A corporation was the most common choice for a business entity for many entrepreneurs years ago. This was due to the fact that it offered much more advantages over the partnerships and the sole proprietorships. But for some time now, the LLC business entity type has taken over and become the most common choice for many entrepreneurs.

The reason is simple. The LLC offers a lot of simplicity and ease which is why many tend to opt for this type of business entity. But this does not mean that the corporations are now a bad option; they still offer a lot of benefits. In this post, you would understand all about the benefits of the corporation and also learn about the various types of corporation and their differences so that you can choose the applicable business entity type for your Nevada corporation.

History of Nevada Corporations

In 1987, Nevada had adopted the Revised Statutes for corporations, which were based entirely on the Delaware corporate statutes that have lured companies from all over the country for the past century. Nevada has always been a professional business state, and it was looking for new methods to increase the revenue of the state where they do not tax the businesses or citizens of the state.

Even though room taxes, games and sales have been the primary source through which the state got its revenue, Nevada’s rapid growth needed more funds to support it. And with an idea to offer companies with beneficial incorporating situations to attract revenue to the state proved to be a new vehicle for the entrepreneurs, and a prosperous new source of income for the Nevada.

During the recent years, there has been an increase in the number of businesses that have been incorporated in Nevada. Between the years 1994 and 1999, the number of new corporations that were filed in a year rose by 75%.

Moreover, about 80,000 companies were filed in the year 2006 even though the population of Nevada is just 2 million people in the whole state. As a matter of fact, the top state that has the highest number of new business filings are those states with the most population, like Florida, Texas, New York, and California.

What is a Corporation?

A business that is granted a charter that recognizes it as a separate legal entity and has its own liabilities, privileges, and rights distinct from those of its owners is a corporation.

The Corporate Business Structure

Even though a corporation is distinct and separate from the officers, directors, and shareholders, it is an entity that can function only through the agents, officers or members in it. Moreover, the entity cannot have any belief or knowledge of any subject that is independent of the belief or knowledge of its people.

A shareholder of the company (the owner or a partial owner) is a holder of the shares of the business, and this person is normally not in any legal danger for any actions of the corporation. This is only when these acts are not fraudulent and damaging or if the corporation does not maintain and follow the formalities. Additionally, the shareholder/stockholder is not the employer of any of those who are working in the corporation nor is this person the owner of the corporate property.

And it is this separation in the corporation that is the most important benefit. Think about the many newsworthy lawsuits that have come up in the last few years where negligence or other significant obligations have been charged against a corporation. There have been cases where the consumers have been affected by the products that a corporation provides. And in all these cases, the shareholders of the corporation were protected as separate, and it was only the corporation that held liable for the issues.

The corporation is also the citizen of the state in which it has been created in. Moreover, it does not stop being a citizen of the same state even after it engages in any business activity or acquires property in another state. And since the corporation is the creation of the state law, all the powers that it has is acquired from the laws of the state and its constitution in which the company is incorporated in.

Being an artificial person of the state, the corporation is deemed to have its home in the state in which it has been incorporated in and the place where it has a lawful presence. When the company engages in business activities in another state, the place of its selected registered agent or resident is at times called the ‘statutory domicile’ of the corporation.

As soon as the corporation is brought to life, it has almost the same privileges and rights that a person in that state has. The corporation has the rights to own and even run businesses, can sue, hire employees, maintain retirement plans for employees, rent office space, make contracts, buy and sell goods and services, and also be sued.

Additionally, the existence of the corporation is not changed even if the director, officer, or shareholder die or go bankrupt. This means that it has a continuous existence, though the existence remains as long as the corporation follows the statutory requirements of the state where it is incorporated.

Moreover, even though the corporation is considered as a ‘person’ legally, the corporation cannot think, talk, walk or act for itself. The corporation cannot produce the products on its own or perform any of the physical tasks needed to run the company. For these tasks, the director (you) and those hired to work within the corporation do it.

The main point that has to be kept in mind is that when you have a corporation, it exists as a separate person or entity. It does not matter which state you live in. It is the corporation that complies with the obligations of the state in which it has been incorporated. With all these details explained about a corporation, it is also important to note that Nevada is the state where a corporation enjoys the most number of benefits.

Comparison of C & S Corporations

There isn’t just one type of corporation in a state. Corporations vary in their organization and structure. You would need to choose the type of tax treatment you want for your corporation. There are two main tax treatments that many attorneys and CPAs would advise to choose: S-elections and C-elections.

But before you choose from one of these, it is important to note that each state has different laws for the corporations. Hence it is better to learn about that state, and its benefits before you choose the tax treatment you want.

The below comparison between the S and C election is a basic one that applies to all the states in the USA:

C Election Corporation

- The profits are taxed on an 1120 tax return at corporate rates, separate from the individual return.

- The profits can be kept as retained earnings.

- Follows the fiscal or calendar year that the Board of Directors has designated.

- Permits to have an unlimited number of stockholders.

- Permits to have limited liability of the directors/officers/owners.

S Election Corporation

- The state taxes would apply for those who are in the state where there is an individual state income tax.

- All the profits of the corporation are taxed on the tax return of the owner even though it is not distributed.

- The profits pass through the individual tax return 1040. This means that there are no tax brackets separate from the personal tax brackets that apply.

- Needs full disclosure of up to 100 corporate owners.

- Normally runs on a calendar year.

- Permits to have limited liability of the directors/ officers/owners.

Note: It should be noted that Nevada is a state in the US where there is no state corporate income tax of any kind for both S-election and C-election corporations.

These are not just the only differences that are there. Several other variations exist between these two types of tax elections that can be understood better by explaining each in details, as shared below.

S Election Corporations

Not any company can choose to be an S corporation. There are a few specific requirements that have to be met for electing the S corporation status. For being listed as an S corporation, you would have to file Form 2533 with the IRS where your corporation has to meet all the following requirements as well:

- It has to be a small business corporation. (The financial institutions like the insurance companies, banks, or building and loan associations are not permitted to take advantage of an S election.)

- It has to be a domestic corporation formed in the US.

- It must just have one class of stock.

- It does not need to have non-resident alien shareholders.

- It can just have certain trusts, estates or individuals as shareholders.

- It can have no more than 100 shareholders.

- It has to adhere to the state statutory limitations, which limit the transfer of ownership/shares of the company.

The S corporation runs on the December 31st calendar-year-end basis. Nevertheless, there are exceptions just like there are exceptions with many of the other rules. The corporation can also choose the Section 444, which would permit the corporation to follow the tax year ending on either September 30, October 31, or November 30. But in this case, estimated tax payments have to be made that negate any advantage a shareholder may get by having an offsetting fiscal year.

Factors When Selecting an S Corporation

Here are some of the considerations while choosing the S corporation:

- When the losses of the corporation flow-through, those losses can be utilized to neutralize the active income from an owner. (Here the active income constitutes the income obtained directly from the business activity.)

- The employee/shareholder of the S corporation might be able to deduct 100% of the cost of medical insurance as an adjustment to income.

- There aren’t any penalties for excessive collected earnings for S corporations.

- There is no double taxation.

- In case the S corporation earns active profits, it can be balanced by the losses from other companies and/or running costs from a sole proprietorship.

- The S corporation has to report bonuses paid for group term life insurance and health insurance as taxable income in case the shareholder owns more than 2% of the stock. Nevertheless, the shareholder still has the eligibility to get the 100% deduction as mentioned before, to help balance this.

Who Should Use S Corporation Status?

The following companies should choose the S corporation status:

- The companies that may be subjected to the Alternative Minimum Tax.

- The companies that don’t expect to distribute multiple classes of stock.

- The companies that have no intention of going public in the future.

- The companies that are expecting to have startup losses during the initial years of operation.

Now that you have understand all about the S corporation, let us more towards understanding the C corporations.

C Election Corporations

The C corporations have a very different tax rate as compared to the individuals. There are some cases where the C corporations pay less tax as compared to the individuals. Moreover, there are no limitations on the shareholders of the C corporations, and the shareholders can be any type of entity or live in any part of the world. This type of corporation is the most flexible one and is even recommended in a few cases.

The only thing about using a C corporation that would trouble you is the double taxation. In the S corporations, the losses and profits flow through the shareholders or the owners of the corporation. And all the taxation takes places at the individual level and not at the corporate level, eliminating the issue of double taxation.

In the C corporation, double taxation occurs when the company has the profits taxed initially after which the dividends are then paid out to the stockholders. These shareholders are then taxed again at a personal level.

Deferring or eliminating profits via a proper financial management would be able to cover this issue easily. Moreover, the double taxation becomes an issue with huge corporations that have many shareholders who want the profits to be distributed to them at the year-end of the corporation. In such cases, the owner can choose what to do with the profits at the end of the year.

In short, they can have a retirement plan that profits are distributed to on a tax-deferred basis, keep retained earnings (up to a maximum cap), pay bonuses (wages) which are tax-deductible to the corporation or pay the dividends to the shareholders (which is not recommended). The earnings that are held can be used for growing the company, buying another company, for the additional investments in equipment, advertising expenses, etc.

So, when the corporation holds the earnings, the profits earned by the corporation is taxed at the corporate level and is left in the corporation. And since it is not distributed to the owners, there isn’t any double taxation on the profits. In case the officers or the owners of the corporation need the money for any personal expenses, they can set up a retirement plan to expense as much from the corporation as possible or get paid a salary in the form of the year-end bonus.

As per the IRS, it is the obligation of the taxpayers to reduce their tax liability. Moreover, the IRS also says that a corporation can also deduct any company expense, so a low tax liability can be obtained by applying proper money management.

Below shared are some additional terms that need to be understood as well:

Private vs. Public Corporations

Moving ahead, let us now see what a public corporation is and what a private corporation is. A private corporation is the one in which the company’s ownership (or shares) is not put up for sale on any public market. On the other hand, a public corporation is a company that is registered with the Securities Exchange Commission (SEC) and has put up stocks for purchase in one of the major stock exchange markets. Examples of public corporations are IBM, AT&T, Facebook, etc.

Closely Held Corporation

A close group or a family owns a closely held corporation, and shares of this company cannot be sold outside the group or family. A corporation is said to be a closely held corporation on in case more than 50% of the value of the outstanding stocks are held indirectly or directly by five or fewer individuals at any time during the last half of the tax year.

To understand better, a corporation is closely held if all of the following apply:

- It is not a personal service corporation.

- It is not an S corporation.

- In case more than 50% of the value of the outstanding stocks are held indirectly or directly by five or fewer individuals at any time during the last half of the tax year. (“Individual” here includes specific trusts and private foundations.)

For determining if five or fewer individuals own more than 50% of the stock value, you would need the help of an attorney or a tax professional.

Domestic Corporation

A domestic corporation is a company which is operated in the state in which it has been incorporated in. For instance, a corporation that is incorporated in Nevada and operates in the same state is a domestic corporation for Nevada.

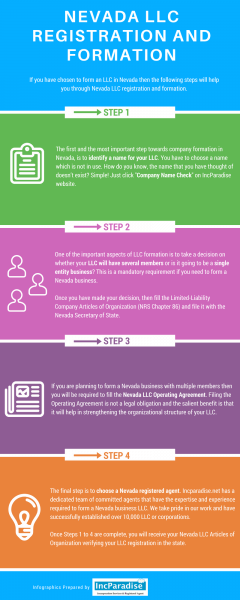

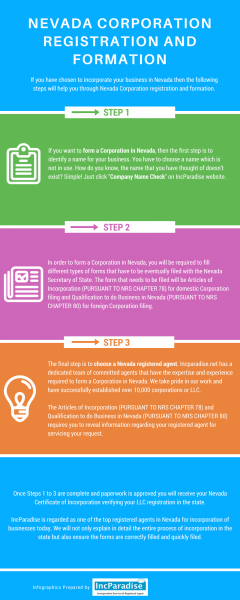

Steps for incorporating your business in Nevada

Now that you are aware of all the types of corporations, what their differences are and what might be the right choice for you, here are some steps that you need to take for incorporating your company in Nevada:

Select a business name

Ensure that you choose a business name that related to your service, product, and business message. The name should also be easy to remember so that customers can easily locate your business. Moreover, you would need to check with the Nevada Secretary of State to see if no other company has taken the name. Check out our article or contact your Secretary of State to see the other naming limitations for your Nevada corporation.

Appoint and/or recruit directors/officers for your corporation

For this, the Nevada Corporation requirements are:

- A Nevada corporation should have at least one or more directors.

- The director/s have to be at least 18 years old.

- The director can be from any part of the world.

- As per the Nevada corporation rules, the director’s names and addresses have to be mentioned on the Articles of Incorporation. (The officer’s names and addresses are not needed.)

Register your Corporation & File for the Incorporation

You would have to register your company and incorporate it to get the Articles of Incorporation for corporations from the Nevada Secretary of State.

Business License and annual report requirements

It is essential to file the Annual List of Directors/Officers and file for the Business License for your Nevada corporation as soon as the company gets incorporated. The filing fee for the Annual list is $150 and $500 for the business license registration.

Get any needed business permits/licenses

Other than the business license, there are many other licenses or permits that you might need depending on the type of service or products you are offering. You would need to get the specific licenses before you can begin operating your business. Check out the Secretary of State for more detail

Get the EIN

In addition to the tax and regulatory obligations, you would also need a Federal tax identification number (EIN).

Additional Requirements

Based on the structure of your company, you would have to satisfy some other stated requirements like:

- Opening a business bank account for all the business transactions.

- Getting a physical address with a mailing address.

- Business phone number.

- Company employees working in the State of Nevada.

How can Inc Paradise help you?

If you have decided on the type of business entity that you want, and are ready to have it registered in Nevada, Inc Paradise can assist you with the registration and incorporation process. Other than that, IncParadise also offers mail-forwarding and virtual business address services.

Order INC now

702-871-8678

702-871-8678