Reinstate California Corporation

REINSTATE A CALIFORNIA CORPORATION COMPLETE GUIDE

When you reinstate California corporation, it means that you are reviving your company or bringing your business back into the “good standing” list of the state. Reinstatement is a process and more often than not, it is required when businesses fail to file or submit their annual report or Statements of Information along with the applicable fee or fail to file certain state fee or even franchise tax.

Why do I reinstate my company?

The essence of California reinstatement lies in the fact that if your business license gets revoked or if the Secretary of State – Business Programs Division finds a business to be in default; your business will not only lose its good standing but also forfeit its corporate powers and privileges in the state.

In order to reinstate California Corporation, you will have to identify the situation in which you need to reinstate.

- Civil Penalties: A business corporation according to CA Corp Code § 2207 (2016) can be liable to pay civil penalties not exceeding $1,000,000 (one million dollars) due to several reasons including if a corporation shows that its shares of stock are materially greater or materially less than the apparent market value. In such a case, the business will be fined but you will not require California reinstatement.

- Suspended or Forfeited: A domestic entity can be suspended and a foreign corporation can be forfeited by the Secretary of State and/or the Franchise Tax Board if the business was unable to file franchise tax or submit the required Statement of Information report annually pursuant to CA Corp Code § 2206 (2016) and CA Corp Code § 2205 (2016). If your business entity has been suspended or forfeited then you will need to reinstate California Corporation.

How to reinstate my Nevada Corporation?

Is there a process for reinstating a California Corporation? The procedure for reinstatement is based on the following:

- California SOS Reinstatement: If your business corporation has been forfeited or suspended due to non-filing of the Statement of Information then you can request a California secretary of state reinstatement by filing current Statement of Information form SI-550 along with Agent for Service of Process and outstanding fee. The form can be submitted through mail, e-filing, and in person.

- California FTB Reinstatement: If your business corporation has been forfeited or suspended due to non-filing of franchise tax then you will be required to file FTB 3557 BC Application for Certificate of Revivor – Corporation with the Franchise Tax Board (FTB). You need to ensure payment of franchise tax, penalties, and interest along with the application.

Note: If your business corporation has been forfeited or suspended by both SOS and FTB then you will be required to file both Statement of Information and Application for Certificate of Revivor with either department.

Whether it is a Reinstatement with FTB or SOS, IncParadise can assist with the filing process

Can I change my Registered Agent at the time of reinstatement?

Yes, you can change your registered agent at the time of California reinstatement pursuant to California Code, Corporations Code – CORP § 17701.13 and 2007 California Corporations Code Chapter 17-Service Of Process (corp: 1700-1702).

IncParadise is one of the reputable and top registered agents in the state of California and we can help you reinstate California Corporation with ease. You can check our services here.

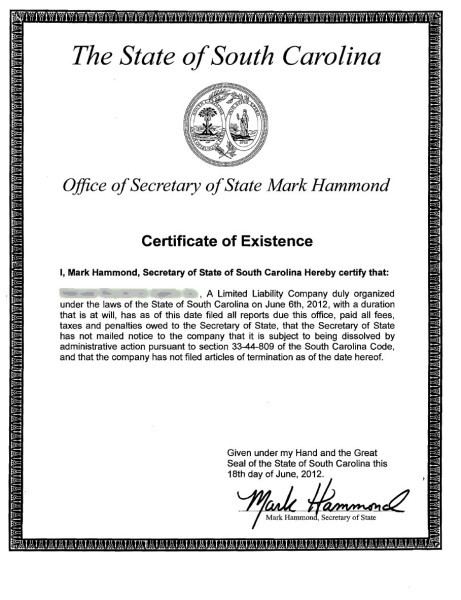

Tax Clearance or Tax Good Standing before reinstating

Several states require a tax clearance or tax good standing certificate while filing for company reinstatement. If you are planning to reinstate California Corporation, you will be required to file a “Tax Status Compliance Certificate”, which is also known as an “Entity Status Letter”. This letter is issued by the California Franchise Tax Board (FTB) to corporations that have met all their tax obligations in the state.

The California Tax Status Compliance Certificate will be issued by FTB to a company if they meet the following requirements:

- A Domestic or Foreign business entity must be registered as a legal entity with the Secretary of State – California

- The California Corporation in question should have paid all types of California state taxes as well as any outstanding fee or penalty.

- The California Corporation should not be in a default or suspended list of businesses

Once you apply for a California Tax Status Compliance Certificate, the processing time can vary from a few weeks to almost a month. We at IncParadise can help in speeding up the process by communicating directly with the California Franchise Tax Board (FTB) on your behalf.

How IncParadise help you?

A business in default or forfeited by the Secretary of State or Franchise Tax Board will lose its rights to operate in California or will be unable to defend against a lawsuit. This is where IncParadise can help you to reinstate California Corporation and regain your “active status”.

IncParadise will provide assistance towards California reinstatement in the following ways:

- Pending Franchise Tax: Experts at IncParadise will identify any pending California franchise tax and also provide guidance towards filing of taxes.

- Reinstatement Forms: Different types of business entities require different California secretary of state reinstatement forms. We will ensure you get the right form and if at all you require help filling the form, we can provide guidance on the same.

- Examine and Submit: We will ensure that the Reinstatement Form filled by you is examined to the last detail and make it ready for submission. We will also submit the form with the California Secretary of State – Business Programs Division.

- Reinstatement: We will notify you or provide you with a file stamped copy of the Certificate of Revival (Reinstatement).

Reinstate California Corporation at $89.00

+ State fees/Annual Fees!

702-871-8678

702-871-8678