Alabama Corporation ORDER ONLINE

Alabama Corporation

ORDER ONLINE: Use this online order form and pay by credit card.

ORDER BY FAX: You can print and fax us this order form.

ORDER ONLINE: Use this online order form and pay by credit card.

ORDER BY FAX: You can print and fax us this order form.

In the U.S.A, most states have made it mandatory for businesses to hold either a Business License or a Permit in order to operate within that state. That said different states have different requirements and laws when it comes to applying for a Permit or a License to carry out business. The question is: do you require such a License in Alaska? Yes, you do.

Is there a process for acquiring a Business License in Alaska? How can you identify what type of license is appropriate for your business? Do you require any other form of documentation or Permit to conduct business in the state? These are some of the questions that you will be confronted with.

Here’s an insight into how business licensing works in the state of Alaska.

In the state of Alaska, in accordance to Alaska Statutes, AS 43.70.020(a) a Business License is mandatory for all businesses. It also specifies that once a license is issued to a business entity for a specific line of work or business, the license will cover all types of business operations in that state.

An Alaska company license is required by a business entity that can be Non-Profit or for a Profit entity that engages or offers to engage in delivery of a service, a trade, an activity or a profession, where the primary goal is to receive a financial benefit in exchange for the provision of goods, services, or other property.

Business License in Alaska may cover several types and lines of business. One of the salient aspects of Alaska state license for business is that effective 10/29/2014 the license statutes allows the issuance of a single license for different (multiple) lines of business activity. For example: If you have an advertising firm, a travel resort, and tour operations then you will require a single business license to cover business activity for all the businesses. The condition is that all type of business advertising as well as operation should take place under the same business name and should have the same business owner.

According to the Alaska Statutes AS 43.70.105, there are few exemptions applicable to Business License in Alaska. Although, an exemption exists under business licensing statutes; it may not exist under agency statutes or other programs like professional licensing requirements, and Procurement statutory requirements among others.

The exemptions are not applicable to the following lines of business:

In accordance to Alaska Statute Title 8 (AS 08), one of the requirements for businesses prior to engaging in a business practice is to obtain a Professional License. It is important to note that a Professional License is not applicable for all lines of businesses.

If applicable, Corporations, LLPs, LLCs, and LPs, can apply to the State of Alaska Professional License Section. The Professional License application form is different for different occupations or businesses, like Athletic Trainer license but has different fees and forms as compared to Real Estate Appraisers license.

In order to apply for Business License in Alaska, you will need to download the required forms. You can apply online or download the form, fill and send the hard copy to Alaska Division of Corporations, Business and Professional Licensing.

If you are applying for a new Business License then you have to download Form 08-4181 and mail it to 333 Willoughby Avenue, 9th Floor, Juneau, AK 99801, PO Box 110806, Juneau, AK 99811-0806. You can also apply online.

The standard processing time for Alaska company license is 10-15 business days in the period from March-September. If you apply outside this period that is from October – February and then there can be delays.

One of the salient aspects is that you can benefit from “Senior Citizen Discount” as well as “Disabled Veteran Discount” on applicable business license fee.

Why should you register a new company in Alaska? Alaska offers a variety of advantages to businesses that are planning to locate and operate from the state. Businesses can leverage a variety of economic factors including prime location, stable economy and low taxation.

Alaska is a state with a geography that creates constraints as well as opportunities for the economy of the state. Alaska has abundance of natural resources, strategically located, and more recently natural beauty has been one of the key factors driving their economy.

What benefits can a startup company in Alaska derive? The state offers a variety of loan programs, incentives, and tax credits to businesses that are willing to relocate here. Let’s take a quick look at some of the business beneficial programs.

When you register a new business in Alaska, you will be able to benefit from a variety of tax credits that the state offers. These tax credits are available depending on the type of industry, associations, and projects performed. Of course, businesses will need to qualify to benefit from this. Some of the commonly applicable tax credits include:

Some of the other tax credits, which are industry specific and you can benefit from include Qualified Oil and Gas Service Industry Expenditure Credit, Qualified Capital Expenditures, Gas Exploration and Development, Minerals Exploration Incentive, Film Production Credit, Frontier Basin Credits, and Exploration Incentive among others

The state of Alaska offers a variety of loan programs to those who register a new company in Alaska. Some of the most popular and successful loan programs include:

Some of the other loan programs that businesses in Alaska can be eligible for include Microloan Loan Program, Alternative Energy Conservation Loan Fund, and Mariculture loan.

If you register a new business in Alaska, are there any disadvantages? When it comes to tax or forming a business in Alaska, there are no disadvantages. The only problems that businesses might face in the state is its remoteness from some of the major markets across the nation and worldwide. Apart from this, the mountainous topography of the state creates a cold climate that ensures the state is covered in a snow blanket for a longer period of time.

According to a report by Alaska Small Business Profile, 2016, 430 establishments started in 2014 and the start-up rate has jumped by 3.2% in 2015. Small and medium sized businesses were set up in a variety of Industries including Construction, Accommodation and Food Services, Professional, Scientific, and Technical Services, Transportation and Warehousing, Agriculture, Forestry, Fishing and Hunting, Educational Services, Finance and Insurance, and Wholesale Trade among others.

This is just the right time to form a Corporation in Alaska and this is one decision you will never regret!

Different types of business entities will require different types of documentations and the fee structure will also be different. In order to make it easier to form a Corporation in Alaska, we have a team of specialists, standing by to help you with information and provide you the necessary support and assistance towards ensuring your business entity is registered. We are one of the top Alaska Registered Agents and are familiar with all processes pertaining to Alaska State Division of Corporations, Business, & Professional Licensing.

Let’s take a look at how you can form an Alaska business Corporation or LLC.

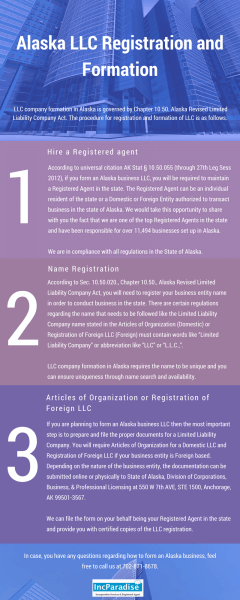

LLC company formation in Alaska is governed by Chapter 10.50. Alaska Revised Limited Liability Company Act. The procedure for registration and formation of LLC is as follows:

According to universal citation AK Stat § 10.50.055 (through 27th Leg Sess 2012), if you form an Alaska business LLC, you will be required to maintain a Registered Agent in the state. The Registered Agent can be an individual resident of the state or a Domestic or Foreign Entity authorized to transact business in the state of Alaska. We would take this opportunity to share with you the fact that we are one of the top Registered Agents in the state and have been responsible for over 11,494 businesses set up in Alaska.

We are in compliance with all regulations in the State of Alaska.

According to Sec. 10.50.020., Chapter 10.50., Alaska Revised Limited Liability Company Act, you will need to register your business entity name in order to conduct business in the state. There are certain regulations regarding name registration that needs to be followed like the Limited Liability Company name stated in the Articles of Organization (Domestic) or Registration of Foreign LLC (Foreign) and must contain words like “Limited Liability Company” or abbreviations like “LLC” or “L.L.C.,”.

LLC company formation in Alaska requires the name to be unique and you can ensure uniqueness through name search and availability.

If you are planning to form an Alaska business LLC then the most important step is to prepare and file the proper documents for a Limited Liability Company. You will require Articles of Organization for a Domestic LLC and Registration of Foreign LLC if your business entity is Foreign based. Depending on the nature of the business entity, the documentation can be submitted online or physically to the State of Alaska, Division of Corporations, Business, & Professional Licensing at 550 W 7th AVE, STE 1500, Anchorage, AK 99501-3567.

We can also file the form on your behalf as your Registered Agent in the state and provide you with certified copies of the LLC registration.

In case, you have any questions regarding how to form an Alaska business, feel free to call us on 702-871-8678.

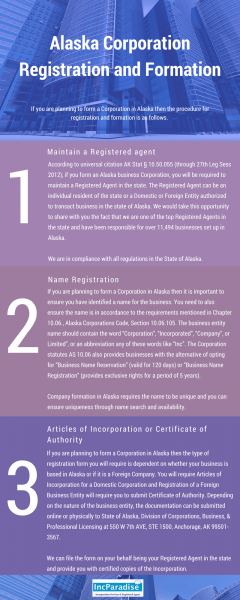

If you are planning to form a Corporation in Alaska then the procedure for registration and formation is as follows:

According to universal citation AK Stat § 10.50.055 (through 27th Leg Sess 2012), if you form an Alaska business Corporation, you will be required to maintain a Registered Agent in the state. The Registered Agent can be an individual resident of the state or a Domestic or Foreign Entity authorized to transact business in the state of Alaska. We would take this opportunity to share with you the fact that we are one of the top Registered Agents in the state and have been responsible for over 11,494 businesses set up in Alaska.

We are in compliance with all regulations in the State of Alaska.

If you are planning to form a Corporation in Alaska then it is important to ensure you have identified a name for the business. You need to also ensure the name is in accordance with the requirements mentioned in Chapter 10.06., Alaska Corporations Code, Section 10.06.105. The business entity name should contain the word “Corporation”, “Incorporated”, “Company”, or Limited”, or an abbreviation of any of these words like “Inc”. The Corporation statutes AS 10.06 also provide businesses with the alternative of opting for “Business Name Reservation” (valid for 120 days) or “Business Name Registration” (provides exclusive rights for a period of 5 years).

Company formation in Alaska requires the name to be unique and you can ensure uniqueness through name search and availability.

If you are planning to form a Corporation in Alaska then the type of registration form you will require is dependent on whether your business is based in Alaska or if it is a Foreign Company. You will require Articles of Incorporation for a Domestic Corporation and Certificate of Authority for Registration of a Foreign Business Entity. Depending on the nature of the business entity, the documentation can be submitted online or physically to the State of Alaska, Division of Corporations, Business, & Professional Licensing at 550 W 7th AVE, STE 1500, Anchorage, AK 99501-3567.

We can file the form on your behalf as your Registered Agent in the state and provide you with certified copies of the Incorporation.

If you have any questions regarding Alaska Incorporation or LLC formation, you can simply visit the Alaska Business formation page.

Alaska boasts of a gross state product exceeding $44.9 billion and federal subsidies, an important aspect of the economy that is perhaps a primary reason for the state witnessing low taxes. In the last decade, the state has seen growth in the tourism sector. If you are wondering if Incorporation in Alaska is a smart idea or not then the list of top companies and employers by Alaska Department of Labor and Workforce Development will definitely be helpful to you. Some of the companies headquartered in the state include FedEx, Wells Fargo, Alaska Communications Systems (ACS), Lowe’s, Costco, Icicle Seafoods, McDonald’s Restaurants of Alaska, and Home Depot among others.

Why is a company Incorporation in Alaska a good decision? This northernmost state is home to 69,115 small businesses with 72% of them being exporters. The state of Alaska offers several benefits in terms of advantages as well as incentives to prospective businesses. Let’s take a look at some of them.

If you set up a company in Alaska especially in the opportunity zones laid out by the Department of Commerce, Community, and Economic Development then your business will be able to enjoy tax benefits on investments. You can check the various opportunity zones by clicking here.

One of the advantages of Incorporation in Alaska is the availability of a variety of loan programs, which will help your business to generate the capital required. Some of the popular loans available include:

A fundamental decision that you will be required to make in order to set up a company in Alaska is the type or form of business organization to register. In the state of Alaska, the different forms of businesses you can choose from include General Partnership, Sole Proprietorship, Business Corporation, Limited Liability Company (LLC), and Limited Partnership (LP).

If you are thinking that a company Incorporation in Alaska might be a tough process then the best way to understand the process is through the following:

What would it cost to set up a company in Alaska?

Check Fees here!

| For Fairbanks, AL(2004): | Index Score |

|---|---|

| Composite: | 128.4 |

| Housing: | 133.2 |

| Utilities: | 128.3 |

| Misc. Goods & Services: | 122.6 |

Alaska’s Permanent Fund helps offset the cost of living. In 2004, each man, woman and child living in Alaska for at least one year received a dividend check from the state government for $919.84.

Alaska is ranked 31st in the nation in terms of crime. (FBI, 2003)

Business Inventory Tax

Alaska has a business inventory tax; however, some municipalities may exempt business inventories.

Business Licenses Fee

Unless specifically exempted by statute, every business must obtain a business license at a biannual fee of $50.

Corporate Income Tax

Alaska uses a graduated percentage of taxable income ranging from 1% for net income below $10,000 to 9.4% for net income over $90,000. Alternative minimum tax rate on capital gains is 4.5%.

Personal Income Tax

None

Personal Property Tax

Taxable

Alaska is the only state where a large part of its land mass is not subject to a property tax. While property tax is the primary method of raising revenues for many of the larger municipalities in the state, smaller municipalities favor a sales tax.

State Sales and Use Tax

Base Rate: None

Machinery Rate: None

There is no statewide sales tax levied. The typical sales tax rates for some municipalities are from 3%-5%.

Unemployment Insurance

Alaska charges new employers the average industry tax rate for 1 year.