Wisconsin

WISCONSIN CORPORATION total only $189.00

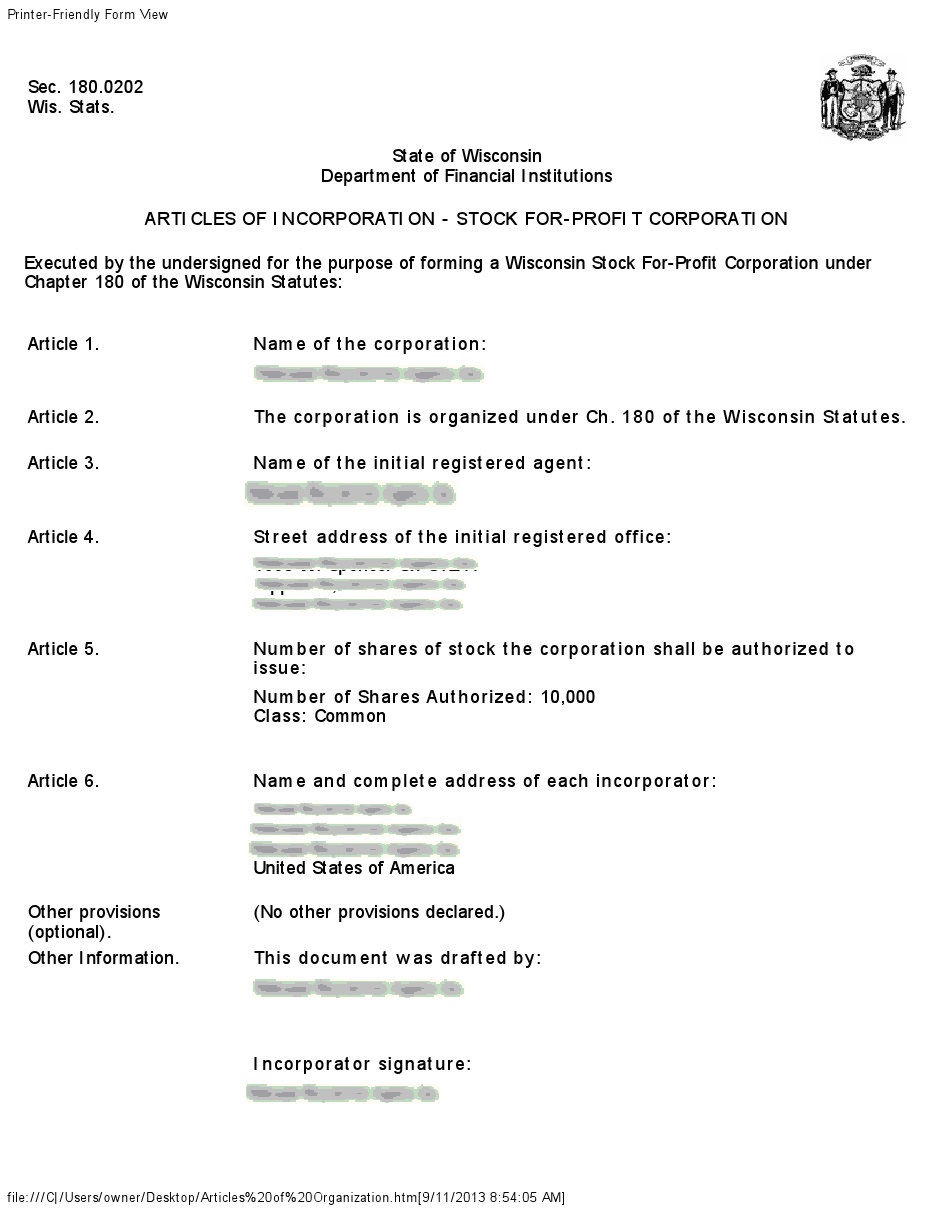

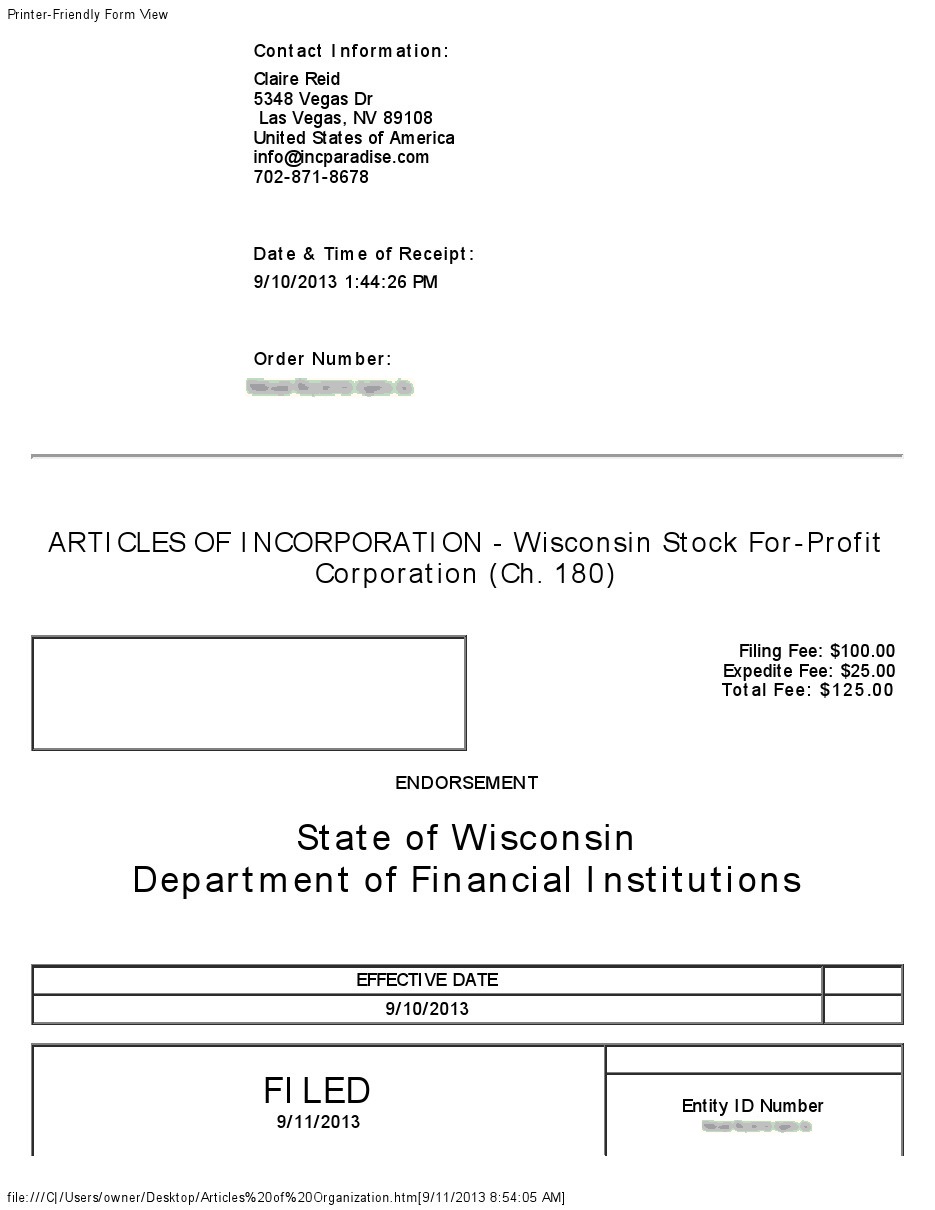

Including Wisconsin State Initial Filing fee $100.00 and $89.00 fee for checking name availability,preparing Wisconsin state-approved Articles of incorporation, filing Articles with state, sending Articles to you.

See what’s included

- $100.00 – Wisconsin State Initial Filing fee

- $89.00 – Checking name availability, preparing state-approved Articles of incorporation, filing Articles with state, sending Articles or Certificate of incorporation to you.

- Company Bylaws included.

- Ready to fill Stock Certificates included

- Meeting of Shareholders Minutes

- Meeting of Directors Minutes included

- Reminders about annual renewals through INCCONTACT

Once your company is set up, you will need:

- Tax ID (EIN) – free over the Internet or phone.

- Yearly Requirements and Fees for Wisconsin companies

- Company Minutes & Stock Certificates are included in incorporation. You will have access to documents generated on your client account.

702-871-8678

702-871-8678