Benefits of using virtual mailbox for your Wyoming Business

BENEFITS OF USING VIRTUAL MAILBOX FOR YOUR WYOMING BUSINESS

A start-up in Wyoming is definitely a great decision especially because the state is known for its pro-business environment. Most entrepreneurs believe that starting a business is not easy and there are so many considerations that need to be made especially when it comes to cutting down start-up costs. One of the ways to cut down costs and yet operate a business is by owning a virtual office or a virtual mailbox in Wyoming. A virtual office fulfills the need for a business address and also provides the flexibility to an entrepreneur to work from anywhere.

An Introduction to Wyoming for Businesses

Whether you are planning to rent commercial space or own a virtual office, with Wyoming mail forwarding; the state offers several benefits to small businesses. In fact, the Cowboy State is considered as one of the best states for new businesses. It is ranked #1 in the State Business Tax Climate Index by Tax Foundation and this is largely due to the fact that the state doesn’t have any corporate or individual income tax. The real GDP of Wyoming in 2018 was $38.37 billion and according to Forbes, the state offers a strong regulatory environment as well as economic climate.

Why is Wyoming the best state to start a business?

The Cowboy State is home to over 65,000 small businesses and these vary from home based start-ups to partnership firms and from LLC to business corporations. Small businesses have always played an integral role in the state’s economy and today there is a new legion of entrepreneurs that are helping drive the economy. The entrepreneurs today are opting to work from their virtual offices as it provides them with privacy, flexibility, and Wyoming mail forwarding services. The Kauffman Indicators of Entrepreneurship research study revealed that 88.28 percent entrepreneurs in Wyoming created their business out of choice and not out of necessity. One of the primary driving forces behind the rise of the entrepreneurs in the state is the various benefits offered to start-ups. Some of the benefits include:

- Good tax climate: There are more and more start-ups opting for virtual offices to benefit from virtual mailbox Wyoming services but more than that, it is the tax climate that makes the final impression. Some of the tax benefits that your start-up will enjoy include:

- There is no personal incomes tax for entrepreneurs

- Small businesses don’t have to pay corporate income tax

- There is no inventory tax in the state

- You will not be required to pay any franchise tax

- You will not be required to pay any value-added tax

- You will not be required to pay any occupation tax

- Start-up Wyoming Services: There are a range of services, programs, and resources offered by the Wyoming Business Council to help build the entrepreneurial ecosystem of the state. The most popular among these are the Small Business Innovation Research (SBIR) or Small Business Technology Transfer programs. The objective of these programs is to provide necessary aid in the form of grants or contracts to small businesses, so that they can conduct research and development (R&D). A virtual mailbox in Wyoming service offered by providers like IncParadise can also play a very important role in minimizing overall startup cost.

- Finance and Grants: Different start-ups have different requirements and Wyoming believes that a small business should not suffer a setback for the lack of finance. There are several loan programs in place that can help small businesses acquire the necessary capital. Some of the loan programs include Community Development Block Grant (CDBG) Program, Small Business Investment Credit Program, Wyoming Partnership Challenge Loan Program, and Kickstart-Wyoming Grant Program among others.

Virtual Mailbox for Wyoming Business

If you are an entrepreneur then Wyoming is just the perfect destination. The Cowboy State offers a pro-business environment and the overall cost of doing business is lower than most of the other states. You can even opt for a virtual office as this will provide you with a street address so that you can work from anywhere and yet enjoy the benefits of Wyoming mail forwarding and state based incentive programs targeted at new businesses.

Why use Virtual Mailbox for your Wyoming business?

The internet has never been more interesting than ever before especially because there are more online businesses vying for an inch of this virtual space. Even with the increasing markets online, a virtual mailbox in Wyoming is one of the most sought after services simply because it provides several benefits especially to start-ups and entrepreneurs. The internet is just the right place for those who believe in a “work from anywhere” lifestyle and this is one of the driving forces behind the increasing popularity for virtual offices. There are several other reasons why Wyoming businesses are opting for virtual mailboxes and some of them are:

- Lower initial cost of setting up a business

- A street address at a prominent location

- Benefit from mail forwarding

- Work flexibility

- Privacy and Security

- Balance of work and personal life

Advantages of using Virtual Mailbox and Mail Forwarding

A virtual mailbox in Wyoming is an integral part of a new age service called the “virtual office”. Although many business owners think that virtual may relate to the internet, that is not the case. In fact, a virtual office is more like an office space at a prominent location where you can receive all your business and personal mail. These services are attracting business owners and entrepreneurs who work from home, or while traveling across the world, or are based in another country. You are probably wondering how the virtual mail center service can help you or your business and the best way to know that is by looking at the following advantages.

- Provides a Professional Image: One of the salient advantages of using a virtual mailbox in Wyoming service is that you will be allotted a proper street address in one of the prominent locations in the state. Even if you are working from home or “on the go”, this street address helps in building a professional image and creates a good first impression with prospective clients and customers.

- Protects Your Privacy: Most business owners working from home or entrepreneurs working from another state don’t want their locations to be disclosed as they may be burdened by junk mail and customer feedback & queries. The virtual mailbox in Wyoming service protects your privacy by providing an alternate address where you can receive all your business as well as personal mail. Apart from this, once you register your business with the Wyoming Secretary of State, the address will be made public. In such a scenario, it is better to register with a virtual address as compared to your home address.

- Mail Forwarding Services: Every business receives mail and this could vary from important business documents from the state and clients to sensitive information forwarded by your bank or a financial institution. A reputable Wyoming mail forwarding service like IncParadise ensures that all your important mail and documents are received securely at the address allotted to you. The mail forwarding services also helps in minimizing the risk of documents and mail getting misplaced, lost, or stolen.

- Access to Other Services: Depending on the Wyoming mail forwarding service you choose, there will be a host of sub-services that you can choose from. One of the quite common is mail scanning and cloud storage. You can request for specific mail to be scanned and uploaded to your cloud storage. This is quite useful especially if you require a specific document at a future date. In the normal scenario, most mail and documents are shredded after they are read and if you require a document after a month, it will not be available. The mail scanning service ensures you always have a digital copy of the mail or document in your cloud storage.

- Streamlining work flow: One of the key advantages of a virtual office with a Wyoming mail forwarding service is that it will help in streamlining business related administrative tasks especially those related to snail mail delivery and sorting. All the correspondence that is received at the digital mail center will be sorted out by an experienced team of administrative staff.

Increase business efficiency using our Wyoming Virtual Mailbox

Wyoming Virtual Mailbox & Mail Forwarding Service

The state of Wyoming is considered one of the best states for start-ups as it provides the right platform for innovations and ample opportunities for small businesses to grow. One of the primary requirements for setting up your business in the Cowboy State is having a proper office address and not a P.O. Box. Whether you are an entrepreneur working from home or a small business owner working while traveling, a street address will project the right brand image. At the same time, you may not be ready to own a commercial space in Wyoming. Is there a way to have a business address without having a brick and mortar office? The IncParadise virtual office and Wyoming mail forwarding service can provide just the perfect solution for you.

Why choose IncParadise Wyoming Virtual Mailbox service?

IncParadise, a reputable Wyoming mail forwarding service provider and one of the top registered agents in the state offers a virtual office and mailbox service intended to help small businesses. We believe that every business is different and hence their requirements are also different. Hence, we have created a Corporate Office Program that offers easy accessibility, high flexibility, and is budget friendly. As a part of this program:

- You will never lose any important mail whether you are based in Wyoming or traveling

- Your mail will be received at our digital mail center where it will be sorted and scanned

- You will get a proper physical address at a prominent location in Wyoming thus increasing business credibility

- You can use the IncParadise virtual mailbox in Wyoming service for scanning of any important mail

- You can use the street address in all your business related documents including business registration and incorporation documents

- The virtual mailbox in Wyoming service will provide you access to a shared working area and conference room

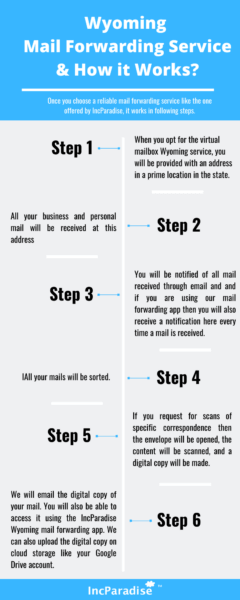

Wyoming Mail Forwarding service & How it works

One of the primary requirements for businesses as stated by the Wyoming Secretary of State is to have a physical address where state documents can be sent to. If you are an entrepreneur or a small business owner, the initial cost of owning office space can be expensive. In such a scenario, opting for a virtual office with Wyoming mail forwarding services can help you save on the initial cost of setting up your business in the state. Simultaneously, you will also be able to provide an actual street address to fulfill the requirements of the Secretary of State.

The virtual mailbox in Wyoming services make it easier to handle your mail while ensuring there is always a digital copy that you can access. The service process of a reliable mail forwarding provider like IncParadise works in the following steps:

- Step#1: When you opt for the virtual mailbox Wyoming service, you will be provided with an address in a prime location in the state

- Step#2: All your business and personal mail will be received at this address

- Step#3: You will be notified of all mail received through email and and if you are using our mail forwarding app then you will also receive a notification here every time a mail is received.

- Step#4: All your mails will be sorted.

- Step#5: If you request for scans of specific correspondence then the envelope will be opened, the content will be scanned, and a digital copy will be made.

- Step#6: We will email the digital copy of your mail. You will also be able to access it using the IncParadise Wyoming mail forwarding app. We can also upload the digital copy on cloud storage like your Google Drive account.

IncParadise Mail forwarding App

You are probably wondering why IncParadise created an application for mail forwarding services. This is the internet age and most entrepreneurs are working online and hence, quick access to mail and reply to customers is crucial for businesses to sustain long-term. This is the methodology and idea behind the IncParadise App – to provide you with quick access to your mail anytime, anywhere. Some of the salient highlights of this app are:

- The virtual mailbox app works with both Android and iOS devices

- Whenever a mail is received at the digital mail center, there will be a notification on this app

- The app makes services more personal and provides privacy as each business or customer has their separate account

- You can use this app to request other Wyoming mail forwarding related services like putting your mails on hold, changing the schedule of mail delivery, changing the mailing address etc.

- You can use this app to order services like request for scanning of specific mail and uploading to your online cloud storage account

702-871-8678

702-871-8678