A DEFINITIVE GUIDE INTO NEVADA BUSINESS LICENSE

When it comes to a favorite state for starting a new business, Nevada is on the top of the list. This is more so because the silver state provides several benefits including strong privacy protection and no state income or franchise taxes. You can establish your business and obtain a Nevada business license to leverage all said benefits of the state.

An Introduction to getting Nevada Business License

Nevada is considered to be a business friendly state and hence it is easy to form an LLC or a business corporation. A Nevada business license is a mandatory requirement pursuant to Nevada Revised Statutes and is applicable for any entity or persons planning to conduct business in the state. Of course, you need to know the type of license or permit required for the corresponding business activity and this information can be gathered through a Nevada business license search.

What makes Nevada Popular amongst New Businesses?

Nevada, the 32nd most populous state in the USA is also known as the “Silver State” due to the precious metal being a key driver of the economy. Today, more than ever before, the health of the Nevada economy is currently robust and it is expected to keep growing at a steady pace. The economy along with incentive programs offered by the state to small businesses has been key to higher registration and application of startups for a Nevada business license.

Why start a business in Nevada?

Whether you are planning to start an LLC or a business corporation, the basic requirements are business registration and application for license and permits in Nevada. Positive business climate and opportunities in varied industries for innovation are two main highlights of the state. Nevada is not only championing the business of innovation but is also promoting the concept of lean startups. There are several advantages and benefits for new businesses in the state including the business license Nevada cost being lower as compared to other states. Some of the benefits include:

- Strong economic benefit: Nevada is home to over 250,000 small businesses and they play an integral role in the 3.3% annual economic growth rate of the state. The state economy has been undergoing significant positive changes as there is a large influx of startups in several industries including technology and professional services. The state provides just the right infrastructure and economic platform to small and medium sized enterprises. You can take advantage of the robust economic policies of the state after acquiring a Nevada corporation or Nevada LLC business license.

- Tax Advantages: Nevada is one of the few states with a strong pro-business environment thanks to its tax advantages. You will be able to benefit from the no state, corporate, franchise, and inventory tax after acquiring your Nevada business license.

- Entrepreneurial Resources: Prior to acquiring the necessary license and permits in Nevada you can check the variety of entrepreneurial resources offered by the Nevada Department of Business and Industry, the Governor’s Office of Economic Development as well as Nevada Research & Innovation Corporation.

- Support for Lean Startups: The state offers several types of resources pertaining to forming and operating a lean startup in the state. You can derive support in areas concerning lean systems and quality management and also attend several workshops focusing on lean manufacturing.

Business Licenses in Nevada

There are several different types of businesses including an LLC and business corporations that exist and are enjoying a steady growth in a wide variety of industries in Nevada. The state offers several benefits to startups through business incentive programs including programs offering loans and grants. In order to benefit from the numerous benefits and tax advantages, you will need to obtain licenses and permits in Nevada specific to the business activity.

Why you need a Nevada business license

The most important aspect of obtaining a license and permit in Nevada is to ensure an entrepreneur or startup can conduct business in the said state. Nevada state business licenses are governed by Chapter 76 of 2015 Nevada Revised Statutes. According to NRS76, it is mandatory for a business or individual to apply for a new license or opt for a Nevada business license renewal and failure to comply may lead to penalties as well as operational restrictions.

It is also important to know that nonprofit entities (NRS Chapter 81) and corporation’s pursuant to NRS84 will be able to benefit from Nevada business license exemptions. All other types of business entities also known as “Title 7” entities will be required to apply for and obtain a Nevada business license prior to conducting business in the state.

The license and permits in Nevada can be classified broadly into three different categories and they are:

- State Business License in Nevada

- Municipal/County Licenses

- Regulatory Licenses and Permits

State Business License in Nevada

A startup or small business planning to form their business in the “Silver State” will have to apply for a state business license; the Nevada business license that is mandatory for all Title 7 entities. Earlier, the State Business License was processed by the Department of Taxation but since October 1, 2009, the filing and processing is being handled by the office of the Secretary of State. The state business license has to be filed along with the initial or annual list and you can file for an online business license Nevada using IncParadise services.

Since, a business cannot become operational without the Nevada business license, IncParadise has included it as a part of your business incorporation process. The Nevada Secretary of State office has made it mandatory to submit the business license along with the initial list or annual list. Hence, IncParadise offers annual report or initial list filing and submission services thus ensuring that the entire business formation process helps you save time.

Register a new business entity in Nevada Today!

Municipal/County Licenses

Depending on the type of business activity, you may also be required to apply for municipal or county license and permits in Nevada. This type of license is categorized under local licensing and this will be apart from the Nevada State Business License. All businesses may not require municipal/county licenses, so let’s look at an example to understand this.

If your business is based in Clark County then you need to first obtain a state business license. You can conduct a Nevada business license search to identify if your business requires any specific license or permits in Clark County. If your business is a food establishment serving liquor then you will need to apply for an Alcoholic Liquor License, which is classified under “Privileged Nevada business license.”

The business license Nevada cost is the same for state licenses but the fee for county license or permit may be different. They will vary according to the type of business activity and the licensing processes involved. You will be required to apply for this license with the office of the Clark County Department of Business License (CCBL).

Regulatory Licenses and Permits

The regulatory business license and permits are normally issued by the counties and the requirement for regulatory license and permits in Nevada is dependent on the jurisdiction your business is operating in. This type of license or permits requires police background checks as well as financial suitability investigations. An example would be Clark County where specific licenses and permits are labeled as “Regulated” pursuant to Clark County Code, Chapters 6 and 7 because of the operating parameters set out in the county code. This is especially applicable for liquor and gaming permits. The business license Nevada costs for these permits are also different from other business licenses.

Obtaining a Business License Varies based on geographic location

Although a Nevada business license can be obtained from the office of the secretary of state; there are several types of local licenses that need to be obtained specifically from the county the business is operating from or the geographical location the business is based in. Let’s look at an example to understand this.

If you are planning to establish your business in Washoe County, NV then you will need to apply for a Nevada LLC business license or for a Business Corporation based on the type of business activity. You may have to acquire permits from different local governmental agencies like the Washoe County Health Department and Fire Department for running a food establishment. Now, if your geographical location is the City of Mesquite then local license and permits in Nevada have to be obtained pertaining to the city’s business code. Depending on the type of business activity, you may need to undergo a building and fire inspection prior to obtaining a license.

A business entity may require a single state business license or multiple licenses and permits. Sometimes, identifying the type of license required can itself be an overwhelming process. At IncParadise, we understand the need for a solution that will not only assist you with identifying the different Nevada LLC business licenses and permits you may require but also make managing them easier. Hence, we have created a new service – business license report, which will provide information pertaining to state licenses, county licenses and permits, process to obtain, specific licenses required and much more.

Identify licensing needs using our business license report!

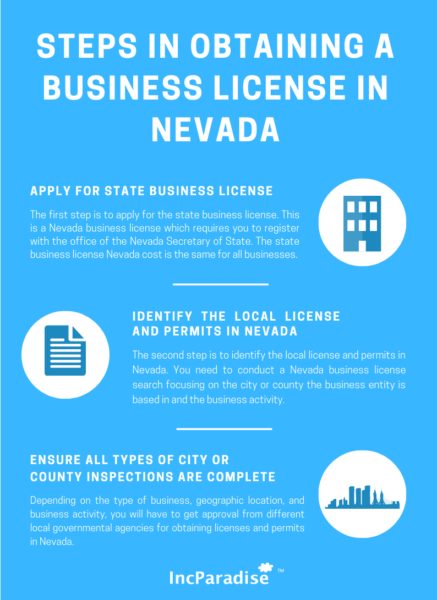

Steps in obtaining a business license in Nevada

The process of obtaining a Nevada business license may seem to be overwhelming but if you follow these 3 steps then it will be much easier.

- Step#1: The first step is to apply for the state business license. This is a Nevada business license which requires you to register with the office of the Nevada Secretary of State. The state business license Nevada cost is the same for all businesses. Prior to filing the license application, you need to have completed the following:

- Register your business and business name

- Register with the Nevada Department of Taxation

- Register for State Industrial Insurance

- Step#2: The second step is to identify the local license and permits in Nevada. You need to conduct a Nevada business license search focusing on the city or county the business entity is based in and the business activity. For example: The City of Reno requires businesses or establishments serving Alcoholic Beverages to obtain a Privileged Business License. Similarly, different cities and counties have different license requirements and application procedures.

- Step#3: You have to ensure all types of city or county inspections are complete. Depending on the type of business, geographic location, and business activity, you will have to get approval from different local governmental agencies for obtaining licenses and permits in Nevada. Local governmental agencies include the City Planning Commission, Building Divisions, Fire Prevention Division, District Health Division, Environmental Control Division, and Police Work Cards Division. Once you have the approval from the agency concerned, you can apply for and obtain your business license or permit. The procedure is the same for Nevada business license renewal as well.

It is easy to form a new business in Nevada with IncParadise!

Types of Business Licenses

In the state of Nevada, most businesses require a general operating license also known as the state business license. Since, each business is different hence the type of Nevada business license is also different. Some businesses may require a local operating license while others may require zoning permits. Some entities after formation can also apply for a Nevada business license exemption if they fulfill the required criteria. The different types of licenses in Nevada include:

- The Standard Operating License: This is a standard Nevada business license that every business planning to operate in the state requires.

- Seller’s License: The Seller’s license also known as the seller’s permit is applicable to businesses that:

- Own a retail store, warehouse, or office

- Sell products and taxable services in the state

- Is an online business selling taxable products or services

The seller’s permit requires a one-time registration and there is no need for Nevada business license renewal.

- Privilege License: This is a type of Nevada business license that is required by specific businesses based in certain geographic locations. For example: certain businesses based in the City of Las Vegas would need to obtain a privilege license as such entities are considered to have the potential to affect the economic, moral, and social well-being of the city as well as its residents. Such businesses include gaming establishments and establishments serving alcoholic beverages. The business license Nevada cost for privilege licenses may differ based on several factors including type of establishment, seating or people, location etc.

- Health License: This is a type of Nevada LLC business license that has to be obtained by food establishments.

- Specific City/County/Municipal Permits: Specific license and permits in Nevada have to be obtained by business entities prior to beginning operations in a city or county. The most common permits include:

- Zoning Permit: This is a type of permit required by businesses operating from a specific zone, For example, a manufacturing business in a retail zone will have to apply for one.

- Building Permits: This type of permit is required by a business entity when they are planning remodeling work within their existing business premise or location.

- Fire Department Permit: This is one of the important as well as basic license and permit in Nevada. This requires inspection of premises by the fire department permit to ensure the premises is structurally sound and safe. The permit is issued only after the premise is approved by the fire department as safe.

How do I obtain or apply for a Nevada State Business License

Every business entity prior to beginning their operation has to apply for the State business license. The application procedure is almost the same for all business entities and the application along with the license fee has to be submitted with the Office of the Secretary of State.

The title 7 entities including corporations and LLCs need to file their application for their State business license along with the Initial List or the Annual List. You can apply for an online state business license or a reputed agent like IncParadise can submit it on your behalf through mail or fax. The application can also be submitted in-person at the Las Vegas and Carson City offices.

Partnerships and sole proprietors can apply for their state business license online during or post business registration with the Secretary of State. The license application including state business license renewal can be mailed, faxed, or submitted in-person. It is important to note that filings without the appropriate fees may be rejected.

If you are feeling overwhelmed with the entire process of obtaining a state business license then IncParadise can help you with the new business incorporation as well as the licensing process. We can also provide assistance towards filing of the initial list or annual report as it is a mandatory requirement for state business license renewal or issuance of new state business licenses.

To form a New Business in Nevada, Simply Click below!

Renew Nevada Business License

Nevada business license renewal is an important process that ensures your business remains operational. Once you have acquired the necessary license and permits in Nevada to operate a business, you will be able to renew the license annually. This is mandatory for the state business license as well as different types of county licenses and permits. Entities that are conducting their business without obtaining or renewing their license or permit will be penalized pursuant to NV Rev Stat § 76.110 (2015).

State Business License Annual Renewal Fee

The state business license Nevada cost is $500 for business corporations and is $200 for all other Title 7 entities including Limited Liability Companies, Limited Partnerships etc.

At the same time, it is important to note that the fee for license and permits in Nevada cities and counties will depend on the business activity and the county the business is operating in.

When is the renewal due?

The State business license renewal is normally due on the last day of the anniversary month in which a permit or license was initially filed. The due date for renewal of state business license for Title 7 entities is the same as the due date for their annual list. The annual list is normally due by the end of the registration or incorporation anniversary month pursuant to Nevada Revised Statutes, NRS § 78.150 and § 86.263.

The state business license renewal due date for Title 7 entities like partnerships and sole proprietors is on or before the date of expiry as listed on their State Business License.

Note: According to NV Rev Stat § 76.130 (2015), if a person or business entity is unable to file annual renewal of state business license on the due date then such a person or entity will incur a penalty and may lead to revocation of its right to transact business in the state.

To form a New Business in Nevada, Simply Click below!

How does IncParadise help you?

IncParadise is one of the reputed and respected registered agents in Nevada offering businesses with a wide variety of services. We strongly believe that forming a business can be a formidable decision owing to the various aspects that one has to consider in helping make that decision. This is where IncParadise provides services catering to specific needs of different forms like Limited Liability Companies and Corporations. Whether it is a need for obtaining licenses and permits in Nevada or registering a new business, we have the team and the tools to fulfill your requirements.

Our expert team will help you to obtain the required licenses for your Nevada businesses

We have a team of experts from different industries possessing profound knowledge of application, filing, and processing of Nevada business licenses. In the state of Nevada, you will need to file the state business license with the initial list or annual list. Our team is not just well versed with licensing requirements but can ensure easy filing of initial lists.

Our back office system reminds/notifies your licenses annual renewal

At IncParadise, we believe that a good team should always have a strong support system. Hence, we have put in place a back office system that will automatically notify you regarding the Nevada business license renewal due date well in advance. This will save you time and penalties on late filing.

702-871-8678

702-871-8678