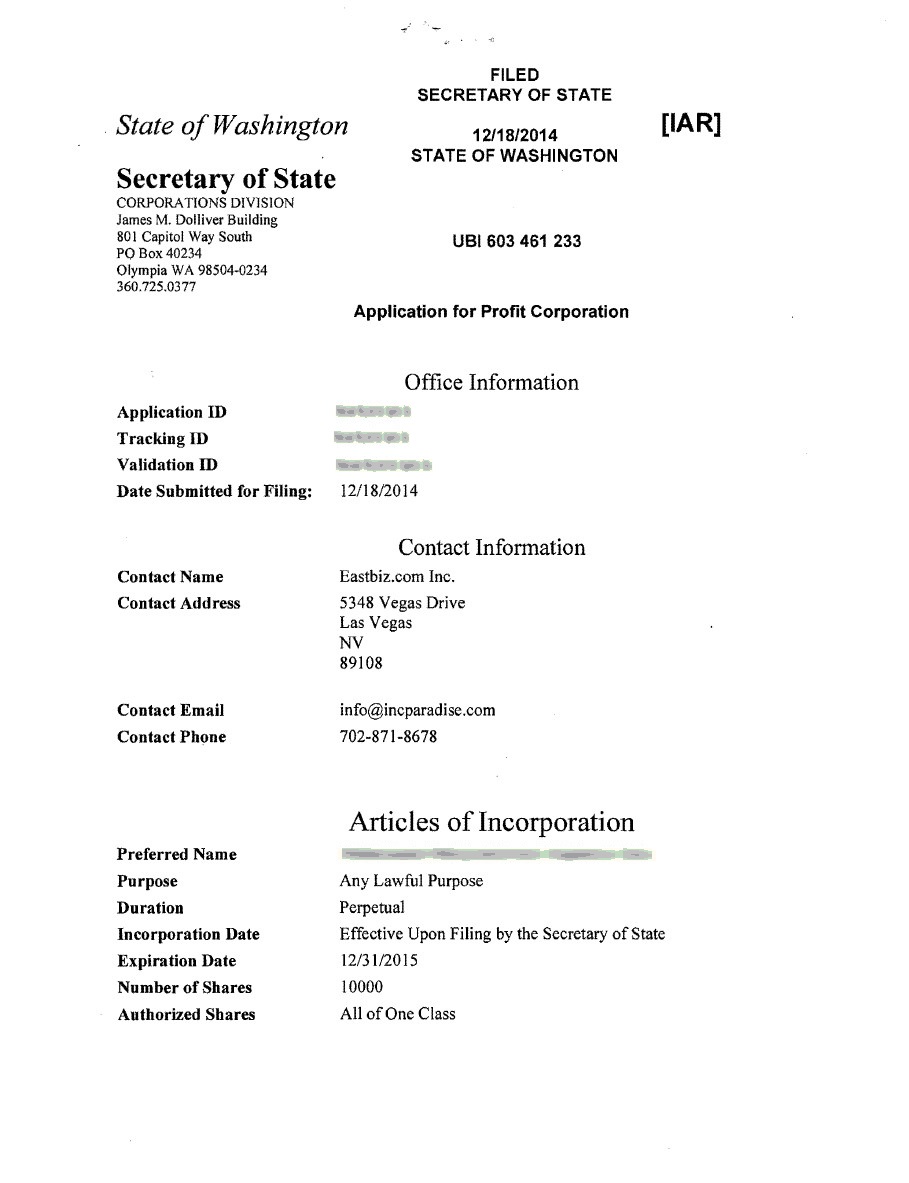

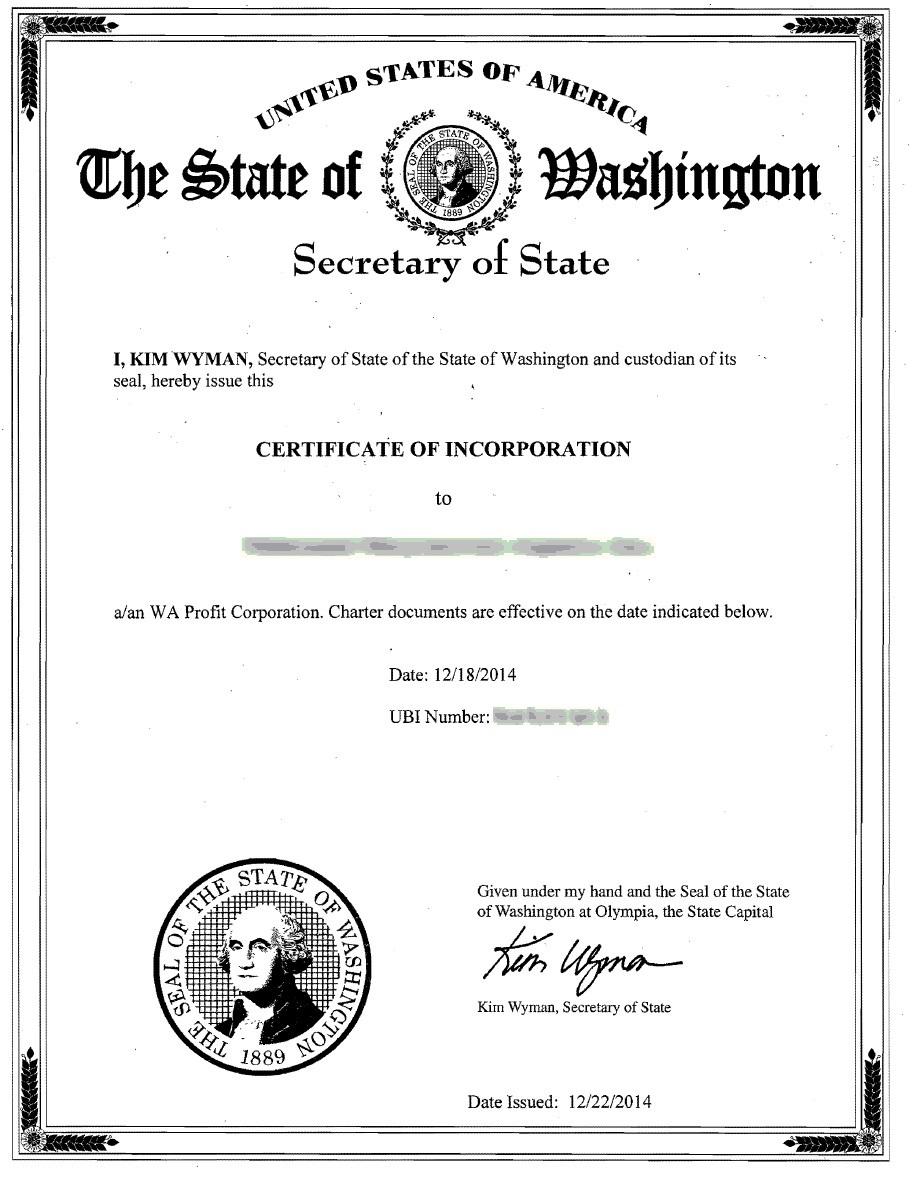

Date Stamped Copies

As a part of the process of company incorporation in Virginia, we will ensure, you receive date-stamped and filed copies that verifies the state has filed as well as formed your corporation.

Costs and Fees associated with Virginia Incorporation

What would it cost to set up company in Virginia? Check Fees here!

702-871-8678

702-871-8678