Starting a Business in Las Vegas – Step by Step Guide

Starting a Business in Las Vegas - Step by Step Guide

Are you thinking of starting a business in Las Vegas – the famous city of Silver State Nevada, Us? If so, it could be one of the most logical decisions since Las Vegas boasts an affordable cost of living. Even, there is a slew of tax breaks that you could receive like- No business income tax, franchise tax, personal income tax, franchise tax, and no gift tax, etc. The absence of several tax impositions has made Las Vegas one of the business-friendly cities and one of the best places for new start-ups.

Another justifiable reason for starting a business in Las Vegas is that after the recession, it has become a buyer’s market. Also, if you are not prepared to buy one, there are numerous below-market leasing-deals available, that you may grab.

Do you want to set up a business in Las Vegas? But you might be wondering about the business opportunities you could have to set up a profitable business in Las Vegas. Do you want to know more about the opportunities that may encounter you while operating the business? Great!

Here are some of the trending small business opportunities, we have gathered for you.

- Cannabis Licensing – After the legalization of cannabis, it has become a hotbed of investments. So, if you want to make huge profits from your business, you could start a consultancy business for cannabis. The cannabis industry is enormous and provides ample of job opportunities. So, do your homework well and create a business plan that can improve your fiscal conditions at a rapid pace.

- E-commerce Business – With the digitization, starting an Ecommerce business has become one of the most profitable business ideas. You can be as much as innovative as you can for attracting your potential customers on the selling-portal or the E-commerce business website. Therefore, if you are starting a business in Las Vegas, you can easily focus your target audience or customers and generate the desired leads.

- Container Restaurant – Another most lucrative idea of starting a business in Las Vegas is to embark a food business in a container. Las Vegas is a city of foodlovers and well-known cuisines like Lemon Spaghetti with Shrimp Giada, Roasted Beef Wellington, Quinoa Fritters, etc. Not only the local people but also the travelers and visitors love to try these dishes. Therefore, the container restaurant business is always profitable biz in Las Vegas.

- The business of Green Consulting – Have you ever heard of the green practices? Well, these days, everywhere in the US, green practices are proliferating at a constant pace. Almost all the existing and new organizations in the US are heading towards green consultancy centers. Hence, if you are starting a business in Las Vegas, this would be a great small and profitable business opportunity.

However, before starting a business in Las Vegas, you need to follow a proper checklist of business formation and documentation to avoid possible disputes. Let us give a closer look at the step by step guide for starting a business in Las Vegas.

#1 Prepare The Business Plan

To put a strong foundation for your business in Las Vegas, you must start by carefully analyzing your business idea and plan for it. It is primary and the most critical step that decides the future success of your business. Proper planning and analyzing involves the answer to various questions like –

- Based On Product Development: Does your business-product solve any specific problem? Is your business helpful enough to stand in the challenging competition?

- Based On Sales & Marketing: Do you know your potential customers? Where could you find them? Are you aware of all the possible tactics to attain their attention and generate leads?

- Based On People and Partnerships: How efficiently could you arrange the hiring process? For successful business growth, ‘which roles you would hire for your company?’ What relationships will you need to form with your company?

- Based On Financial Planning: For a fantastic break even, How many clients or sales, you would require? How much capital is required to execute your business idea? What are the sources of investors or funding?

#2 Choosing an Apt Business Name

A business name itself holds a substantial percentage of weightage concerning the launch of a new business. And, starting a business in Las Vegas also requires detailed attention to the choice of an eye-catchy business name as well. While being in the process of picking a good and well-suited business name, you must go through the official website of Nevada Secretary of State and gather all the necessary information. Here are some of the critical points to be mentioned in your to-do-list for business name selection.

Check Name Availability

Do you want to choose a legal name for starting a business in Las Vegas? Well, if yes, you have to first check for its availability with the Secretary of State or SOS. Ensure that the business or entity name you are choosing should not be in use or has already been licensed by someone else. Always consider that business name, for which, you could reserve a domain.

You can check the federal trademark database to make sure that the name is not registered with any local business license bureau. If you are not going to create your business website at the initial stages of starting a business in Las Vegas, buying a domain would help you to secure your business name from getting acquired by others for future reference. After all, the name of your company would become your business identity in the upcoming years and gain acceptance globally.

Business Entity Search

For starting a business in Las Vegas, business entity research is as critical as checking for the business name availability. While doing a business entity search, you have to obtain the below-mentioned information about a business:

- Whether the business has been formed legally?

- Either the business is in good standing or not?

- What is the address of that particular business?

- What is the official address of that business-specific registered agent?

#3 Figure Out A Business Address

Well, if you have decided on the business name and have reserved that already, you should hop over to the next critical step for starting a business in Las Vegas. Now, you have to figure out a suitable business address, which could be your home address, an actual office or even a virtual office. The business address is vital for almost all the paperwork that is required to start any new business, so always make a wise decision.

You are suggested to choose the right address at the initial stages of the business formation rather than switching or changing an address down the road. Later it may cause inconvenience financially, as an example, Nevada Secretary of State charges about $175 for an address change. The business address is mentioned under the public record, but for some of the applications, you could also use a separate mailing address. In this scenario, you may use a house address or PO box number.

#4 Determine a Business Structure

Starting a business in Las Vegas might seem an easy task but, its formation process is very challenging. You always have to follow the steps that could aid to increase the credibility of your business. So, if you are ready with an effective business plan, name, and address, you would now need to choose a well-suited business structure from the three basic options as mentioned.

- DBA: “Doing Business As” or DBA usually does not comes under a separate structure. But, it could be used as a different business name by an individual or a partner.

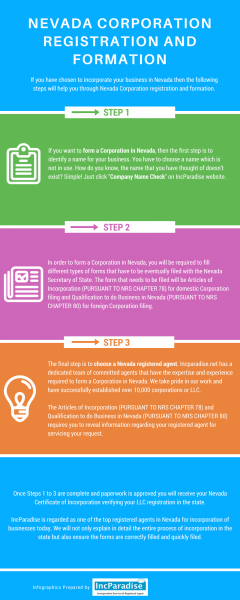

- Corporation: A corporation works as a separate entity including officers, shareholders, and directors. It is a bit-complex business structure as compared to the DBA, though it requires limited liability protection. There are a few professions like architects, doctors, lawyers, etc. are required to choose “Professional Corporation.”

- LLC: An LLC or “Limited Liability Company” is a renowned type of business structure that provides limited liability protection to the owners with less complexity. It has considerably replaced the other business structures by providing easy management and taxation benefits being a separate entity. Additionally, it also attracts more investors as compared to the other structure types.

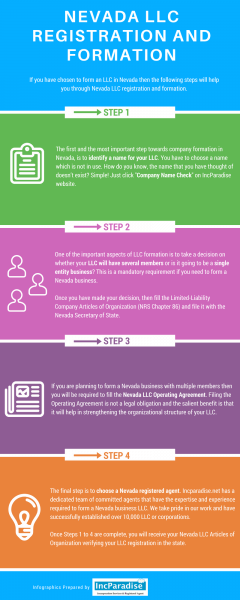

Adding to the above information on the different business structures, always remember that if you are starting a business in Las Vegas, you should register your company as a Nevada business entity(LLC or a Corporation). It will not only increase the credibility of your business but will also protect it from personal liabilities, in case your business is sued. Also, an LLC is the most opted business structure in Nevada, whose setup requires as little as $75.

#5 Get Your State Business License

Another most crucial step in starting a business in Las Vegas is applying for a business license. There is a very fancy-schmancy online portal, provided by the Nevada Secretary of State, which is called as SilverFlume. Though the paper route is also available, the online portal is considerably a convenient way to apply for the license. You have to file – Articles of Organization for LLC, Certificate of Limited Partnership or Articles of Incorporation for a corporation. Lastly, you would require to submit the Initial List of – Members, Managers, Partners or Officers. And, your deemed entity in Nevada would be established.

Also, if you are starting a business in Nevada, you should be aware that there are certain exemptions to the state business license requirement. But, by the time you’re an entity, you would have to pay $200. Being a nonprofit company, say be it a motion picture company, a specific type of insurance company, or a governmental entity, you are eligible to apply for an exemption by mailing the required form.

#6 Get an EIN number

Now, the next step for starting a business in Las Vegas is getting an EIN or Employer Identification Number for your business, which is issued by the by the IRS. Either you have a partnership, LLC or a corporation, obtaining an EIN is very vital. An Employer Identification Number is a type of Taxpayer Identification Number. It is also abbreviated as TIN, which helps to identify or to verify any Nevada LLC with the IRS. Moreover, it is free of cost and could be obtained from the IRS website.

Having an EIN for your Nevada LLC, allows you to open a separate LLC bank account. Not only this, with EIN you could apply for several permits or business licenses also. With an EIN you are also allowed to file taxes at the federal, state, and local level. And, if applicable, you can handle employee payroll. Also, if you want to obtain business lines of credit or business loans, having an EIN is a must.

#7 Registering with the Nevada Department of Taxation

If you are Starting a business in Las Vegas, applying for a business license is something unavoidable. Firstly, you have to register your business with the Nevada Department of Taxation to submit it as proof for obtaining the business licenses. Also, note that you require to apply for a sales tax permit also if you’re selling tangible goods.

Furthermore, if you instead of selling, buy products or goods for consumption in your business like office supplies, you would require a use tax permit. Let us say, if you are not paying tax at the time of purchase, you have to calculate the intended amount of the brought items in Nevada. After that, you would require to remit or pay back the same amount to the state.

#8 Getting A Business Insurance

Getting insured is again a very crucial step for starting a business in Las Vegas. It helps you to manage all the possible risks that might occur on the path of growing your business. Here are the common types of business insurance that you may consider.

- Professional Liability Insurance

- Workers Compensation Insurance

- General Liability Insurance

As an example, if you have a home-based business or any small business, you should purchase a general liability policy or insurance. And, being a firm like accounting and consulting, should go for professional liability policy. Additionally, if you have a business with one or more employees, including all the corporate officers and LLC members should have workers compensation insurance, in Nevada.

Conclusion

Now that you have got all the necessary information and checklist for starting a business in Las Vegas, you might have initiated the most crucial step of business formation- business planning. But, if you do not want to lose the ground by making any mistake by not following the further steps adequately, you should hop over the IncParadise to get professional assistance. We expertise in providing complete business incorporation and registration services. So, what are you waiting for? Contact us now to register and incorporate your dream business today!

702-871-8678

702-871-8678