Texas

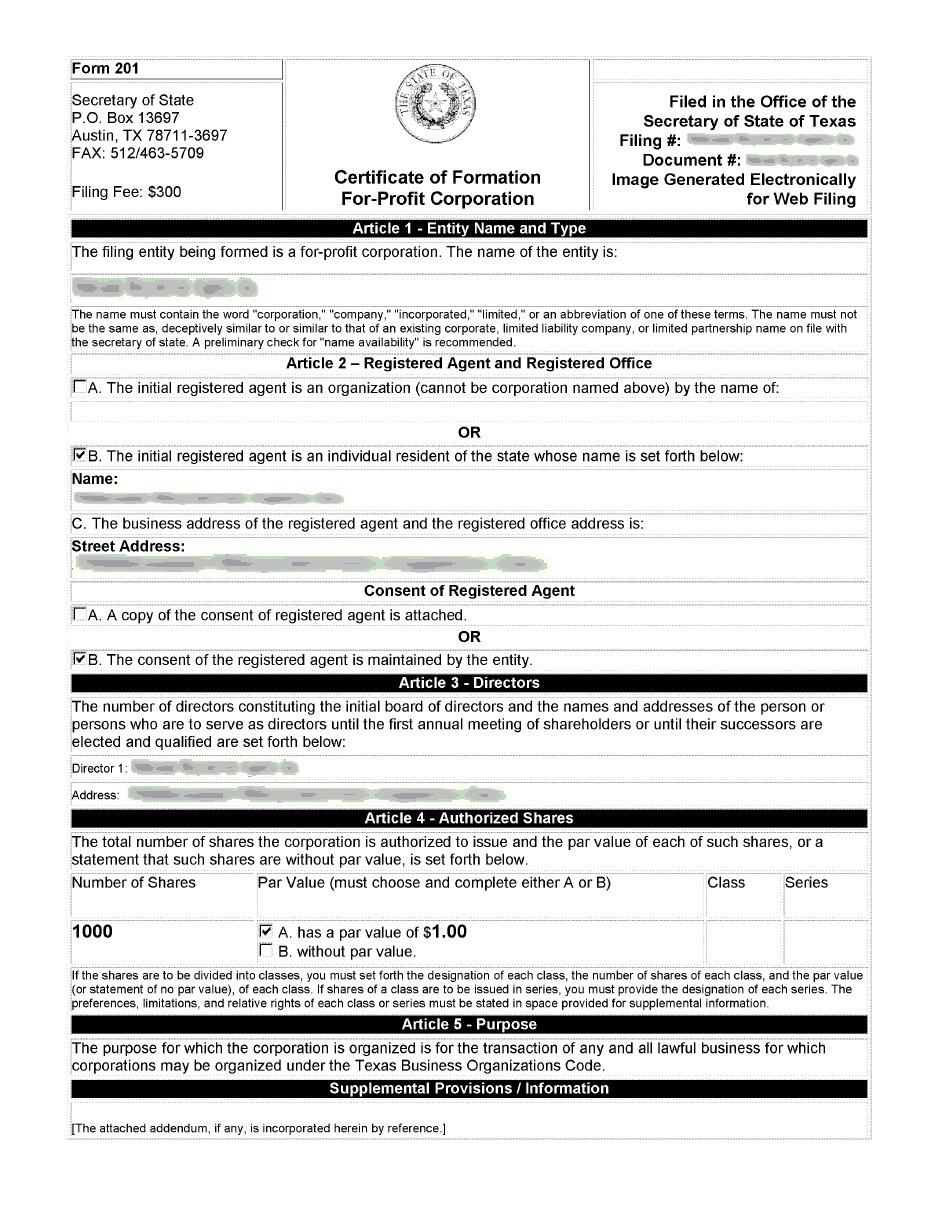

TEXAS CORPORATION total only $389.00

Including Texas State Initial Filing fee $300.00 and $89.00 fee for checking name availability,preparing Texas state-approved Articles of incorporation, filing Articles with state, sending Articles to you.

See what’s included

- $300.00 – Texas State Initial Filing fee

- $89.00 – Checking name availability, preparing state-approved Articles of incorporation, filing Articles with state, sending Articles or Certificate of incorporation to you.

- Company Bylaws included.

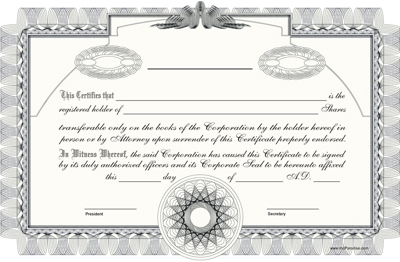

- Ready to fill Stock Certificates included

- Meeting of Shareholders Minutes

- Meeting of Directors Minutes included

- Reminders about annual renewals through INCCONTACT

Once your company is set up, you will need:

- Tax ID (EIN) – free over the Internet or phone.

- Yearly Requirements and Fees for Texas companies – Both domestic limited liability companies and foreign limited liability companies doing business in Texas are subject to the state franchise tax. Questions regarding the franchise tax should be directed to the Comptroller of Public Accounts, Tax Assistance Section, Austin, Texas, 78774-0100.

- Company Minutes & Stock Certificates – are included in incorporation. You will have access to documents generated on your client account.

702-871-8678

702-871-8678