Incorporate in Maine

Incorporate in Maine

The economy of Maine is supported by both agriculture and industries. The agricultural economy is being driven by eggs, poultry, cattle, dairy products, apples, wild blueberries, maple sugar, and maple syrup. Industries in Maine focus primarily on lumber and wood products, paper, leather products, electronic equipment, textiles, food products, and bio-technology. If you want to set up a company in Maine then it does not have to necessarily be an industry, it can be services as well.

Why Choose Maine for Incorporation?

Maine has witnessed a growth in small and medium sized enterprises with almost 2,087 companies involved in exporting goods and generating $2.3 billion. The top industries in terms of small business employment include Health Care and Social Assistance, Retail Trade, Manufacturing, and Other Services (except Public Administration).

Now let’s take a look at some of the salient benefits that are responsible for fueling growth of small businesses:

- Maine Opportunity Zones: This is a program aimed at small and medium sized enterprises. If you set up a company in Maine opportunity zone then your business would be eligible for a variety of abatements, credits, and deductions. There are 32 such zones Map of Opportunity Zones.

- Business Equipment Tax Exemption (“BETE”) Program: The BETE program has been implemented to provide 100% property tax exemptions to qualified businesses.

- Pine Tree Development Zone Program (PTZ): The PTZ Program offers eligible businesses an opportunity to almost eliminate state taxes for a period of ten years. In order to enjoy the benefits of the PTZ program, you will have to set up a company in Maine and in eligible sectors like Biotechnology, Financial Services, Information Technology etc.

How do you incorporate in Maine?

Is there a specific process for company incorporation in Maine? What documents do you require and who processes these documents? These are some of the questions that you will be confronted with and hence the following steps will provide you with information on how incorporation works in Maine:

Type of Business

What type of businesses can you form in Maine? The type of domestic or foreign business entities that can be incorporated or formed in the state include General Partnership, Corporation, S-Corporation, Limited Liability Company, Limited Partnership, Limited Liability Partnership, and Nonprofit Corporation. The first step towards company incorporation in Maine is to identify the type of business you want to set up.

Business Entity Name

What is the next step towards incorporation in Maine? The next step is to identify and reserve a name and this can be done as follows:

- Naming Requirements: The naming requirements for LLC should be pursuant to MRS Title 31 §1508 while that of a business corporation should be pursuant to 13-C MRSA §401. The name of each limited liability company must contain words like “Limited Liability Company” or abbreviations like “L.L.C.” or “LLC”. A corporate name must contain words like “corporation”, or “incorporated” or abbreviations like “corp.” or “inc.”

- Business name search: You need to search for a business name that is not in use currently. You can conduct a name search here.

- Name Reservation: Once you have identified business entity name, you can reserve the name with the Secretary of State for a period of 120 days. The forms are different for LLC (MLLC-1) and Corporation (MBCA-1).

- Name Registration: If you are foreign entity planning to set up company in Maine then you will be required to register business name with the Secretary of State. The forms are different for LLC (MLLC-2) and Corporation (MBCA-2).

Choose a Registered Agent

In the state of Maine, every business entity states whether a Business or Professional Corporation or a Limited Liability Company is required to maintain a registered agent governed by MRS Title 31 §1661. We are one of the respected registered agents in Maine and will be responsible for initiating company incorporation in Maine through processing of all your documents including “Articles of Incorporation” for domestic corporations and “Application for Authority” for foreign corporations.

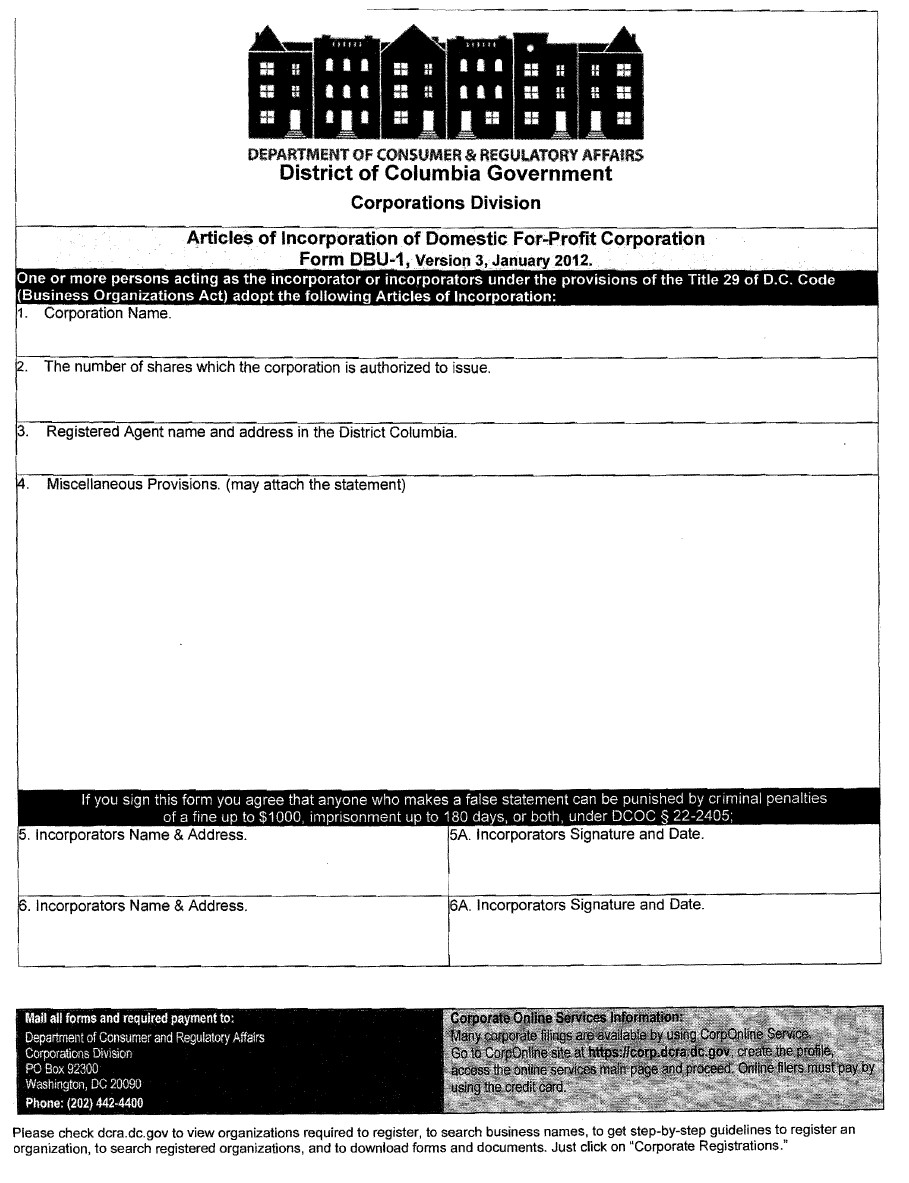

Articles of Incorporation and Application for Authority

The process of incorporation and the fee varies according to the type of business entity you want to form.

- If you are planning to form a domestic corporation (For profit), then you will have to file “Articles of incorporation” pursuant to 13-C MRSA §202.

- If you are planning a foreign business incorporation in Maine then you will be required to file an “Application for Authority” pursuant to 13-C MRSA §1503.

In order to streamline the process we can file documents on your behalf through the online process or through an expedited process.

Date Stamped Copies

As a part of the process of company incorporation in Maine, we will ensure, you receive date-stamped and filed copies that verifies the state has filed as well as formed your corporation.

Costs and Fees associated with Maine Incorporation

What would it cost to set up company in Maine? Check Fees here!

702-871-8678

702-871-8678