Why should you set up company in Mississippi? The state has one of the best business climates as the government has kept taxes low, strengthened existing infrastructure, brought innovation and advancement to workforce training programs. Today, the top industries in the state where businesses have experienced high levels of growth include Agriculture, Manufacturing, Services(hotels, private health care, repair shops, law firms, casino gaming), and Fishing.

Why Choose Mississippi for Incorporation?

Although Mississippi is home to a variety of industries, one of the largest is the tourism industry with food services and drinking establishments, casino and non-casino hotel, and motels being the key drivers of the $395.1 million revenue in 2016. Higher business incorporation in Mississippi travel and tourism industry has also bolstered employment in the state.

Now let’s take a look at some of the salient reasons that are responsible for fuelling growth of small businesses:

- Rural Opportunity Zones (ROZ): One of the programs that businesses can benefit from post incorporation in Mississippi is the “Opportunity Zones Program”. If your business qualifies for this program then you can earn tax relief on the capital gains. You can check the designated Mississippi opportunity zones map here.

- Business Incentive Tax Credits: There are a variety of tax incentives that are available to small and medium sized enterprises after they set up company in Mississippi. These tax incentives can be categorized under the following:

– Income tax incentives

– Franchise tax incentives

– Sales or Use tax incentives

– Property tax incentives

How do you incorporate in Mississippi?

What is the process of incorporation in Mississippi? What type of documentation is required? These are some of the common questions that you will be confronted with if you are planning to start a new business in the state. The following steps will enable understanding of the entire process:

Business Type

The first step towards incorporation in Mississippi is choosing the type of business you want to form. You can form different types of businesses in the state including Limited Liability Companies, C and S Corporations, General Partnership (GP), Limited Partnership (LP), and Limited Liability Partnership (LLP). If you choose to form an LLC or a Corporation then you need to identify if it will be a domestic or foreign entity. The forms and fee will be different for each type of entity.

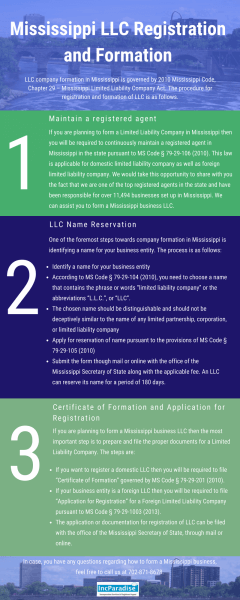

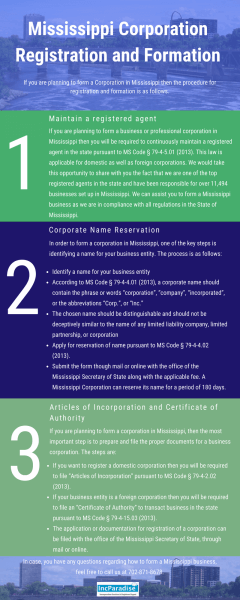

Business Entity Name

One of the most important steps towards incorporation in Mississippi is naming your business entity. You have to start by identifying, searching, reserving, or registering the business entity name. There are 3 steps towards business name formation and they are:

- Naming Requirements: According to MS Code § 79-29-109 (2013) for LLC and MS Code § 79-4-4.01 (2013) for a business corporation, the name should contain the words “limited liability company”, “corporation”, “incorporated” or abbreviation like “LLC. “, “corp.”, and “inc.” The names should be distinguishable from existing names.

- Business name search: You need to search for a business name that is not in use currently. You can conduct name search here.

- Name Reservation: Once you have identified a business entity name, you have to reserve the name pursuant to MS Code § 79-4-4.02 (2013) for corporations and MS Code § 79-29-111 (2013) for a limited liability company. The name can be reserved for a period of 180 days.

Choose a Registered Agent

Whether you form a corporation or an LLC business entity, in order to transact business in the state of Mississippi, you will have to maintain a registered agent pursuant to MS Code § 79-4-5.01 (2013) and MS Code § 79-29-113 (2013). We are one of the respected registered agents in Mississippi and will be responsible for initiating incorporation in Mississippi through processing of your “Articles of Incorporation” for domestic entities and “Certificate of Authority” for foreign business entities.

Articles of Incorporation and Certificate of Authority

You will be required to submit “Articles of Incorporation” if your business is a domestic corporation and a “Certificate of Authority” if it is a foreign business entity. In order to streamline the process of incorporation in Mississippi, we can file documents on your behalf through the online process or through an expedited process.

Date Stamped Copies

As a part of the process of company incorporation in Mississippi, we will ensure, you receive date-stamped and filed copies that verifies the state has filed as well as formed your corporation.

Costs and Fees associated with Mississippi Incorporation

What would it cost to set up a company in Mississippi? Check Fees here!

Order LLC now Order INC now

702-871-8678

702-871-8678