News

Articles

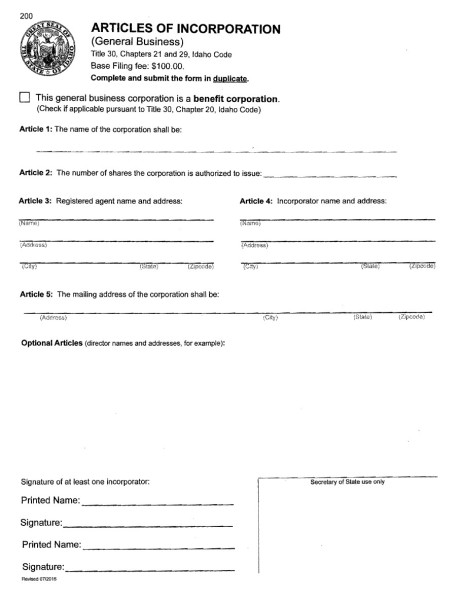

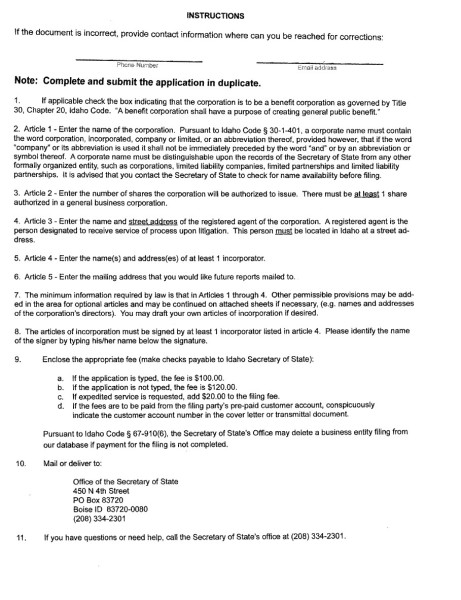

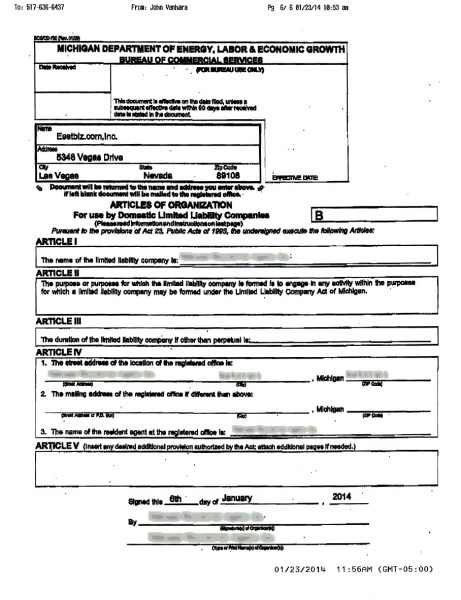

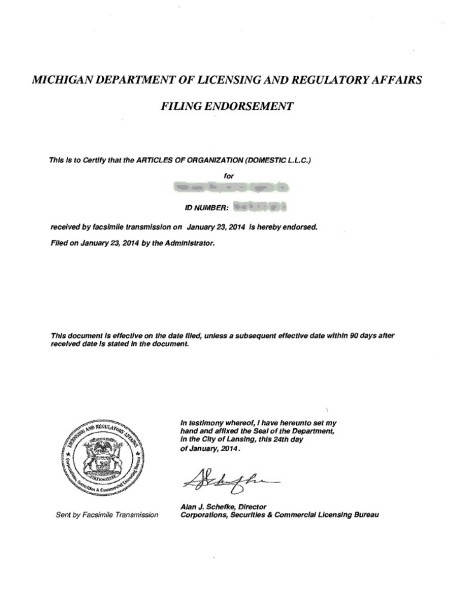

What you receive when filing Corporation or LLC in Michigan

Alabama

ALABAMA CORPORATION total only $289.00

Including Alabama State Filing fee $200.00 and $89.00 fee for checking name availability,preparing Alabama state-approved Articles of incorporation, filing Articles with state, sending Articles to you.

See what’s included

- $200.00 – Alabama State Filing fee

- $89.00 – Checking name availability, preparing state-approved Articles of Incorporation, filing Articles with state, mailing them to you.

- Company Bylaws included.

- Ready to fill Stock Certificates included

- Meeting of Shareholders Minutes

- Meeting of Directors Minutes included

- Reminders about annual renewals through INCCONTACT

Once your company is set up, you will need:

- Tax ID (EIN) – free over the Internet or phone.

- Yearly Requirements and Fees for Alabama companies

- Company Minutes & Stock Certificates – are included in incorporation. You will have access to documents generated on your client account.

Alabama additional services

Alabama LLC ORDER ONLINE

Alabama LLC (Limited Liability Company)

ORDER ONLINE: Use this online order form and pay by credit card.

ORDER BY FAX: You can print and fax us this order form.

Alabama Annual Report

Annual Reports for Alabama Corporations & LLCs

Initial reports are due 2 ½ months after initial set up. Each year thereafter, C corps and S corps annual reports are due 2 ½ months after the end of the year for the company, i.e. if end of year is Dec 31st annual report is due March 15th. For LLC’s the annual report is due 3 ½ months after year end. In the above example, the annual report would be due April 15th.

The penalty for failure to timely file an Alabama business privilege tax return by the due date is 10% of the tax shown due with the return or $50, whichever is greater. The penalty for failure to timely pay the amount of tax shown due on an Alabama business privilege tax return equals to 1% of the amount of tax shown due on the return for each month the tax is unpaid – not to exceed 25% of the amount shown due on the return.

IncParadise does not currently prepare the Alabama Business Privilege Tax Return & Annual Report. However, you may download copies of the required forms at the Alabama Department of Revenue’s website.

!! Zkouška skrytého menu

Annual Reports for Alabama Corporations & LLCs

Initial reports are due 2 ½ months after initial set up. Each year thereafter, C corps and S corps annual reports are due 2 ½ months after the end of the year for the company, i.e. if end of year is Dec 31st annual report is due March 15th. For LLC’s the annual report is due 3 ½ months after year end. In the above example, the annual report would be due April 15th.

The penalty for failure to timely file an Alabama business privilege tax return by the due date is 10% of the tax shown due with the return or $50, whichever is greater. The penalty for failure to timely pay the amount of tax shown due on an Alabama business privilege tax return equals to 1% of the amount of tax shown due on the return for each month the tax is unpaid – not to exceed 25% of the amount shown due on the return.

IncParadise does not currently prepare the Alabama Business Privilege Tax Return & Annual Report. However, you may download copies of the required forms at the Alabama Department of Revenue’s website.

702-871-8678

702-871-8678