Date: 06/22/2015 |

Category: |

Author: Jakub Vele

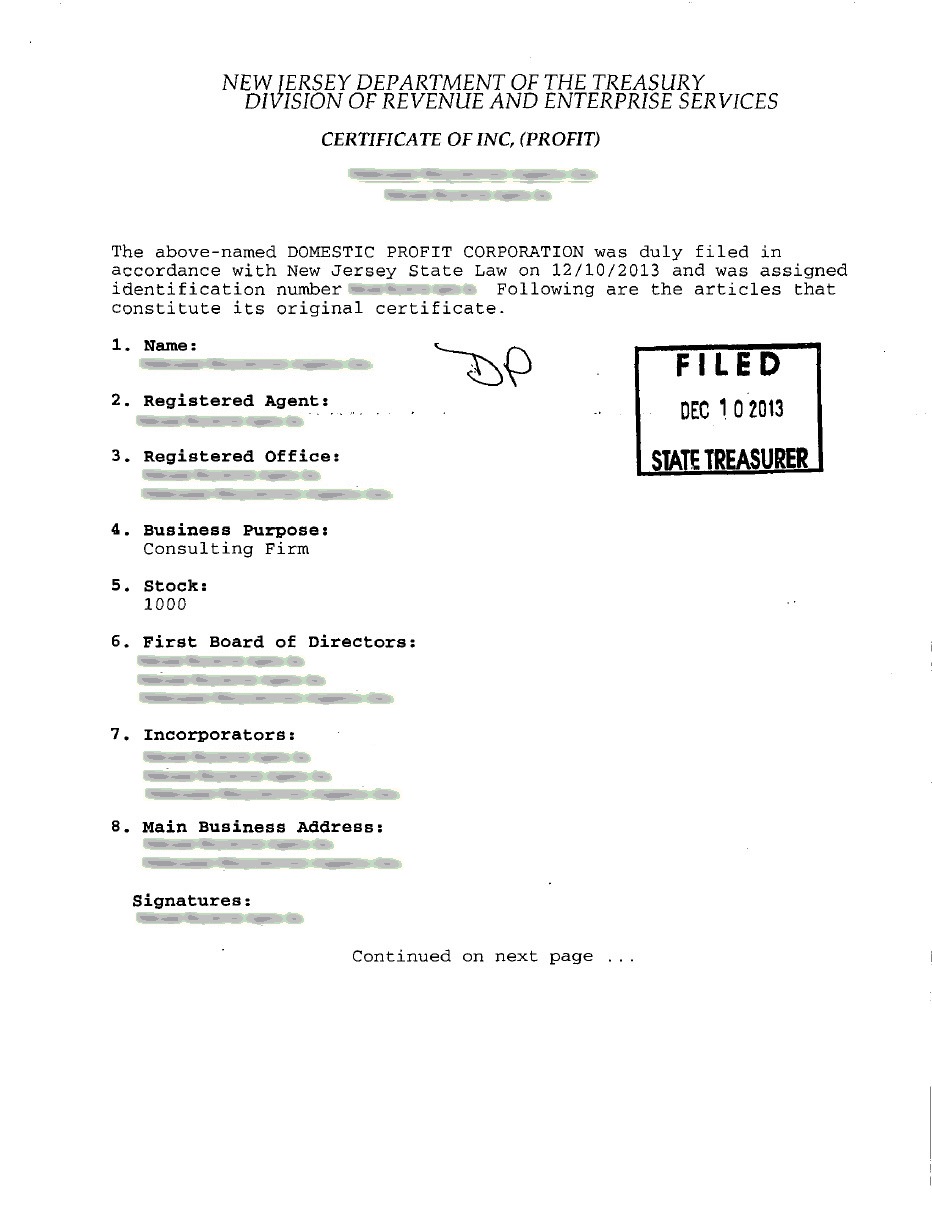

NEW JERSEY CORPORATION total only $214.00

Including New Jersey State Initial Filing fee $125.00 and $89.00 fee for checking name availability,preparing New Jersey state-approved Articles of incorporation, filing Articles with state, sending Articles to you.

See what’s included

Once your company is set up, you will need:

- Tax ID (EIN) – free over the Internet or phone.

- Yearly Requirements and Fees for New Jersey companies – Statement of Information is an initial statement of officers or member/managers that must be filed with the New Jersey Secretary of State within 90 days after filing original articles, and every year thereafter in the applicable filing period. For LLCs there is an addition Franchise Tax that is $800.00 per year. The first payment must be made within 3 months of your LLC.

- Company Minutes & Stock Certificates – are included in incorporation. You will have access to documents generated on your client account.

New Jersey additional services

Date: |

Category: |

Author: Jakub Vele

New Jersey LLC ( Limited Liability Company )

ORDER ONLINE: Use this online order form and pay by credit card.

Date: |

Category: |

Author: Jakub Vele

New Jersey Registered Agent / Resident Agent

Pricing $89.00 per year, special for pre-pay $40 per year

Don’t get fooled by companies claiming the lowest price and increasing it later. Our pricing is very simple. We charge $89 per year. We also have few specials. Whenever you decide to pre-pay additional years you get them for $40/year.

New Company

starting business

(new corporation, LLC, etc.)

Order now

Change of Agent

changing existing

agent to us

Order now

Renewals

existing clients

for NJ resident agent

Order now

Why you need a Registered Agent?

New Jersey State laws require business entities to maintain a Resident Agent in the state that you form your business. The agent’s name and office address are included in the Articles of Incorporation or Articles of Organization to give public notice of where to send important documents to your business entity.

If you need Registered agent in other State than New Jersey click here.

We offer Registered Agent service in all 50 States.

State Fee for changing New Jersey Registered Agent

Change of Registered Agent/Registered Office/Resignation: $29.00.

Registered Agent Requirements

The registered agent in New Jersey must maintain a business office that is identical to the registered office and must be either: (1) a natural person at least 18 years old and residing in the state, or (2) a corporation with authority to transact business in the state.

Date: |

Category: |

Author: Jakub Vele

Annual Reports for New Jersey Corporations & LLCs

All profit and nonprofit corporations (domestic and foreign), as well as all limited partnerships, limited liability companies, and limited liability partnerships must submit annual reports and associated processing fees each year following their dates of incorporation/registration.

The state annual fees are $75.00 for corporations and LLCs + $3.00 payment processing fee. The report is due by the end of the anniversary month of the date of incorporation.

If you need help, we can file the annual report for you. Our fee is only $45. To order our service, please click on the following link:

Date: |

Category: |

Author: Jakub Vele

New Jersey Incorporation Frequently Asked Questions

Do I need to reserve a corporate name?

No, but it is recommended to reserve a name prior to filing to ensure that it remains available during the incorporation process.

How do I reserve a corporate name?

The reservation of your corporate name will be handled by IncParadise and is included in the price of our service.

Do I have to renew my name registration?

How do I incorporate in New Jersey?

When using our service, IncParadise will file, on your behalf, the required administrative forms and articles of incorporation with the appropriate New Jersey agency.

Is a registered agent required?

Yes. The registered agent must maintain a business office that is identical to the registered office and must be either: (1) a natural person at least 18 years old and residing in New Jersey, or (2) a corporation with authority to transact business in the state. As part of our ongoing service, IncParadise does provide a registered agent service option that you can select during the online registration process.

How many Incorporators are required to form a corporation in New Jersey?

One or more are required.

How many Directors are required to start a corporation in New Jersey?

One or more as specified and required in the articles of incorporation.

Are corporations in New Jersey required to file an Annual Report?

Yes. A report must be filed by a date designated by the State Treasurer.

702-871-8678

702-871-8678