Date: 06/22/2015 |

Category: |

Author: Jakub Vele

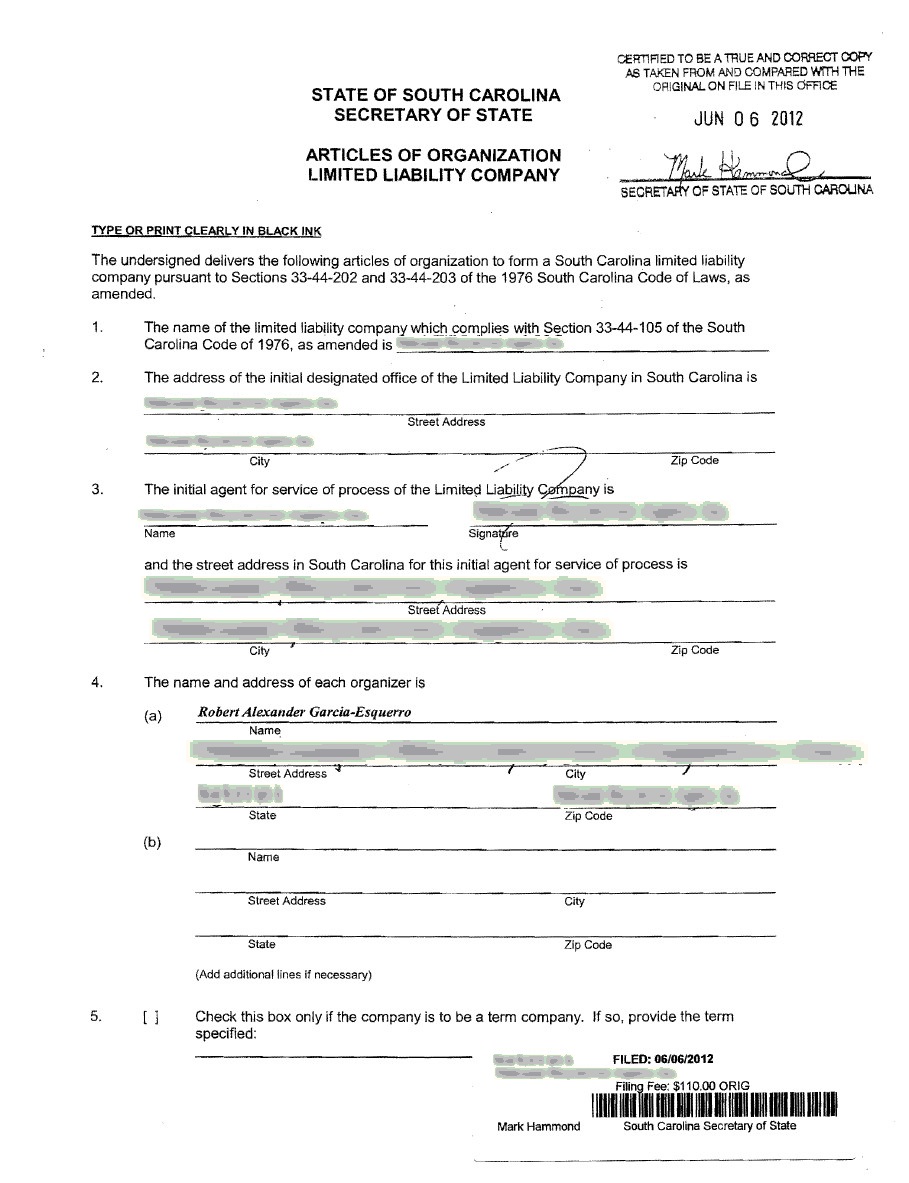

SOUTH CAROLINA CORPORATION total only $224.00

Including South Carolina State Initial Filing fee $135.00 and $89.00 fee for checking name availability, preparing South Carolina state-approved Articles of incorporation, filing Articles with state, sending Articles to you.

See what’s included

South Carolina additional services

Date: 07/06/2015 |

Category: |

Author: Jakub Vele

South Carolina Corporation

ORDER ONLINE: Use this online order form and pay by credit card.

Date: |

Category: |

Author: Jakub Vele

South Carolina LLC ( Limited Liability Company )

ORDER ONLINE: Use this online order form and pay by credit card.

Date: |

Category: |

Author: Jakub Vele

South Carolina Registered Agent / Resident Agent

Pricing $89.00 per year, special for pre-pay $40 per year

Don’t get fooled by companies claiming the lowest price and increasing it later. Our pricing is very simple. We charge $89 per year. We also have few specials. Whenever you decide to pre-pay additional years you get them for $40/year.

New Company

starting business

(new corporation, LLC, etc.)

Order now

Change of Agent

changing existing

agent to us

Order now

Renewals

existing clients

for SC resident agent

Order now

Why you need a Registered Agent?

South Carolina State laws require business entities to maintain a Resident Agent in the state that you form your business. The agent’s name and office address are included in the Articles of Incorporation or Articles of Organization to give public notice of where to send important documents to your business entity.

If you need Registered agent in other State than South Carolina click here.

We offer Registered Agent service in all 50 States.

State Fee for changing South Carolina Registered Agent

For Corporations – Resignation of Agent: $5.00; Change of Registered Agent: $10.00. For LLCs – Resignation of Agent: $10.00; Change of Registered Agent: $10.00

Registered Agent Requirements

The registered agent must have a business office identical to the registered office and must be either: (1) an individual residing in the state, or (2) a corporation with authority to transact business in the state. The registered agent must sign the articles of incorporation indicating his or her acceptance to act as the registered agent.

Date: |

Category: |

Author: Jakub Vele

Annual Reports for South Carolina Corporations & LLCs

In South Carolina, annual reports for profit Corps are NOT filed with the SC Sec. of State’s office, but as part of their corporate tax return with the SC Dept of Revenue. Corporate tax returns/annual reports are due on the 15th day of the third month after the close of the Corp’s fiscal year. For LLCs, annual reports are not required to file.

Date: |

Category: |

Author: Jakub Vele

South Carolina Additional Services

TAX ID (Employment Identification Number - EIN) - FREE

Self-Service: Obtaining a Tax ID number doesn’t cost any money. You can apply by phone, fax or mail. You can also call toll free at (800) 829 4933 and get EIN instantly over the phone. If you apply by fax, it takes about 4-5 business days. If you apply by mail, it takes about 3-4 weeks. Please find information about Tax ID – EIN here.

Full Service: Do you need assistance with obtaining a tax ID? We can help prepare the form and obtain the tax ID for $45. Order here Tax ID.

S CORPORATION STATUS ELECTION

What is “S Corporation”?: An “S Corporation” is a corporation that elects to be taxed under Subchapter S of the Internal Revenue Code and receives IRS approval of its request for Subchapter S status. As a legal entity (an artificial person), the S corporation is separate and distinct from the corporation’s owners (the stockholders). Under Nevada incorporation law, there is no distinction between a C corporation and an S corporation. The incorporation process is the same. However, the two type of corporate entities are subject to differing federal and state tax treatment. Our cost is $45. Order S Corporation filing here.

FINCEN BENEFICIAL OWNERSHIP INFORMATION REPORTING

We can help you submit the filing with FinCEN for your company. Companies formed in 2024 have 90 days to file initial reports after receiving official notification of their creation. Companies existing before 2024 have a deadline of January 1, 2025, for their initial reports. Those established after 2025 will have 30 days to file initial reports after registration.

Let IncParadise efficiently and affordably handle your BOI reporting with FinCEN, allowing you to focus on running your business and avoid costly compliance mistakes.

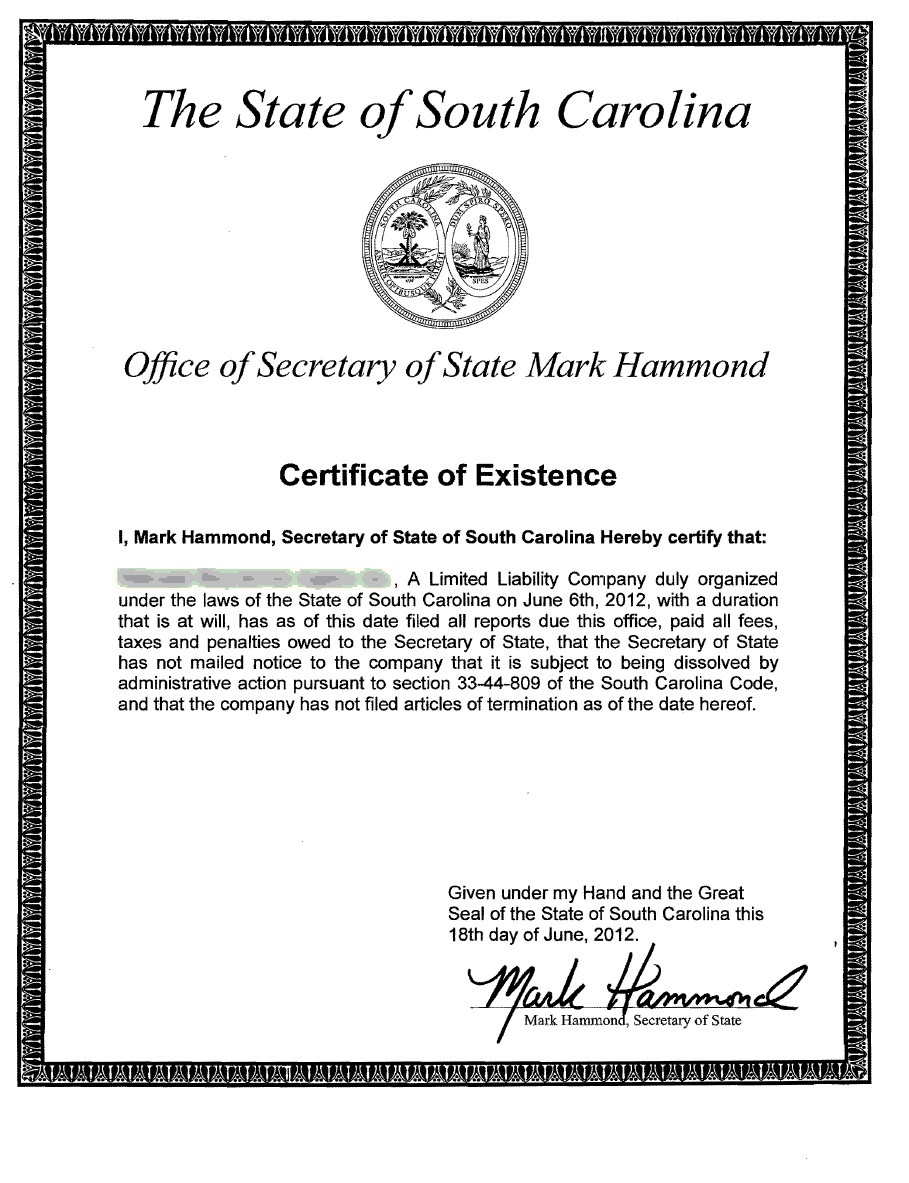

SOUTH CAROLINA CERTIFICATE OF GOOD STANDING

A certificate of good standing (certificate of existence) is a document issued by the Secretary of State certifying that your corporation does exist legally and that it is in good standing with the state. We can obtain one for you. The fee is $89 + state fee.

SOUTH CAROLINA APOSTILLE

In 1981, the United States joined the 1961 Hague Convention abolishing the Requirement of Legalization for Foreign Public Documents. The Convention provides for the authentication of public (including notarized) documents to be used in countries that have joined the convention. Apostille of Articles of Incorporation or other document is issued by the Secretary of State. Price is $89 + state fee.

SOUTH CAROLINA REINSTATEMENT OF CORPORATION/LLC

If your charter was revoked and you want reinstate the company, you have to pay all due fees and penalties and file appropriate annual reports.

Do you need somebody to handle reinstatement for you? Please contact us! We charge $89. We can find out how much money you owe for state fees.

SOUTH CAROLINA AMENDMENTS OF ARTICLES

There are times when a business needs to change the information included in the Articles of Incorporation or Articles of Organization. To do this, you need to file an amendment with the South Carolina Secretary of State. Some reasons a business may need to file an amendment are to change the company’s name, to expand or alter the company’s business purpose, or to change the number of authorized shares or par value (for corporations only).

Do you need somebody to handle the filing of amendment for you? Please contact us! We charge $89 + state fees. Pay by PayPal (our email address is paypal@https://incparadise.net).

FOREIGN QUALIFICATION (all U.S. states)

Registration of foreign company qualifying to conduct business in other states: If your company expects to transact business outside your state of formation, your company may be required to qualify as a “foreign corporation” or “foreign LLC.” We can file the necessary paperwork to qualify your business as a foreign corporation or LLC in any of the 50 states.

Do you need somebody to handle foreign qualification for you? Please contact us!

Read more information about Foreign Qualification here

Foreign qualification fees

U.S. ADDRESS FOR PERSONAL OR BUSINESS USE AND MAIL FORWARDING

Do you need U.S. street address as your mailing address. Mail is forwarded once a week. We offer mail forwarding service based in Las Vegas, NV.

There are two options:

– $150 per year. $2.50 per mailout plus postage.

– $99 per year. $5.50 per mailout plus postage.

To order mail forwarding, click here.

BUSINESS LICENSE REPORT

Business licenses are mandatory for every business in the USA to operate legally. You may require federal, state, local licenses, permits, and tax regulations for your business.

Obtaining business licenses and permits is a daunting and time-consuming process as it entirely depends on the business industry, location, etc. IncParadise makes the business license process easy for you by delivering a report that lists the required federal, state, local licenses, permits, and tax regulations. Our expert research team searches, identifies and verifies the local, state, and federal licenses and permit requirements for your business type and location. They then send you the report with a list of these business license requirements so that you can save yourself time and effort.

Order Business License Report

TOLL-FREE NUMBERS

We offer the best toll-free numbers on the market. Nationwide businesses, mid-sized and small businesses, and families can order toll-free 800 services and get a number that rings directly to your home or business. Redirect it to your fax machine or cell phone and back as you change locations. Track calls on the Internet in real time. Select an easily remembered vanity number for your business. You will get: custom routing, voice mail, inbound faxing, website account management, call recording, lead generation, vanity numbers, national toll-free database search and much more!

More information here.

702-871-8678

702-871-8678