Are you thinking of starting your business in Wyoming? Well, you are then on the right track to make your business highly successful. It was in 2016 when Business Insider had identified Wyoming as one of the best states in which you can start your own business. Due to the business-friendly climate here, most of the entrepreneurs tend to open their business here. As a matter of fact, Wyoming has the fourth-highest rate of new entrepreneurs who come in to launch their business. The best part about this state is that it has a record of the highest business survival.

And that is not all; the overall business climate of Wyoming is well-known for the low labor costs making it a great choice. Moreover, the state does not have any corporate, personal income or inventory taxes. As compared to any other state, it is the right place for you to begin your business assuming that you want it to be highly successful.

Order LLC now Order INC now

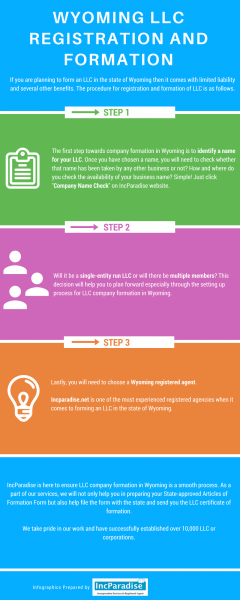

To help you in starting your business in Wyoming the right way, we have shared the steps to help you below:

Step #1: Prepare the Business Plan

The very and the most important step to begin with when starting a business in Wyoming is to write a business plan. Many people feel that writing a business plan is not something important, and is only needed when you are looking for a loan from the bank. Yes, the bank does not loan money until you have submitted the business plan, but there are many more benefits of having a business plan.

As you write a business plan, your ideas would flow in and out easily while you make your way towards becoming a great entrepreneur. The business plan would help you in creating a roadmap for you to know where your business would go or where you want your business to go. In short, if you want your business to be successful, business planning is a critical element of it.

Step #2: Choose a Business Entity

After you have prepared your business plan, the next step for starting a business in Wyoming is to select the business entity that your company would have. The business structure of a company and business entity mean the same thing. The business structure is basically how the business is legally organized to do the business. There are four main business entities that have been explained below briefly:

Sole Proprietorship

It is a business that runs with just one person who decides to go into the business themselves and work it out that way. This structure is the most straightforward, easiest and least expensive structure to set up compared to all the other entities. But in this case, the owner is responsible personally for any action or debt in the company. This thing is called unlimited liability, and is the biggest downside to this structure.

Basically, if this business gets in trouble in court, or has some debts, the owner’s personal assets are at risk. This means that the person’s personal property, cash or anything along with the company’s assets would be used to pay off all the dues. In this case, the owner would laos have to pay a lot more taxes as compared to other entities. Regardless of this, there is no filings for this structure making is less expensive to set up.

General Partnerships

In this structure, two or more people come together to start a business as partnership. Just like the sole proprietorship, this structure does not need the filing any form to set up the company and also has the unlimited liability. This means that in case the partnership is sued, the personal assets of the owners would be at risk. Moreover, the partnership does not pay tax directly from the business income. Instead, the losses and profits are passed through to the personal tax return of the owners, where they need to pay self-employment taxes.

Corporation

A corporation is a legal business that is separate from the person who owns it or started it. Even though a corporation is expensive to set up and much more complicated than the partnerships and sole proprietorships, the corporation offers a shield for the owner’s personal assets as an advantage. This means that the person’s assets would not be touched if the company is sued.

You can also choose the way in which you want your corporation to be taxed as. Additionally, there isn’t any self-employment tax that is placed on the owner’s tax return for the income they get from the corporation. If you choose to form a corporation when starting your business in Wyoming, you would need to file the Articles of Incorporation with the Secretary of State where the fee to incorporate is $100.

LLC (Limited Liability Company)

An LLC is one of the most popular choice amongst all mentioned here. It offers the liability protection of a corporation while you can run the company as a sole proprietorship. As a matter of fact, unlike the corporations, the LLC does not have any obligations like the corporations such as to hold the shareholders meeting, taking minutes, etc.

The LLC has a higher tax flexibility as compared to the other entities. Moreover, the income that is earned in this structure can be taxed as a partnership, a sole proprietorship, or a corporation, based on how the company owner wants. For forming the LLC, you would need to file for the Articles of Organization with the Secretary of State with a filing fee of $100.

Step #3: Choose the right Business Name

Now that you have selected the business entity, the next step is to get a business name. Though selecting a name is easier said than done, following the right tips would help you avoid any trouble in choosing the wrong name. Yes, it is possible to change the name of your company later on but it is always better to avoid such a thing. Do remember the following points if you want to choose the right name for the company you are starting in Wyoming:

- Ensure that the name is unique, easy to pronounce/understand. Practise saying the name loud in phrases to see how it sounds. See that the name can survive over time, like “CD world” is not a good idea.

- When you decide for a name, search the web to see if it is available on any search engine results. This would help you find out if there is any other company with the same name and would help you avoid any potential conflicts in the future.

NOTE: In case you want to take your business internationally or even nationally, it is highly important for your company name to be unique.

- Check with your state to see what words you cannot use in the name of the company. Words like bank or government are not allowed. Hence, it is better to know the words to avoid before you fall in trouble with the government later on for using a word you weren’t supposed to.

- Ensure that your company’s name doesn’t have any misspellings, or if there is any other company that has a name which is in plurals. Check if there is any variations of spelling, sound-alikes and other versions of the name you selected for starting your business in Wyoming.

- Last but not the least, check if the company name is available with the state by entering the name on the Wyoming Secretary of State’s website.

Step #4: Register your Business

Every state has its own requirements for registering a business. Since you have selected the business name and the business entity, the next thing you need to do is register your business. Just to be clear, the business registration certificate is different from the business incorporation certificate (Articles of Incorporation).

Usually, some states and cities need the business (even home-based business) to register with them before running in the state. In this process, the company gets the business license that then allows the company to run the business. In short, the business registration is important for any and every business entity. On the other hand, incorporation is not important for all the business entities.

Basically, incorporation is needed when you choose to make your company an LLC or a corporation. In this case, you would get the Articles of Incorporation. For registering your business, you would have to file with the Wyoming State Department through their website where the filing fee is $100.

For you to be able to register your business with the Wyoming government, you need to have a local address in the state or you would have to hire a professional Registered Agent to incorporate your LLC or corporation. This agent needs to have a physical street address in Wyoming. Agents like these help you with a lot of steps to setup and run your business.

The sole proprietorships and partnerships do not have to incorporate, but they would need to file a DBA in Wyoming. DBA means “doing business as,” and is filed with the county. This is done since you would have picked up a business name which is not the same as your own name. And this means that you would have to register what you do under that business name with the DBA filing.

Order LLC now Order INC now

Step #5: Get your FEIN or EIN (Federal Employer Identification Number)

The EIN is a nine-digit tax identification number that is given by the IRS (Internal Revenue Service). This number is used to track the tax returns in a business, identifies the business operating in the US, is used to open a bank account. Just like what a security number is for a person in the US, the EIN number is a security number for the business. As a matter of fact, not all the businesses need to get the EIN number.

The corporations, partnerships, sole proprietorships and LLCs have to file for the EIN when they hire employees. This means that the single-member LLC or sole proprietorship that have no employees do not need an EIN. For these cases, the social security number is used of the owner. You can file the EIN online easily within just a few minutes to get it immediately. Or you can also file the form SS-4 of the IRS and mail it to them.

Step #6: Apply the Business Permits & Licenses

For you to move ahead towards starting your business in Wyoming, you would have get the required permits and licenses needed. And since there is no specific agency that would give you all the desired licenses, you would have to register with multiple agencies based on the service you are offering or product you are producing and selling.

The following are the types of business licenses that you might need:

- Sales Tax License: Any business that sells a tangible good or services at wholesale or retail would have to obtain the sales tax license in Wyoming. For this, you would have to contact the Department of Revenue. The fee for filing for this license is $60 and it takes about 10 days to have it issued to you.

- Professional Licenses: There are various professionals who usually have to register with the government like physical therapists, athletic trainers, landscapers and many more. Based on what you are offering or doing, you might need this license. Get more details from Wyoming Department of Administration and Information.

- Specific Permits: Other than the licenses mentioned, there are many other permits that are needed such as permits for exporting, selling liquor, using specific equipments, food services, contractors and many others. Contact your state secretary to know more about the licenses you might need.

- Local Business Permits: You know that you need the business licenses from the state to run your business. But you might also need some permits for running your business in the locality you have selected. Based on the area, you might need business licenses for building/building improvements, zoning, signage requirements, etc.

Additionally, check with your community as well so that you do not get in trouble for just doing what you want without having the permit to it.

Step #7: Open Company Accounts

The next step to starting your business in Wyoming is to open a business bank account and get the related credit card. For you to keep your personal and business expenses separate, it is important to have a business account and a credit profile. Moreover, if you have chosen to open an LLC or a corporation, you would have to create your bank account. This is because, if you by mistake mix your personal and business expenses, you would end up losing the limited liability that you have.

To open a bank account, you would need the business documents, your personal documents of proof, and your EIN. If there are any other members, their personal details would also be needed and you would have to get them to sign the forms for opening the account.

Step #8: Ongoing Requirements

In Wyoming, you would not have to pay any an annual franchise tax, unlike the other states where you need to pay it. Here are some of the things that you would have to take care of based on your entity kind:

- DBA: The DBA would be valid for 5 years mostly in many places after which you might need a renewal. Other than that, you would just have to pay the taxes every year and have the specific licenses renewed as and when needed.

- LLC: For LLCs, you would have to file the annual report on or before the month’s first day of when the company was formed. The cost starts from $50, which can increase based on the revenue of your business.

- Corporation: Like LLCs, Wyoming corporations must file an annual report on or before the first day of the month the LLC was formed. This costs a minimum of $50, and may increase based on your business’s revenue.

Step #9: Look for Funding

With all the legal documents ready for your business, do you have the funding required to run it? If you already have savings that you want to use (called bootstrapping – using your own money), you not need to get outside investment. But in case you do not have any investment to add in for your business, you might need some outside help so that your business can run smoothly.

And obtaining funding can be highly stressful and very time-consuming, if you do not do it the right way. Here are some of the options that you can try to get outside investment for your company:

- Conventional Bank Loan

- SBA Loan Guarantee

- Peer-to-Peer Lending (getting loans from an investor instead of a bank)

- Grants (The government offers a lot of grants and you can participate in it. If your idea is great, you would succeed in getting it. Check out your options at http://grants.gov).

Step #10: Hire Employees

The last step towards running your business is to hire the right employees. But before you can do this, ensure that you have your EIN number. After that you would need to fill out the paperwork for your employees. There are a lot of other things that you would have to take care of. And for this, it is important that you connect with a lawyer so that you get everything done right.

Ready to start your business in Wyoming?

If you have your idea ready and have prepared your business plan, it is time to register your business with the government. Inc Paradise can help you with it along with other related services that would help you set up your business properly in Wyoming. Check out the services we offer here!

Order LLC now Order INC now

307-460-5009

307-460-5009