Incorporate in Idaho

Incorporate in Idaho

As a state that has experienced a GDP growth of 4.8 percent, Idaho is ranked 7th highest in the country thanks to the annual growth rate of 2.7 percent. Whether you want to set up company in Idaho or transfer your business from another state, the state offers some of the best business incentives including tax credits and grants. The Gross State Product was recorded at $65 billion in 2017 and Forbes has ranked Idaho 14th best in terms of economic climate and 11th best in terms of growth prospects in the nation.

Why Choose Idaho for Incorporation?

Is company incorporation in Idaho the best business opportunity? Definitely! Idaho is one of the few states with a surprising economic turnaround story driven by streamlining of regulations, lowering of taxes, and bringing down government spending. The state government has implemented several beneficial programs for small businesses leading to an increase in the number of businesses getting incorporated in the state.

Now let’s take a look at some of the salient benefits that are responsible for fueling growth of small businesses:

- The Opportunity Zones program is aimed at small and medium sized enterprises. Incorporation in Idaho opportunity zones can provide businesses with the benefit of enjoying tax relief on the capital gains. List of opportunity zones

- Tax Reimbursement Incentive program is another beneficial program for businesses formed in the state. The salient aspect of this program includes a tax credit of a maximum of 30% on payroll, income, as well as sales taxes for a period of 15 years.

- Idaho’s State Trade Expansion Program (STEP) Grant provides financial support to those businesses that want to export to international markets. The grant reward can vary from a minimum of $3,000 to $15,000.

How do you incorporate in Idaho?

Is there a process through which you can set up company in Idaho? What type of documentation is required? Is the process tough? If you are confronted with these questions then the following steps will help you understand how incorporation works in Idaho:

Type of Business

You can form different types of businesses in Idaho and this includes Limited Liability Company (LLC), Domestic and Foreign Profit and Non-Profit Corporation, Professional Service Corporation, Limited Liability Partnership (LLP), Limited Partnership (LP), and General Partnership (GP). The first step towards company incorporation in Idaho is choosing the type of business you want to form. Know more

Business Entity Name

What is the next step in company incorporation in Idaho? The next step is to identify and reserve a name and this is done as follows:

- Naming Requirements: According to Section 30-21-301, Idaho Code, a corporate name should contain the words “incorporated,” “corporation,” or abbreviations like “inc.,” “corp.,” etc. Similarly, an LLC should contain “limited liability company,” “LLC” or “L.L.C.”

- Business name search: You need to search for a business name that is not in use currently. You can conduct name search here.

- Name Reservation: Once you have identified business entity name, you can reserve the name with the Secretary of State pursuant to Section 30-21-303, Idaho Code. Name reservations are valid for a period of 120 days.

- Name Registration: If you are foreign entity planning to set up company in Idaho then you will be required to register a business name with the Secretary of State pursuant to Section 30-21-301, Idaho Code.

Choose a Registered Agent

According to Section 30-21-401, Idaho Code, a domestic or foreign corporation or LLC in the state of Idaho will be required to maintain a registered agent. We are one of the respected registered agents in Idaho and will be responsible for initiating incorporation in Idaho through processing of all your documents including “Articles of Incorporation” for domestic corporations and “Foreign Registration Statement” for foreign corporations.

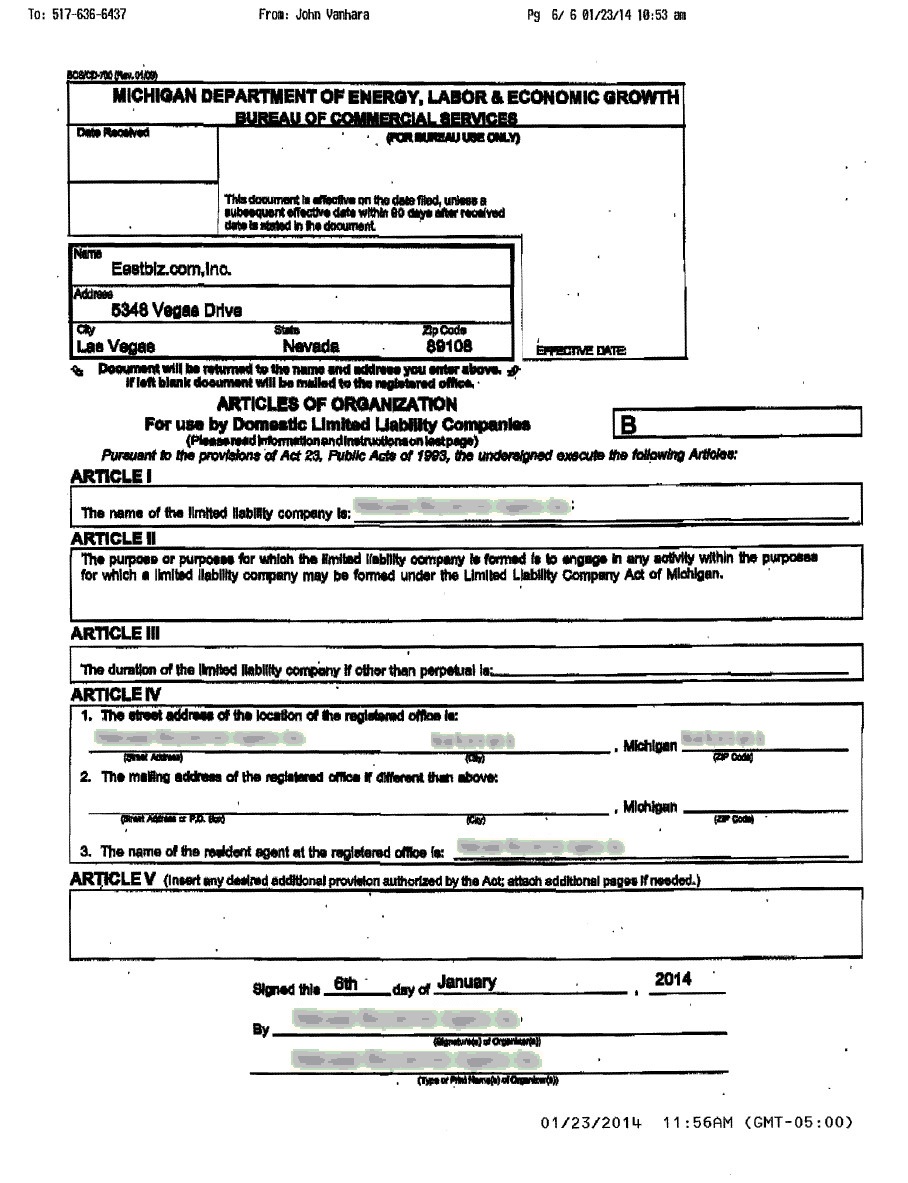

Articles of Incorporation and Foreign Registration Statement

You will be required to file “Articles of Incorporation” pursuant to Section 30-29-201, Idaho Code, if your business is a domestic corporation. You will have to file a “Certificate of Authority” pursuant to Section 30-21-501, Idaho Code, if it is a foreign business entity. In order to streamline the process of incorporation in Idaho, we can file documents on your behalf through the online process or through an expedited process.

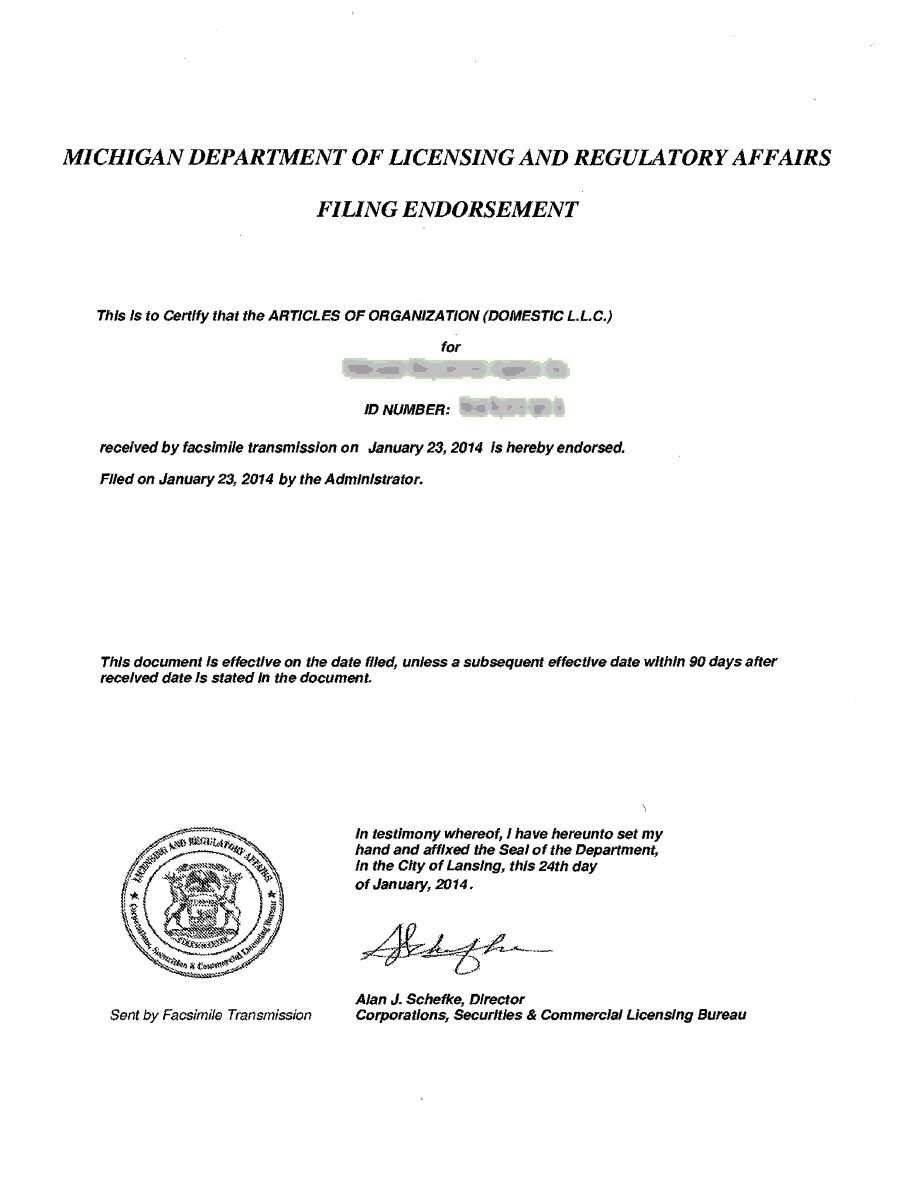

Date Stamped Copies

As a part of the process of company incorporation in Idaho, we will ensure, you receive date-stamped and filed copies that verifies the state has filed as well as formed your corporation.

Costs and Fees associated with Idaho Incorporation

What would it cost to set up company in Idaho? Check Fees here!

702-871-8678

702-871-8678